Volvo 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 103

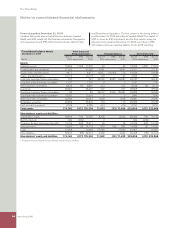

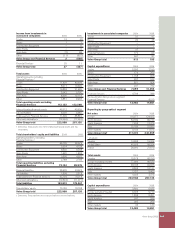

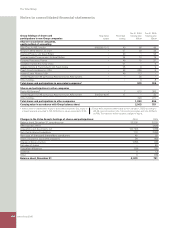

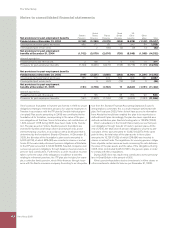

Note 12 Income taxes

Income taxes were distributed as follows:

2004 2005

Current taxes relating to the period (1,854) (2,568)

Adjustment of current taxes for prior periods 288 147

Deferred taxes originated or reversed

during the period (1,662) (2,933)

Recognition and derecognition of

deferred tax assets 99 446

Total income taxes (3,129) (4,908)

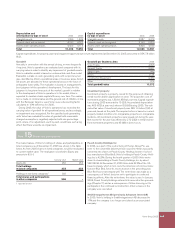

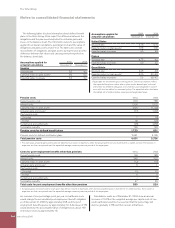

Provisions have been made for estimated tax charges that may arise

as a result of prior tax audits in the Volvo Group. Tax claims for which

no provision has been deemed necessary of approximately 695

(1,433) were reported as contingent liabilities.

Deferred taxes relate to income taxes payable or recoverable in

future periods in respect of taxable temporary differences, deducti-

ble temporary differences, unused tax loss carryforwards or unused

tax credit carryforwards. Deferred tax assets are recognized to the

extent that it is probable that the amount can be utilized against

future taxable income. At December 31, 2005, the valuation allow-

ance attributable to deductible temporary differences, unused tax

loss carryforwards and unused tax credit carryforwards for which no

deferred tax asset was recognized amounted to 2,972 (2,592).

At year-end 2005, the Group had unused tax loss carryforwards

of about 6,100 (10,100), of which approximately 1,400 (1,900) will

expire within 5 years.

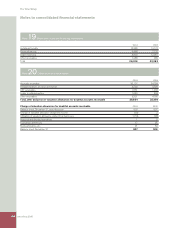

The Swedish corporate income tax rate is 28%. The table below

shows the principal reasons for the difference between this rate and

the Group’s tax rate, based on income after fi nancial items.

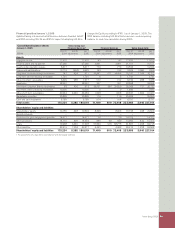

2004, % 2005, %

Swedish corporate income tax rates 28 28

Difference in tax rate in various countries 3 3

Capital gains (3) (1)

Other non-taxable income (3) (1)

Other non-deductible expenses 2 1

Adjustment of current taxes for prior years (2) (1)

Recognition and derecognition of

deferred tax assets (1) (2)

Other, net 0 0

Income tax rate for the Group 24 27

Specifi cation of deferred tax assets

and tax liabilities 2004 2005

Deferred tax assets:

Unused tax loss carryforwards 3,223 2,125

Other unused tax credits 259 295

Intercompany profi t in inventories 294 544

Valuation allowance for doubtful receivables 587 644

Provisions for warranties 966 1,449

Provision for residual value risks 544 576

Provisions for

post-employment benefi ts 4,366 4,541

Provisions for restructuring measures 220 120

Fair value of derivative instruments:

Change of hedge reserves – 224

Other deductible temporary differences 2,347 2,670

12,806 13,188

Valuation allowance (2,592) (2,972)

Deferred tax assets after

deduction for valuation allowance 10,214 10,216

Deferred tax liabilities:

Accelerated depreciation on property,

plant and equipment 2,047 2,347

Accelerated depreciation on

leasing assets 815 1,297

LIFO valuation of inventories 160 217

Capitalized product and software

development 1,445 1,970

Untaxed reserves 126 112

Fair value of derivative instruments:

Change of hedge reserves – 95

Other taxable temporary differences 1,058 1,111

5,651 7,149

Deferred tax assets, net

1 4,563 3,067

1 Deferred taxes are partially recognized in the balance sheet on a net basis

after taking into account offsetting possibilities.

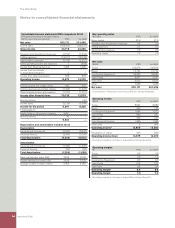

The cumulative amount of undistributed earnings in foreign subsidi-

aries, which Volvo currently intends to indefi nitely reinvest outside of

Sweden and upon which deferred income taxes have not been pro-

vided is approximately 16,810 (12,211) at year end. There are differ-

ent taxation rules depending on country, some which have no tax

effect and some countries with withholding taxes. See note 36 how

Volvo handles equity currency risk.

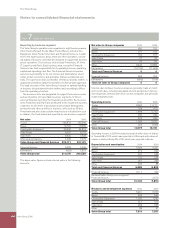

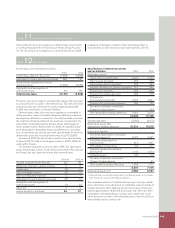

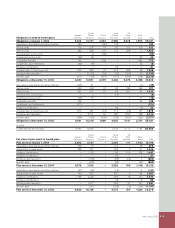

Note 11Other fi nancial income and expenses

Other fi nancial income and expenses in 2004 include a write-down

of 1,196, pertaining to the restructuring of Henlys Group Plc, note

15. The net amount of exchange losses were 20 (1). As from 2005

revaluation of derivatives related to Volvo’s funding portfolio is

accounted for as other fi nancial income and expenses, 251 (–).