Volvo 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 61

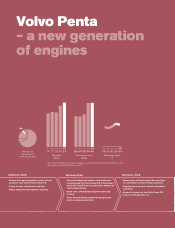

Development of market shares

The total market share for the Volvo Group’s

truck operations in the heavy trucks segment

in Europe 27 was 25.2% in 2005, compared

with 26.5% a year earlier. Volvo Trucks’ market

share declined to 14.4% (15.2) primarily due

to lower deliveries to central Europe. Renault

Trucks’ market share declined to 10.8% (11.3)

as a result of a lower share of the French mar-

ket.

In North America, the total market share for

heavy trucks (Class 8) was 19.6% (19.4). Volvo

Trucks’ market share declined to 9.3% (9.7),

primarily as a result of limitations in production

capacity. Mack Trucks increased its market

share due to the very high demand in the com-

pany’s core segments to 10.3% (9.7).

In Brazil Volvo Trucks’ market share

increased to 13.6% (13.1).

Good earnings trend

Net sales for Volvo’s truck operations amoun t-

ed to SEK 155,396 M, which adjusted for

changed exchange rates corresponded to an

increase of 11%. The increase was attributable

to higher sales, primarily in North America,

South America and Other markets. Demand

in North America was driven by a continued

strong US economy, which resulted in

increased transport needs. In addition, there

is a need to renew truck fleets, which certain

hauling companies are doing prior to the new,

stricter emission legislation becoming effect-

ive at the beginning of 2007. In Europe,

demand rose somewhat from an already his-

torically high level. In total, Volvo delivered

214,379 trucks in 2005, 11% more than in the

preceding year.

Trucks’ operating income increased by 30%

to SEK 11,717 M (8,992) for 2005. The

increase is primarily related to North America,

where both Mack Trucks and Volvo Trucks

improved profitability as a result of good price

realization and increased sales volumes. In

Europe, Renault Trucks continued to improve

profitability, while it came down somewhat,

from a good level, for Volvo Trucks. The operat-

ing income in Europe was impacted by

increased costs during the second half of

2005 as a co n s equen ce of la unc he s and pro -

duction changeovers in connection with the

introduction of a new generation of trucks and

engines.

Production and investments

Renault Trucks’ plant in Blainville, France

opened a new, ultramodern facility for pre-

treatment of cabs for painting, with higher

capacity, better quality and improved environ-

mental features.

To meet the favorable demand for products

in the construction segment, Mack Trucks

started a second shift in May 2005 at the plant

in Macungie, Pennsylvania, in the US, which

increased production capacity by about 40%.

Investments to produce the engines of

tomorrow for the North American market con-

tinued in Hagerstown, Maryland in the US.

During the year, series production of Volvo’s

12- and 16-liter engines was started and pre-

production of the new Mack engines series

was initiated toward year-end.

Volvo Trucks opened a new assembly plant

in Durban, South Africa, as a consequence of

operations being discontinued at the plant in

Botswana. AB Volvo decided during the year

to invest SEK 650 M in a new paint shop at the

Umeå cab plant in Sweden. The new facility is

expected to be the world’s cleanest topcoat

paint shop.

Volvo Trucks Mack Trucks

04 05

9.7% 9.3% 9.7% 10.3%

1 In heavy trucks segment (class 8).

04 05

Volvo Trucks Renault Trucks

04 05

15.2% 14.4% 11. 3% 10.8%

1 In heavy trucks segment.

04 05

Market shares in Europe1

Market shares in North America1