Volvo 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 87

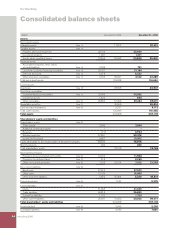

However, the Volvo consolidated balance sheet and income state-

ment still recognizes leasing contracts as operational and, accord-

ingly, reports higher sales and depreciation.

Investments in other companies

Volvo accounts for all investments in companies, except if these

investments are classifi ed as associated companies in accordance

with IAS 39, Financial Instruments: Recognition and Measurement.

Companies listed on a fi nancial exchange should be reported in the

balance sheet to market value. Under IAS 39, unrealized gains and

losses attributable to the change in market value of investments are

reported in a separate component of shareholders’ equity except

when decline in value is other than temporary. If the value decline is

considered other than temporary, the value should be written down

through the income statement. IAS 39 is applied by Volvo as of Jan-

uary 1, 2005 and the difference in valuation compared with Swedish

GAAP and the 2004 accounting principles is that all such invest-

ments have been carried at their cost of acquisition unless there has

been a permanent decrease in value. The difference between the

valuation at December 31, 2004 and January 1, 2005 is reported in

shareholders’ equity. Unlisted shares, for which a reliable fair value

can not be determined, should be reported at a historical cost

reduced in appropriate cases by write-downs.

Reporting of fi nancial assets and liabilities

Volvo reports marketable securities in accordance with IAS 39

based on classifi cation of these assets into a category valued at fair

value through profi t and loss. As of January 1, 2005, Volvo applies

IAS 39, regarding the time that fi nancial assets should be derecog-

nized from the balance sheet. This occurs when substantially all risks

and rewards have been transferred to an external party. Correspond-

ing principles are applied regarding fi nancial assets in Volvo’s seg-

ment reporting. Under Swedish GAAP, for the 2004 comparison year,

fi nancial assets should be derecognized at settlement or if the own-

ership of the fi nancial assets had been transferred to an external party.

Financial liabilities are reported at historical value reduced by

amortization. Transaction cost in connection with raising fi nancial

liabilities are amortized over the fi nancial loan’s duration as a fi nan-

cial expense.

Receivables

Accounts receivables are initially recognized at fair value, normally

equal with the nominal amount. In cases in which the payment terms

exceed one year, the receivable is carried at its discounted present

value. Provisions for doubtful receivables are made on a current

basis after an assessment of whether the customer’s ability to pay

has changed.

Hedge accounting

In accordance with IAS 39, which is applied by Volvo as of January

1, 2005, certain fi nancial instruments shall be reported at fair value

in the balance sheet. In order to apply hedge accounting, the follow-

ing criteria must be met: the position being hedged is identifi ed and

exposed to market value movements, for instance related to

exchange-rate or interest-rate movements, the purpose of the loan/

instrument is to serve as a hedge and the hedging effectively pro-

tects the underlying position against changes in the fair value.

Financial instruments used for the purpose of hedging future cur-

rency fl ows are accounted for as hedges if the currency fl ows are

considered highly probable to occur.

– For fi nancial instruments used to hedge forecasted internal

commercial cash fl ows and forecasted electricity consumption, the

fair value is debited or credited to a separate component of equity to

the extent the requirements for cash-fl ow hedge accounting are ful-

fi lled. To the extent that the requirements are not met, the unrealized

gain or loss will be charged to income statement. Gains and losses

on hedges are reported at the same time that the gains and losses

arise on the items hedged and are recognized in consolidated share-

holders’ equity.

– For fi nancial instruments used to hedge interest and currency

risks on loans, Volvo previously applied through and including 2004

hedge accounting in accordance with Swedish GAAP. The difference

between the carrying value according to Swedish GAAP and the fair

value according to IFRS as of January 1, 2005 will be charged

against the income statement over the remaining time of the hedged

instrument. Under the more complex rules in IAS 39, Volvo has cho-

sen not to apply hedge accounting. The difference between carrying

values reported under Swedish GAAP and fair values to be reported

under IFRS pertains to unrealized interest-rate gains and losses

attributable to the period between the reporting date and maturity

dates of the derivatives. The unrealized gains and losses will be

charged to the fi nancial net in the income statement.

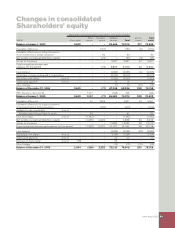

– Volvo applies hedge accounting for certain net investments in

foreign operations. The current result for such hedges is reported in

a separate component in shareholders’ equity. In the event of a

divestment, the accumulated result from the hedge is recognized in

the income statement.

Research and development expenses

Volvo applies IAS 38, Intangible Assets, for reporting of research

and development expenses. In accordance with this accounting rec-

ommendation, expenditures for development of new products, pro-

duction systems and software shall be reported as intangible assets

if such expenditures with a high degree of certainty will result in

future fi nancial benefi ts for the company. The acquisition value for

such intangible assets shall be amortized over the estimated useful

life of the assets. The rules means that high demands are estab-

lished in order for these development expenditures to be reported as

assets. For example, it must be possible to prove the technical func-

tionality of a new product or software prior to this development

being reported as an asset. In normal cases, this means that expen-

ditures are capitalized only during the industrialization phase of a

product development project. Other research and development

expenses are charged to income as incurred.

Depreciation, amortization and impairments of tangible

and intangible non-current assets

Volvo applies historical costs for valuation of intangible and tangible

assets. Loan expenses during the acquisition period for a non-cur-

rent asset are expenses. Depreciation is based on the historical cost

of the assets, adjusted in appropriate cases by write-downs, and

estimated useful lives.

Depreciation periods

Capitalized type-specifi c tools 2 to 8 years

Operational leases 3 to 5 years

Machinery 5 to 20 years

Buildings and Investment property 25 to 50 years

Land improvements 20 years

Product and software development 3–8 years

In connection with its participation in aircraft engine projects with

other companies, Volvo Aero in certain cases pays an entrance fee.

These entrance fees are capitalized as an immaterial asset and

amortized over 5 to 10 years.