Volvo 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 113

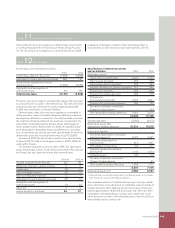

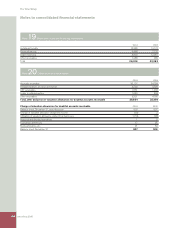

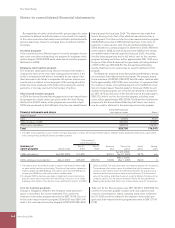

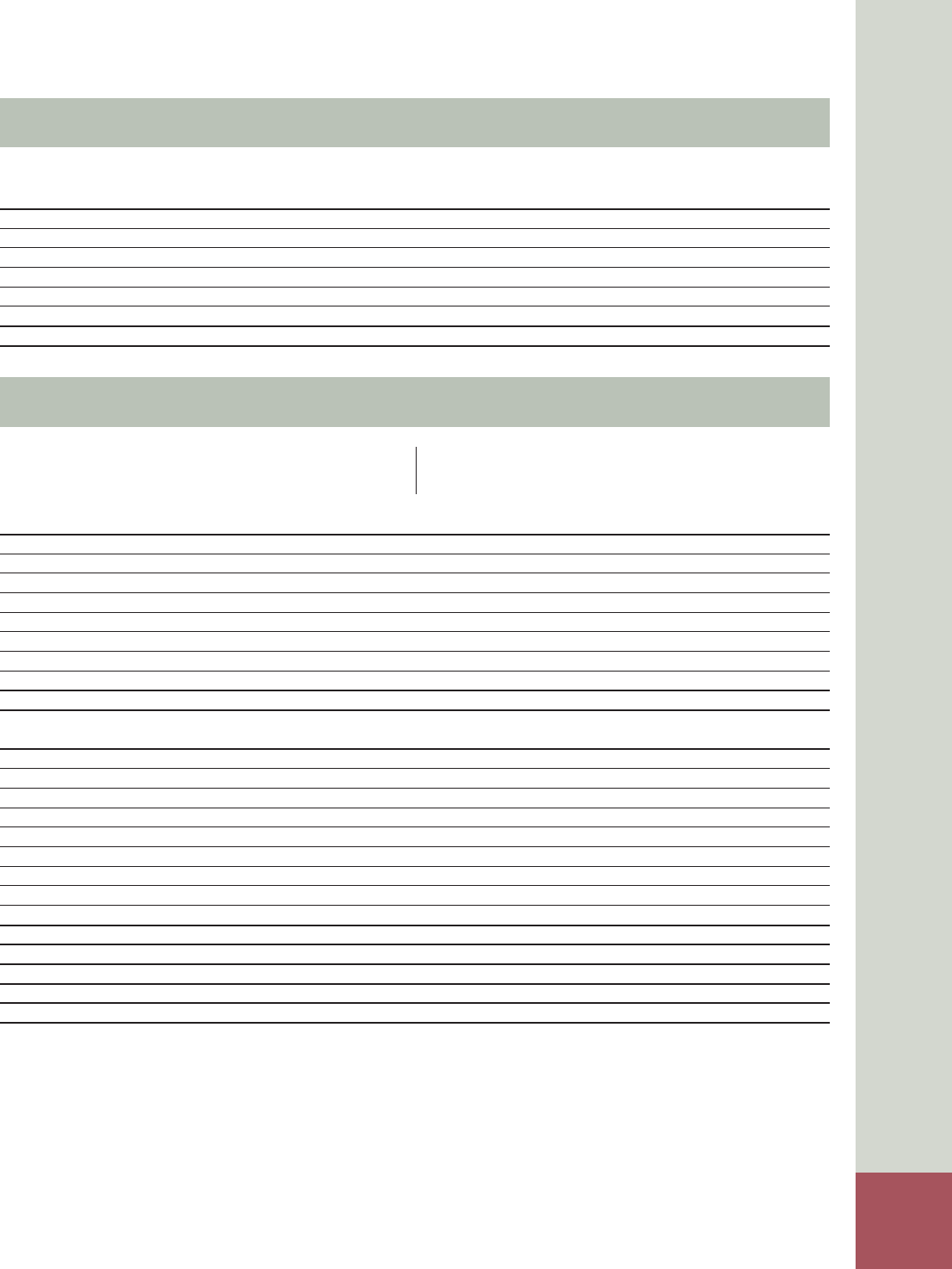

Note 25 Other provisions

Value in Provisions Acquired and Trans- Value in Whereof Whereof

balance and divested lation Reclassi- balance due within due after

sheet 2004 reversals Utilization companies differences fi cations sheet 2005 12 months 12 months

Warranties 6,742 7,332 (6,610) 4 639 56 8,163 4,441 3,722

Provisions in insurance operations 312 76 – – – – 388 – 388

Restructuring measures 571 (27) (215) 7 30 6 372 273 99

Provisions for residual value risks 987 95 (186) 7 123 (95) 931 472 459

Provisions for service contracts 1,512 379 (327) (39) 97 1 1,623 914 710

Other provisions 4,354 2,436 (2,368) 24 481 (113) 4,814 3,179 1,634

Total 14,478 10,291 (9,706) 3 1,370 (145) 16,291 9,279 7,012

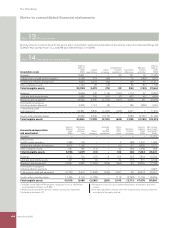

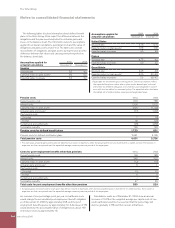

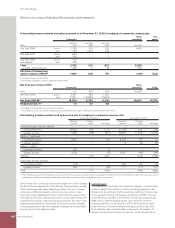

Note 26 Non-current liabilities

The listing below shows the Group’s non-current liabilities in which

the largest loans are distributed by currency. Most are issued by

Volvo Treasury AB.

Information on loan terms is as of December 31, 2005. Volvo

hedges foreign-exchange and interest-rate risks using derivative

instruments. See Note 36.

Bond loans 2004 2005

GBP 2004/2006, 5.18% 1,905 –

SEK 1998–2005/2007–2009, 1.78–5.2% 4,798 4,931

JPY 2001–2005/2007–2011, 0.42–2.3% 542 475

HKD 1999/2006, 7.99% 85 –

CZK 2001–2005/2007–2010, 2.27–6.5% 380 400

USD 1998–2005/2007–2008, 4.29–5.0% 2,150 1,788

EUR 1997–2005/2007–2011, 2.33–6.12 17,546 19,928

Other bond loans 206 48

Total 27,612 27,570

Other loans 2004 2005

USD 1989–2005/2007–2015, 4.07–13.0% 5,360 6,193

EUR 1996–2005/2007–2013, 0.5–9.59% 2,596 2,735

GBP 1995–2004/2007–2010, 4.87–7.58% 1,269 1,859

SEK 1992–2004/2007–2013, 2.19–4.85% 519 647

BRL 2000–2005/2008–2011, 5.0–18.35% 944 1,230

CAD 2002–2004/2008–2010, 3.78–3.88% 1,557 1,950

AUD 2004/2008, 5.89% 49 –

MXN 2003/2007, 9.19–9.34% – 835

Other loans 505 536

Total other long-term loans 12,799 15,985

Deferred leasing income 1,377 1,689

Residual value liability 3,122 2,931

Other long-term liabilities 154 639

Total 45,064 48,814

Of the above long-term loans, 1,501 (1,422) was secured.