Volvo 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

88 Volvo Group 2005

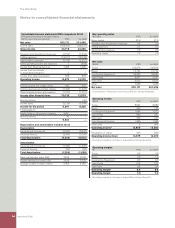

Notes to consolidated fi nancial statements

The estimated value of investment property is based on dis-

counted cash fl ow projections. The valuation is performed by the

Group’s Real Estate business unit. The required return is based on

current property market conditions for comparable properties in

comparable locations.

Goodwill is reported as intangible non-current assets with inde-

fi nite useful life. Annually, testing is carried out to determine any

impairment through calculation of the asset’s recovery value. If the

calculated recovery value is less than the carrying value, a write

down is made to the asset’s recovery value.

Similarly, impairment testing is carried out at the closing date if

there is any indication that a non-current asset has declined in value.

Leasing – Volvo as the lessee

Volvo evaluates leasing contracts in accordance with IAS 17, Leases.

In those cases in which the fi nancial risk and benefi ts that are

related to ownership are in signifi cant respects held by Volvo, Volvo

reports the asset in the balance sheet at the lowest of the leased

object’s fair value or the present value of minimal leasing fees. The

future leasing fees are reported as loans. The lease object is depre-

ciated in accordance with Volvo’s principle for the respective non-

current asset. The leasing fees are distributed between amortization

and interest expenses.

Non-current assets held for sale and discontinued operations

Volvo applies IFRS 5, Non-current Assets Held for Sale and Discon-

tinued Operations as of 2005. Processes are continuously ongoing

regarding the sale of assets or groups of assets at minor values. In

cases in which the criteria for being classifi ed as a non-current asset

held for sale are fulfi lled and the asset or group of assets is other

than of minor value, the asset or group of assets and the related

liabilities are reported on a separate line in the balance sheet. The

asset or group of assets are tested for impairment and valued at fair

value after deduction for selling expenses if impaired.

Inventories

Inventories are stated at the lower of cost, in accordance with the

fi rst-in, fi rst-out method (FIFO), or net realizable value. The historical

value is based on the standard cost method, including costs for all

direct manufacturing expenses and the apportionable share of the

capacity and other related manufacturing costs. The standard costs

is tested regularly an adjustment is made based on current condi-

tions. Costs for research and development, selling, administration

and fi nancial expenses are not included. Net realizable value is cal-

culated as the selling price less costs attributable to the sale.

Share-based payments

Volvo applies IFRS 2, Share-based Payments for the new share-based

incentive program adopted at the Annual General Meetings in 2004

and 2005. IFRS 2 distinguishes “cash-settled” and “equity-settled”, in

Volvo case, shares, components of share-based payments. The Volvo

program include both a cash-settled and an equity-settled part. The

value of the equity-settled payments is determined at the grant-date,

recognized as an expense during the vesting period and credited to

equity. The fair value is calculated according to share price reduced by

dividend connected to the share before the allotment. The additional

social costs are reported as a liability, revalued at each balance sheet

date in accordance with URA 46, issued by the Swedish Financial

Accounting Standards Council’s Emergency Issue Task Force. The

cash settled payment is revalued at each balance sheet day and is

reported as an expense during the vesting period and as a short term

liability. An assessment whether the terms of payment will be fulfi lled

is made continuously. If the assessment changes, the expense will be

adjusted. The equity-settled part was earlier accounted for at fair

value and provided for as an accrued expense over the vesting period

with a ”true-up”each reporting date.

Pensions and similar obligations (Postemployment benefi ts)

Volvo applies IAS 19, Employee Benefi ts, for pensions and similar

obligations. In accordance with IAS 19, actuarial calculations should

be made for all defi ned-benefi t plans in order to determine the

present value of obligations for benefi ts un-vested by its current and

former employees. The actuarial calculations are prepared annually

and are based upon actuarial assumptions that are determined close

to the balance sheet date each year. Changes in the present value of

obligations due to revised actuarial assumptions are treated as actu-

arial gains or losses which are amortized over the employees’ aver-

age remaining service period to the extent these exceed the corridor

value for each plan. Deviations between expected return on plan

assets and actual return are treated as actuarial gains or losses.

Provisions for post-employment benefi ts in Volvo’s balance sheet

correspond to the present value of obligations at year-end, less fair

value of plan assets, unrecognized actuarial gains or losses and

unrecognized unvested past service costs.

In accordance with the IFRS transition rules, the carrying amount

of the liability is determined at January 1, 2004 in accordance with

IAS 19 and the actuarial gains and losses set at zero. As a supple-

ment to IAS 19, Volvo applies URA 43 in accordance with the

recommendation from the Swedish Financial Accounting Standards

Council in calculating the Swedish pension liabilities.

For defi ned contribution plans premiums are expensed as incurred.

Provisions for residual value risks

Residual value risks are attributable to operational leasing contracts

and sales transactions combined with buy-back agreements or

residual value guarantees. Residual value risks are the risks that

Volvo in the future would have to dispose used products at a loss if

the price development of these products is worse than what was

expected when the contracts were entered. Provisions for residual

value risks are made on a continuing basis based upon estimations

of the used products’ future net realizable values. The estimations of

future net realizable values are made with consideration of current

prices, expected future price development, expected inventory turn-

over period and expected variable and fi xed selling expenses. If the

residual value risks are pertaining to products that are reported as

tangible assets in Volvo’s balance sheet, these risks are refl ected by

depreciation or write-down of the carrying value of these assets. If

the residual value risks are pertaining to products, which are not

reported as assets in Volvo’s balance sheet, these risks are refl ected

under the line item short-term provisions.

Warranty expenses

Estimated costs for product warranties are charged to operating

expenses when the products are sold. Estimated costs include both

expected contractual warranty obligations as well as expected good-

will warranty obligations. Estimated costs are determined based

upon historical statistics with consideration of known changes in

product quality, repair costs or similar. Costs for campaigns in con-

nection with specifi c quality problems are charged to operating

expenses when the campaign is decided and announced.

Restructuring costs

Restructuring costs are reported as a separate line item in the

income statement if they relate to a considerable change of the

Group structure. Other restructuring costs are included in Other