Volvo 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162

|

|

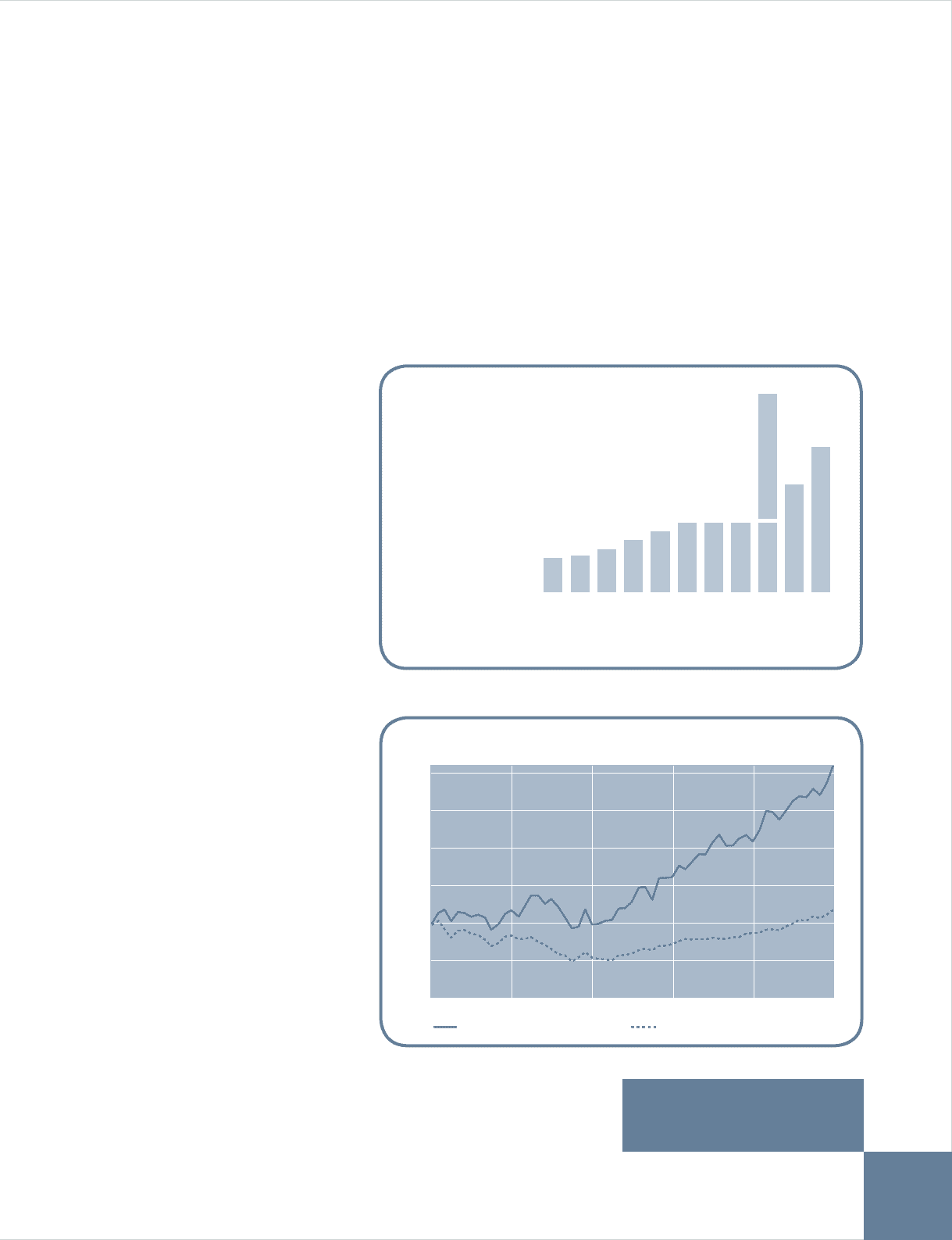

Shareholder value

Volvo’s financial strength and cash flow

have enabled the Group to pay its share-

holders a competitive return on their

investment.

Dividend policy

Volvo’s objective is that the effective

return to the shareholders (dividend com-

bined with the change in the share price)

will exceed the industry average.

Higher earnings

and increased

dividend

During 2005, earnings per share rose to

SEK 32:21 (23:58). The Board of Directors

proposed that the dividend for 2005 be

increased to SEK 16.75 (12.50) per share.

Although the Volvo Group is active in a

cyclical industry, the ordinary cash dividend

has increased continuously since 1995.

Competitive total

return

The total return on the Volvo share (share

price development including re-invested

dividends) has averaged 25% annually

since 2001.

During the same period, the total return

on the Stockholm Stock Exchange as a

whole was 4% annually, according to the

SIX Return Index.

Shareholder value

95 96 97 98 99 00 01 02 03 04 05

Dividend per share, SEK

n

4.00 4.30 5.00 6.00 7.00 8.00 8.00 8.00 8.00 12.50 16.75

Direct return, % 2.9 2.9 2.3 3.2 3.2 5.1 4.5 5.6 10.5 4.7 4.5

1 Including dividend from Ainax.

Ainax:

SEK 15

1

Historically stable dividend

More information about the

Volvo share is presented on

pages 28 and 150.

B Share (incl. re-invested dividends) SIX Return Index Source: SIX

01 02 03 04 05

0

50

100

150

250

300

200

Total return, Volvo B

Index 100 = Volvo B share price January 1, 2001.

Volvo Group 2005 13