Volvo 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 Volvo Group 2005

The share

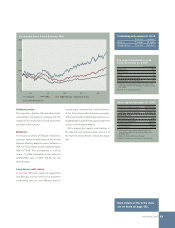

Favorable share performance

The trend on the world’s leading stock

exchanges during 2005 was generally favor-

able. On the Stockholm Stock Exchange, the

Affärsvärlden General Index (AFSX) rose

by 33%.

On the Stockholm Stock Exchange, the

Volvo B share gained 42% during 2005, com-

pared with an increase of 48% for the MSCI

Europe Machinery Index, Morgan Stanley’s

European index of engineering companies.

At the end of the year, the share price for

the B share was SEK 374.50, compared with

SEK 263.50 at the end of 2004. The highest

price paid during the year was SEK 378.50, on

December 30, 2005, a record high. The lowest

price paid was SEK 260.00 on January 5,

2005.

Market capitalization

At December 31, 2005, the market capitaliza-

tion of Volvo amounted to SEK 150 billion,

compared with SEK 107 billion at December

31, 2004. Volvo’s market capitalization was

equivalent to 4.5% of the total market cap-

italization of the Stockholm Stock Exchange.

Trading

The majority of trading in Volvo shares takes

place via the Stockholm Stock Exchange,

where the shares have been listed since 1935.

Trading in Volvo involves Volvo A and Volvo B

shares with the tickers VOLV A and VOLV B

respectively. A trading block comprises 100

shares.

During 2005, a total of 558 (540) million

shares were traded on the Stockholm Stock

Exchange, corresponding to a daily average

of 2.2 (2.1) million shares traded. The turnover

rate was 129%, compared with 124% for the

Stockholm Stock Exchange as a whole.

ADR program in the United States

Since 1985, a program for American Deposit-

ary Receipts (ADRs) has existed in the United

States. Each ADR represents one Volvo B

sha r e a nd t he Vol vo AD R i s tr a de d w i th the

ticker VOLVY on NASDAQ. In 2005, the

average daily volumes of ADRs traded were

78,555 (94,695) and the total number of

outstanding ADRs at year-end was about

13 million (20 million).

Sweden (51)

France (22)

US (11)

UK (7)

Switzerland (2)

Others (7)

1 Share of capital, registered shares.

Ownership by country1, %

1 Share of capital, registered shares.

Non-Swedish owners (49)

Savings funds (11)

Pension funds

and insurance

companies (17)

Swedish private

shareholders (12)

Others (11)

Ownership categories1, %

8.0 8.0 8.0 12.5 16.75

(3.5) 3.3 0.7 23.6 32.2

Earnings1 and cash

dividend per share

1 Years 2004 and 2005 are reported

in accordance with IFRS and 2001,

2002 and 2003 in accordance with

prevailing Swedish GAAP.

See Note 1 and 3.

01 02 03 04 05

Earnings1

per share, SEK

Dividend per share, SEK

0

4.5 5.6 10.5

17.6 (14.8) 71.2

4.7

25.5

4.5

48.5

Direct return

Effective return

Direct return1 and

effective return2, %

1 Dividend as percentage

of share price.

2 Share price at year-end, including

proposed dividend during the

year, divided by share price at

the beginning of the year.

01 02 03 04 05

0

Volvo included in Dow Jones

Sustainability Index

Since 2002, Volvo has been

included in the Dow Jones

Sustainability World Index (DJSI

World). DJSI World is a worldwide

index based on global companies’

efforts regarding sustainable devel-

opment. Companies are evaluated

annually according to a model

embracing finance, environment and

social factors. DJSI World comprises

the highest-ranked

10% of the 2,500

companies included

in the Dow Jones

Global Index. Volvo

is also one of

slightly more than

170 companies

included in the Dow Jones STOXX

Sustainability Index, which com-

prises leading European companies.

Further information is available at

www.sustainability-indexes.com

➡