Volvo 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 109

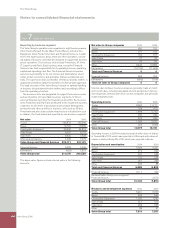

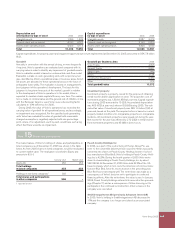

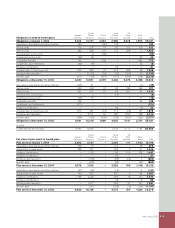

Note 21 Marketable securities

Marketable securities consist mainly of interest-bearing securities, distributed as shown below:

2004 2005

Government securities 6,354 4,226

Banks and fi nancial institutions 371 464

Real estate fi nancial institutions 19,220 24,020

Other 10 124

Total 25,955 28,834

Note 22 Cash and cash equivalents

2004 2005

Cash in banks 5,787 5,652

Time deposits in banks 3,004 2,461

Total 8,791 8,113

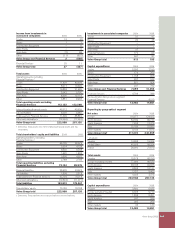

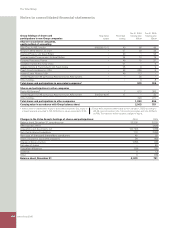

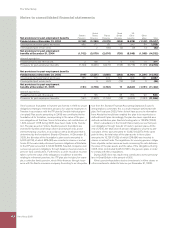

Note 23 Shareholders’ equity

The share capital of the Parent Company is divided into two series of

shares: A and B. Both series carry the same rights, except that each

Series A share carries the right to one vote and each Series B share

carries the right to one tenth of a vote. The shares quota value is

SEK 6.00.

Total share capital by year end 2004 amounted to 2,649 and was

based on 441,520,885 registered shares. During 2005 share capital

was reduced by 95 through cancellation without repayment of

3,084,619 Series A shares and 12,752,222 Series B shares. After

reduction share capital amounts to 2,554 and is based on

425,684,044 registered shares.

The total number of registered shares by year end 2005

amounted to 425,684,044. Volvo held 5% of the registered shares

at year end 2005, 21,220,535 shares whereof Series A shares

4,145,627 and Series B shares 17,074,908. At year end 2004, Volvo

held 7% of the registered shares, 31,391,043 shares whereof Series

A shares 7,075,246 and Series B shares 24,315,797. The total

number of outstanding Volvo shares by year end 2005 amounted to

404,463,509 whereof Series A shares 131,374,699 and Series B

shares 273,088,810. The average number of outstanding shares

was 405,242,037 in 2005.

Cash dividend decided by the Annual General Meeting 2005 was

12:50 (8:00) per share or total 5,055 (3,356).

Unrestricted equity in the Parent Company at December 31, 2005

amounted to 41,220.

Changes in outstanding Volvo shares

Balance December 31, 2004 410,129,842

Buy-back of shares in 2005 (5,730,000)

Share-based incentive program 63,667

404,463,509

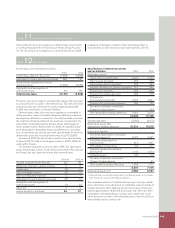

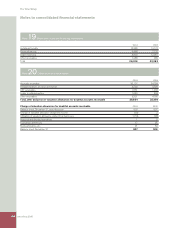

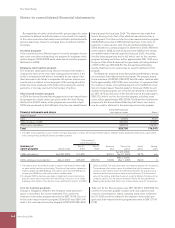

Note 24 Provisions for post-employment benefi ts

Post-employment benefi ts, such as pensions, healthcare and other

benefi ts are mainly settled by means of regular payments to inde-

pendent authorities or bodies that assume pension obligations and

administer pensions through defi ned contribution plans. The remain-

ing post-employment benefi ts are defi ned benefi t plans; that is, the

obligations remain within the Volvo Group or are secured by own

pension foundations. Costs and the obligations at the end of period

for defi ned benefi t plans are calculated based on actuarial assump-

tions and measured on a discounted basis. The Volvo Group defi ned

benefi ts plans relate mainly to subsidiaries in the US and comprise

both pensions and other benefi ts, such as healthcare. Other large-

scale defi ned benefi t plans apply for salaried employees in Sweden

(mainly through the Swedish ITP pension plan) and employees in

France and Great Britain. See note 1 for further information about

the accounting principles.