Volvo 2005 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

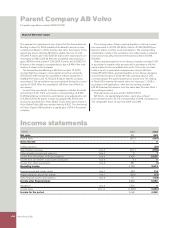

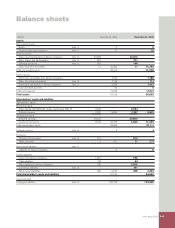

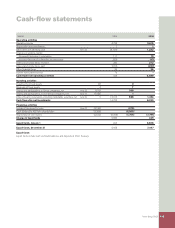

Parent Company AB Volvo

136 Volvo Group 2005

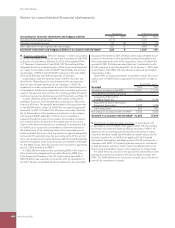

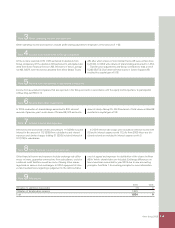

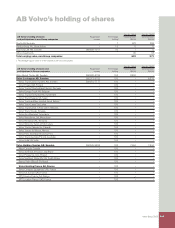

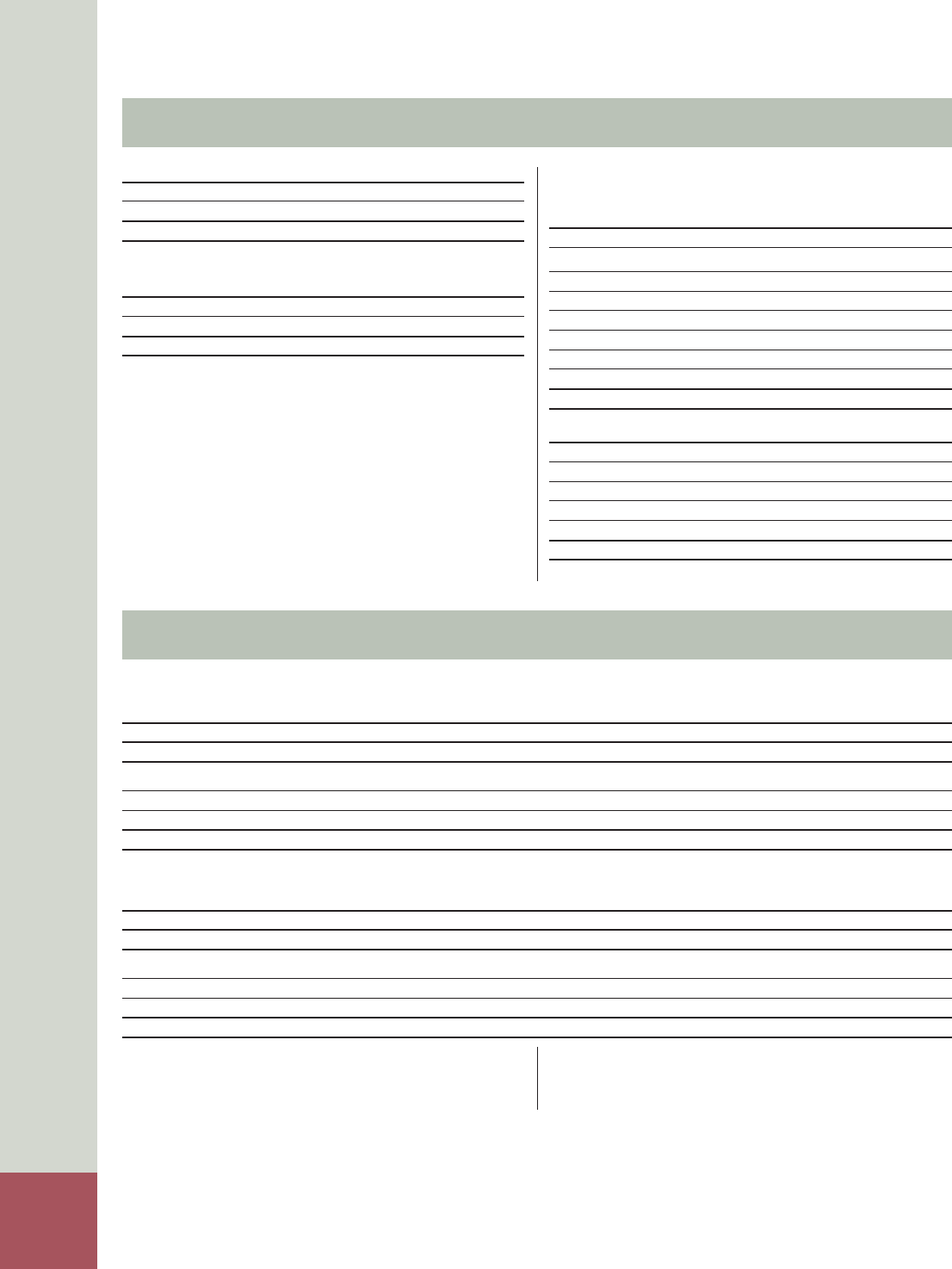

Note 11Intangible and tangible assets

Value in Value in

balance sheet Capital Sales/ balance sheet

Acquisition cost 2004 expenditures scrapping 2005

Rights 52 – – 52

Total intangible assets 52 – – 52

Buildings 9 – (3) 6

Land and land improvements 4 – (1) 3

Machinery and equipment 49 0 (1) 48

Total tangible assets 62 0 (5) 57

Value in Value in Net carryng

balance sheet Sales/ balance sheet value in balance

Accumulated depreciation 2004 2 Depreciation 1 scrapping 2005 2 sheet 2005 3

Rights 52 – – 52 0

Total intangible assets 52 – – 52 0

Buildings 1 0 0 1 5

Land and land improvements – 0 – 0 3

Machinery and equipment 40 1 (1) 40 8

Total tangible assets 41 1 (1) 41 16

1 Including write-downs.

2 Including accumulated write-downs.

3 Acquisition value, less accumulated depreciation, amortization and write-

downs.

The assessed value of buildings was 3 (5) and of land 1 (2). Capital

expenditures in tangible assets amounted to 0 (2). Capital expendi-

tures approved but not yet implemented at year-end 2005 amounted

to 0 (0).

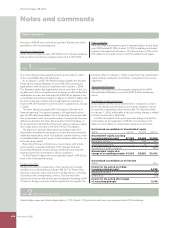

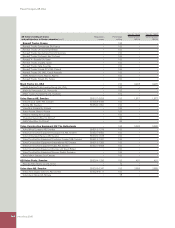

The table below shows the principal reasons for the difference

between the corporate income tax (28%) and the tax for the period.

2004 2005

Income before taxes 6,484 5,590

Income tax according to applicable tax rate (28%) (1,815) (1,565)

Capital gains 184 149

Non-taxable dividends 46 2,565

Non-taxable revaluations of shareholdings (153) (2,358)

Other non-deductible expenses 26 (24)

Other non-taxable income 282 3

Adjustment of current taxes for prior periods 92 –

Total income taxes (1,338) (1,230)

Specifi cation of deferred tax assets 2004 2005

Tax-loss carryforwards 942 –

Valuation allowance for doubtful receivables 1 1

Provision for post-employment benefi ts 154 177

Other deductible temporary differences 0 20

Other taxable temporary differences (110) –

Deferred tax assets 987 198

Note 10 Income taxes

2004 2005

Current taxes 92 (331)

Deferred taxes (1,430) (899)

Total income taxes (1,338) (1,230)

Current taxes were distributed as follows:

Current taxes 2004 2005

Current taxes for the period – (331)

Adjustment of current taxes for prior periods 92 –

Total income taxes 92 (331)

Claims as a consequence of tax audit carried out previously for

which provisions are not deemed necessary amount to – (135). The

amount is included in contingent liabilities.

Deferred taxes relate to estimated tax on the change in tax-loss

carryforwards and temporary differences. Deferred tax assets are

reported to the extent that it is probable that the amount can be

utilized against future taxable income.

Deferred taxes related to change in tax-loss carryforwards

amount to –942 (–1,427) and to changes in other temporary differ-

ences to 43 (–3). Income taxes of 110 regarding prior periods have

been debited directly to equity in connection with change of

accounting principle.

Notes to fi nancial statements