Volvo 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

110 Volvo Group 2005

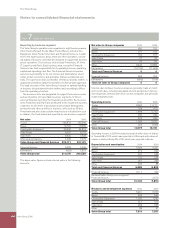

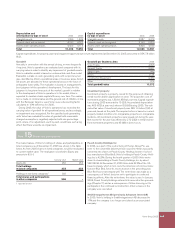

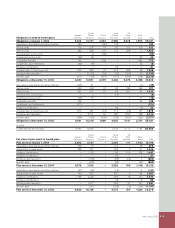

Pension costs 2004 2005

Current service costs 616 788

Interest costs 1,306 1,315

Expected return on plan assets (931) (1,133)

Actuarial gains and losses

1 (17) (107)

Past service costs

– Unvested 7 (4)

– Vested 38 (20)

Curtailments and settlements (28) (362)

Termination benefi ts 729 124

Pension costs for defi ned benefi t plans 1,720 601

Pension costs for defi ned contribution plans 2,681 3,165

Total pension costs 4,401 3,736

1 For each plan, actuarial gains and losses are reported as income or expenses, when the accumulated amount exceeds the so called corridor. The income or

expenses are then recognized over the expected average remaining service period of the employees.

Costs for post-employment benefi ts other than pensions 2004 2005

Current service costs 196 188

Interest costs 349 323

Expected return on plan assets (12) (15)

Actuarial gains and losses

1 6 1

Past service costs

– Unvested (1) (1)

– Vested 5 4

Curtailments and settlements – 0

Termination benefi ts 47 24

Total costs for post-employment benefi ts other than pensions 590 524

1 Actuarial gains and losses are for each plan reported as income or expenses, when the accumulated amount exceed the so called corridor. The income or

expenses are then recognized over the expected average remaining service period of the employees.

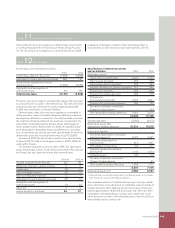

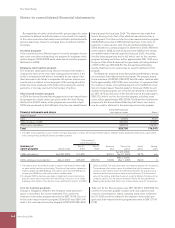

An increase of one percentage point per year in healthcare costs

would change the accumulated post-employment benefi t obligation

as of December 31, 2005 by approximately 208, and the post-

employment benefi t expense by approximately 19. A decrease of 1%

would decrease the accumulated value of obligations by about 198

and reduce costs by approximately 16.

Calculations made as of December 31, 2005 show an annual

increase of 10.0% in the weighted average per capita costs of cov-

ered healthcare benefi ts; it is assumed that the percentage will

decline gradually to 5% and then remain at that level.

Notes to consolidated fi nancial statements

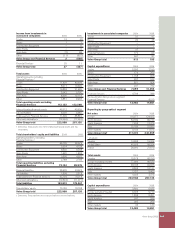

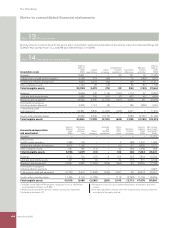

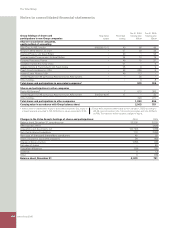

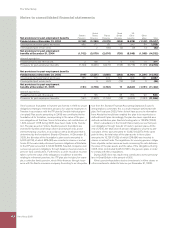

The following tables disclose information about defi ned benefi t

plans in the Volvo Group. Volvo report the difference between the

obligations and the plan assets adjusted for actuarial gains and

losses in the balance sheet. The information refers to assumptions

applied for actuarial calculations, periodical costs and the value of

obligations and plan assets at year-end. The tables also include

reconciliation of obligations and plan assets during the year and the

difference between fair values and carrying amounts reported on

the balance sheet date.

Assumptions applied for 2004 2005

actuarial calculations December 31 December 31

Sweden

Discount rate 5.0 4.0

Expected return on plan assets

1 6.0 6.0

Expected salary increases 3.2 3.2

Assumptions applied for 2004 2005

actuarial calculations December 31 December 31

United States

Discount rate 5.75 5.75

Expected return on plan assets

1 7.65 7.65

Expected salary increases 3.5 3.5

France

Discount rate 4.75 4.0

Expected salary increases 3.0 3.0

Great Britain

Discount rate 5.25 4.8

Expected return on plan assets

1 6.25 5.2–6.5

Expected salary increases 3.5 3.8–4.0

1 Applicable for the following accounting period. These assumptions refl ect

the expected long-term return rate on plan assets, based upon historical

yield rates for different categories of investments and weighted in accord-

ance with the foundation’s investment policy. The expected return has been

calculated net of administrative expenses and applicable taxes.