Volvo 2005 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 123

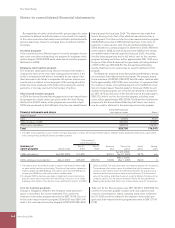

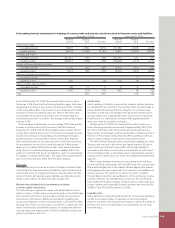

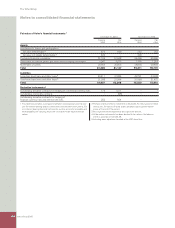

Outstanding derivate instruments for hedging of currency risks and interest rate risks related to fi nancial assets and liabilities

December 31, 2004 December 31, 2005

Notional Carrying Notional Carrying

amount value Fair value amount value Fair value

Interest-rate swaps

– receivable position 76,667 1,659 2,919 101,483 2,348 2,348

– payable position 68,018 (1,585) (2,144) 116,824 (2,222) (2,222)

Forwards and futures

– receivable position 497,951 168 168 395,144 120 120

– payable position 499,512 (182) (182) 343,309 (112) (112)

Foreign exchange derivative contracts

– receivable position 17,120 286 286 18,619 355 355

– payable position 8,273 (82) (107) 14,474 (331) (331)

Options purchased, caps and fl oors

– receivable position – – – – 0 0

– payable position 200 – (4) 502 (5) (5)

Options written, caps and fl oors

– receivable position 133 0 0 0 0 0

– payable position 1,946 (12) (12) 822 (5) (5)

Total 252 924 148 148

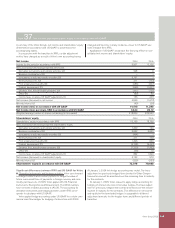

funds. At December 31, 2005, the average interest rate on liquid

funds was 2.3%. Volvo’s interest bearing liabilities, apart from loans

designated to funding of the customer fi nancing portfolio, consisted

on the same date mainly of provisions for post-employment benefi ts

and loans. For the outstanding loans, the interest rate terms with

consideration of derivative instruments were corresponding to a

fi xed interest period of six months. The average interest rate at year-

end was 4.7%.

If assuming an instantaneous one percentage (100 basis points)

increase in interest rates of all currencies from their levels at

December 31, 2005, with all other variables held constant, Volvo’s

income after fi nancial items over a 12-month period would increase

by 225. If assuming a corresponding one percentage (100 basis

points) decrease in interest rates, Volvo’s income after fi nancial

items would decrease by the same amount. It should be noted that

the assumptions on which this sensitivity analysis is based upon

rarely occur in reality. Actual interest rates rarely move instantane-

ously. Also, the sensitivity analysis assumes a parallel shift of the

yield curve and that both assets and liabilities react correspondingly

to changes in market interest rates. The impact from actual interest

rate movements may thus differ from the above analysis.

Price risks

The exposure for price risks as a result of changes in interest rates

is attributable to fi nancial assets and liabilities with extended fi xed

interest rate terms. A comparison between carrying values and fair

values of Volvo’s all fi nancial assets, liabilities and derivative instru-

ments is presented in the table Fair value at page 124.

Market risks attributable to investments in shares

or other equity instruments

The Volvo Group is exposed to market risks attributable to invest-

ments in shares or other equity instruments because funds that have

been transferred to Volvo’s pension plans partially are invested in

instruments of this nature. Additional information regarding plan

assets and obligations of Volvo’s pension plans is presented in Note

24. Apart from Volvo’s pension plans, investments in shares are only

made if motivated by operational purposes. A comparison between

carrying values and market values of Volvo’s holdings in listed com-

panies is included in Note 15.

Credit risks

Volvo’s granting of credits is governed by common policies and rules

for classifi cation of customers. The credit portfolio should include a

proper distribution among different categories of customers and

industries. Credit risks are managed through active monitoring, fol-

low-up routines and in appropriate cases repossession of products.

Furthermore, it is continuously monitored that appropriate allow-

ances are made for doubtful receivables.

On December 31, 2005, the credit portfolio within Volvo’s cus-

tomer fi nancing operations amounted to approximately SEK 79 bil-

lion. The credit risks within this portfolio are distributed among a

large number of individual customers and dealers. Collaterals exist in

the form of the products being fi nanced. When granting credits, an

effort is made to balance risk exposure and expected yield.

The Volvo Group’s fi nancial assets are primarily managed by Volvo

Treasury and invested in the money and capital markets. All invest-

ments must meet criteria for low credit risk and high liquidity. In

accordance with Volvo’s credit policy, counterparties for both invest-

ments and transactions in derivatives must in general have received

a rating of “A” or better from one of the well established credit-rating

agencies.

When using derivative instruments a counterparty risk will arise,

i.e. the risk that a counterparty will not fulfi ll its part of a contract and

that a potential gain will not be realized. Where appropriate, master

netting agreements are signed with the respective counterparties to

reduce exposure. The credit risk in futures contracts is limited

through daily or monthly cash settlements of the net change in value

of open contracts. The estimated gross exposure for counterparty

risks related to forward exchange contracts, interest rate swaps and

futures, options and commodity forward contracts amounted to 891;

2,468; 51 and 54 as of December 31, 2005.

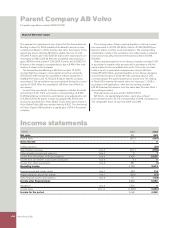

Liquidity risks

Volvo maintains a strong fi nancial position by continuously keeping a

certain percentage of sales in liquid assets. A proper balance

between short-term and long-term borrowing, as well as the ability to

borrow in the form of credit facilities, are designed to ensure long-

term fi nancing.