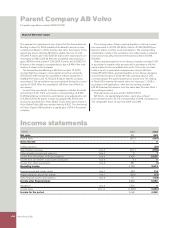

Volvo 2005 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 127

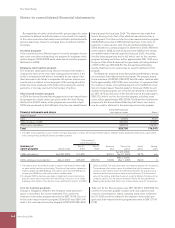

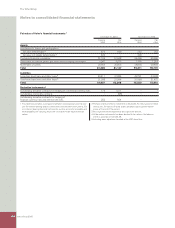

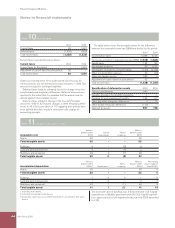

Adjustment from carrying amount SFAS 115 SFAS 115

2004 to fair value according to IFRS gross adjustment 2004-12-31 IFRS adjustment gross adjustment 2005-01-01

Available for sale (494) 494 0

(494) 494 0

The carrying values and fair values for the securities were distributed

as follows:

December 31, 2004

Carrying value Fair value

Available for sale

Marketable securities 387 387

Shares and convertible debenture loan 677 183

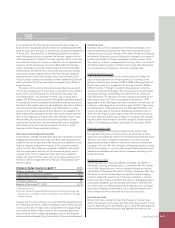

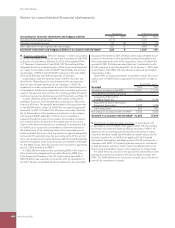

D. Restructuring costs. Volvo reports restructuring costs in

accordance with IAS 37 Provisions, contingent liabilities and contin-

gent assets. Restructuring costs are reported in the year restructur-

ing plans have been approved by the Boards of each company and

communicated to all affected parties. The accounting standards for

recoginizing restructuring costs under US GAAP, SFAS 146

“Accounting for costs Associated with Exit or Disposal Activities,” are

more strict. Restructuring costs are, in some cases, accounted for

on an accrual basis under US GAAP while under IFRS a provision is

booked.

During 2004, Renault Trucks industrial relocation was treated dif-

ferently under US GAAP, compared with IFRS. The restructuring

costs will be distributed under US GAAP during 2004–2006 while

they under IFRS was expensed in its entirety in 2004.

E. Provisions for post-employment benefi ts. Effective 2004,

provisions for post-employment benefi ts in Volvo’s consolidated

fi nancial statements are accounted for in accordance with IAS 19,

Employeee benefi ts. See Notes 1 and 24. In accordance with US

GAAP, post-employment benefi ts should be accounted for in

accordance with SFAS 87, “Employers Accounting for Pensions” and

SFAS 106, “Employers’ Accounting for Post-retirement Benefi ts

Other than Pensions”. The differences between Volvo’s accounting

principles according to IFRS and US GAAP pertain to different tran-

sition dates, recognition of past service costs and minimum liability

adjustments.

F. Product development. Volvo applies IAS 38 Intangible Assets.

In accordance with IAS 38, expenditures for development of new

products, production and information systems should be recognized

as intangible assets if such expenditures with a high degree of cer-

tainty will result in future fi nancial benefi ts for the company. The

acquisition value of such intangible assets should be amortized over

the useful lives of the assets. Under US GAAP, all expenditures for

development of new and existing products should be expensed as

incurred.

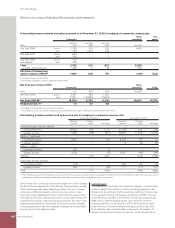

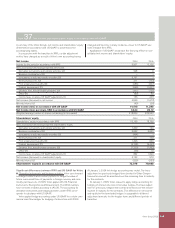

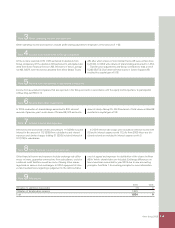

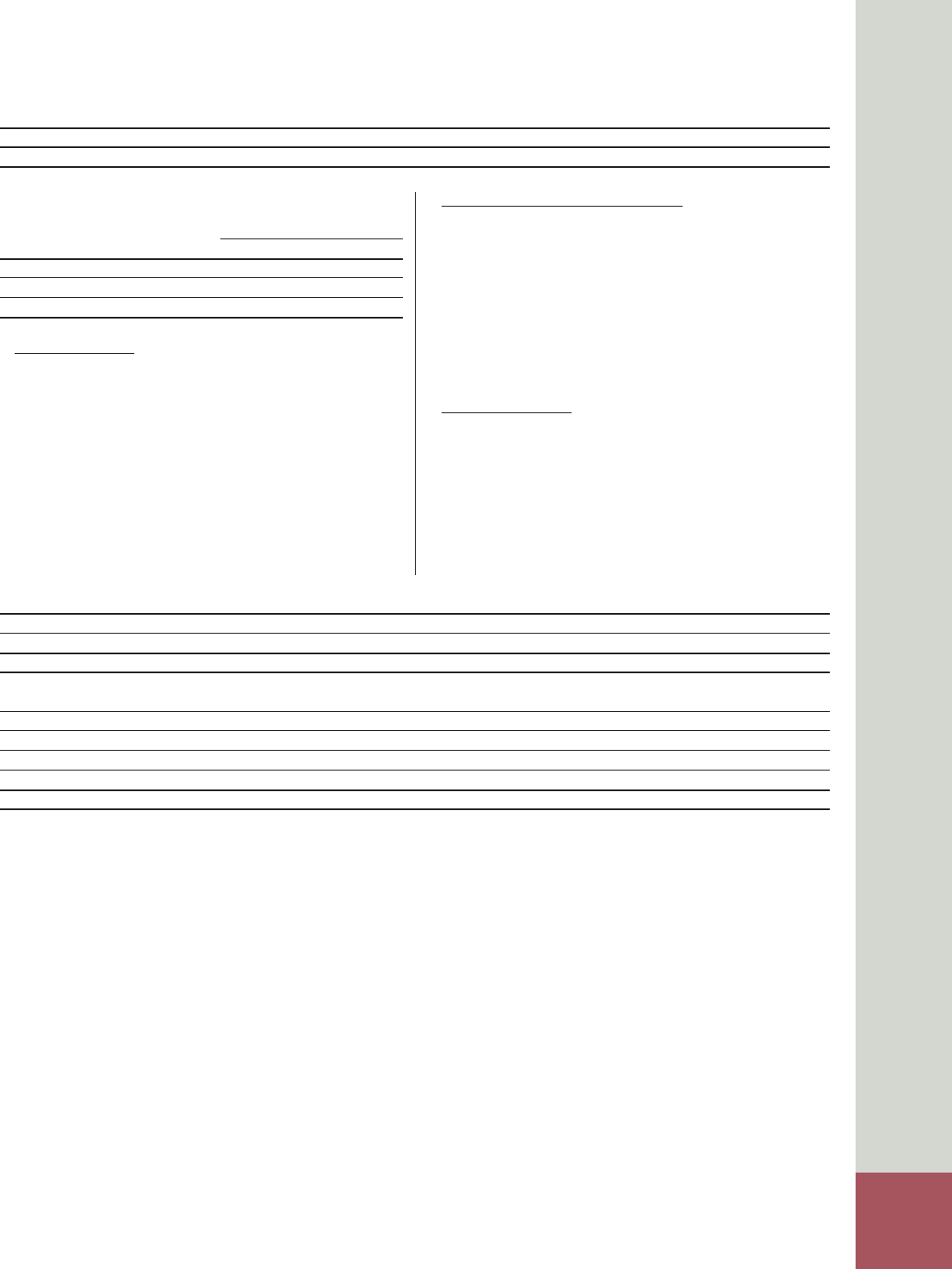

Net periodical costs for post-employment benefi ts 2004 2005

Net periodical costs in accordance with IFRS 4,401 3,736

Net periodical costs in accordance with US GAAP 4,687 4,043

Adjustment of this year’s income in accordance with US GAAP, before income taxes (286) (307)

Net provisions for post-employment benefi ts Dec 31, 2004 Dec 31, 2005

Net provisions for post-employment benefi ts in accordance with IFRS (14,332) (11,462)

Difference in unrecognized actuarial (gains) and losses 5,266 5,762

Difference in unrecognized past service costs 602 686

Minimum liability adjustments (4,542) (5,458)

Net provisions for post-employment benefi ts in accordance with US GAAP (13,006) (10,472)