Volvo 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 49

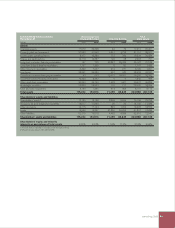

Operating margin

% 2004 2005

Trucks 6.6 7.5

Buses 2.0 2.8

Construction Equipment 6.5 7.9

Volvo Penta 10.4 9.6

Volvo Aero 5.8 11.1

Volvo Group1 6.9 7.9

Volvo Group 7.3 7.9

1 Excluding revaluation of shares in Scania AB and

Henlys Group Plc.

Consolidated income statements 1

SEK M 2004 2005

Net sales 202,171 231,191

Cost of sales (158,453) (180,823)

Gross income 43,718 50,368

Research and development expenses (7,614) (7,557)

Selling expenses (18,317) (19,616)

Administrative expenses (5,310) (6,147)

Other operating income and expenses 7 (399)

Income from Financial Services 1 1,365 2,033

Income from investments in associated companies 2 (568)

Income from other investments 828 37

Operating income 14,679 18,151

Interest income and similar credits 993 816

Interest expenses and similar charges (1,426) (1,134)

Other financial income and expenses 2 (1,210) 181

Income after financial expenses 13,036 18,014

Income taxes (3,129) (4,908)

Income for the period 3 9,907 13,106

3 Attributable to:

Equity holders of the parent company 9,867 13,052

Minority 40 54

9,907 13,106

Earnings per share, SEK 23.58 32.21

1 Financial Services reported in accordance with the equity method.

2 2004 includes a write-down relating to the holding in Henlys Group Plc of SEK 1,196 M.

Change in operating income

SEK bn

Operating income 2004 14.7

Higher volumes and improvement

of gross margins 5.4

Higher income from Financial Services 0.7

Changes in currency exchange rates 0.1

Higher capitalization of development

costs 1.3

Higher research and development

expenditures (1.1)

Higher selling and administrative

expenses (2.0)

Revaluation of shares in Scania AB

and Henlys Group, 2004 (0.8)

Other (0.1)

Operating income 2005 18.2

Volvo Penta maintained its high profitability

during 2005 and at the same time imple-

mented aggressive investments in product

development and substantial marketing

efforts to capitalize on the new and competi -

tive product portfolio. Operating income

remained at the same level as in 2004, SEK

943 M (940).

As an effect of the recovery in the aero-

space industry, volumes rose for Volvo Aero.

Combined with a favorable product mix and

price realization, this resulted in an increase

in operating income of 107% to SEK 836 M

in 2005.

During the year Celero Support AB was

divested with a capital gain of SEK 430 M. In

total during 2005, Volvo’s holding in Peach

County Holding Inc. (Blue Bird) impacted oper-

ating income negatively with an amount of SEK

653 M including a write-down of SEK 550 M

during the fourth quarter.

Impact of exchange rates

on operating income

The average exchange rates between the

Swedish krona and other major currencies

such as the US dollar and the Euro were almost

unchanged for 2005 compared to 2004. As a

consequence, the impact on operating income

from currency movements was significantly

less in 2005 with a positive impact of about

SEK 100 M.

Financial net

The net interest expense for 2005 amounted

to SEK 318 M compared to SEK 433 M for the

previous year. The improvement is primarily

a result of lower cost for the pension liability

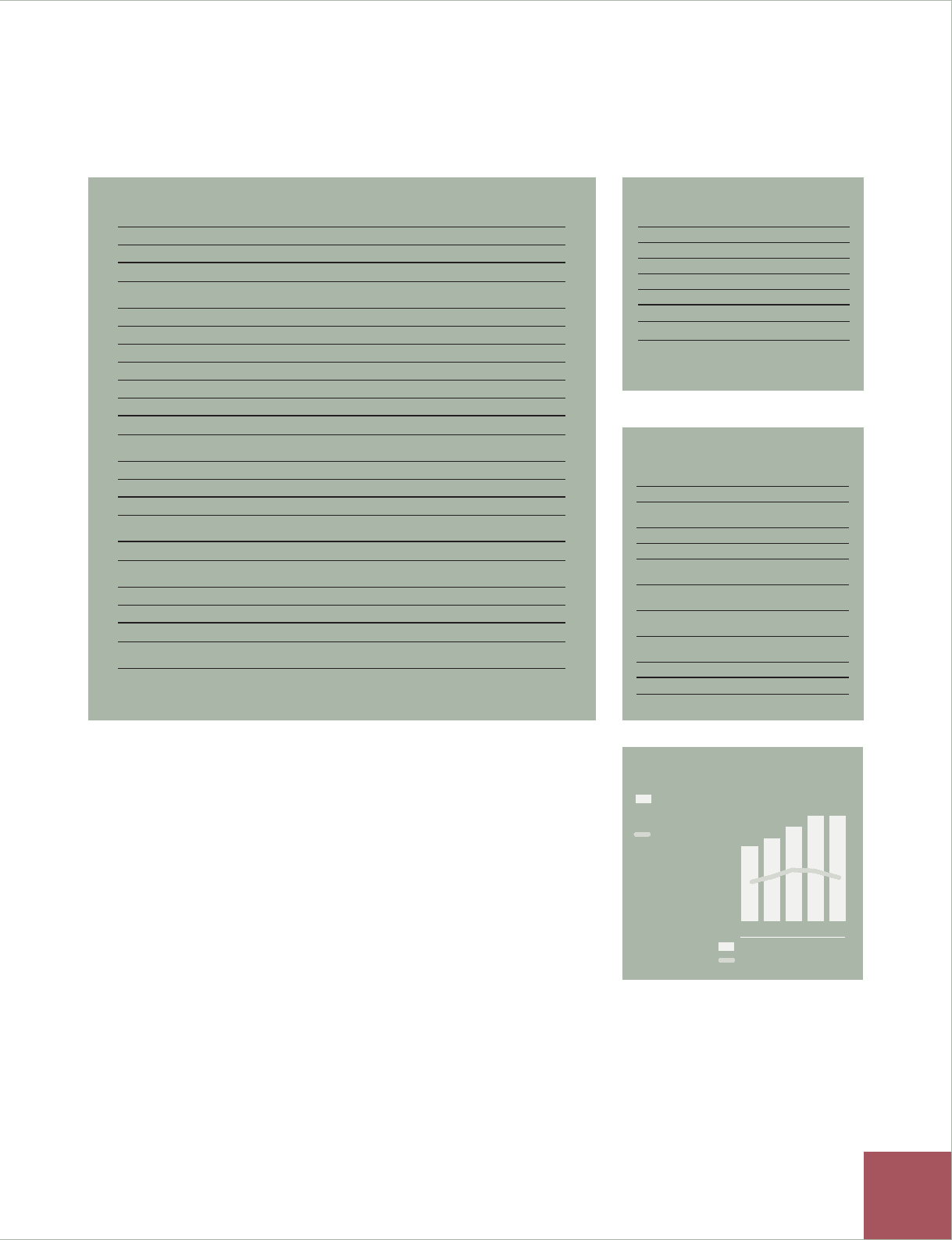

2.8 3.2 3.7 3.8 3.3

Research and development costs1

Research and development

costs, SEK bn

Research and

development costs,

% of net sales

01 02 03 04 05

5,4 5,9 6,8

3,0 3,3 3,9 7,6

3,8 7,6

3,3

1 Years 2004 and 2005 are reported in accordance with

IFRS and 2001, 2002 and 2003 in accordance with

prevailing Swedish GAAP. See Note 1 and 3.