Volvo 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 105

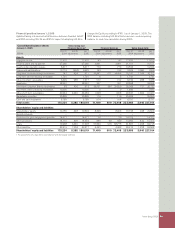

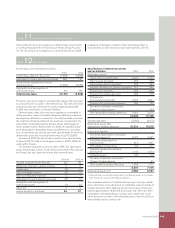

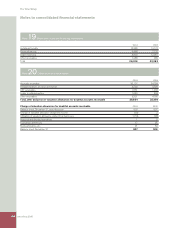

Depreciation and

amortization by type of asset 2004 2005

Intangible assets 1,396 1,409

Property, plant and equipment 4,182 4,370

Assets under operating leases 4,425 4,115

Total 10,003 9,894

Capital expenditures

by type of asset 2004 2005

Intangible assets 2,287 3,473

Property, plant and equipment 5,790 6,829

Assets under operating leases 4,406 4,549

Total 12,483 14,851

Capital expenditures for property, plant and equipment approved but not yet implemented at December 31, 2005, amounted to SEK 7.8 billion

(8.2).

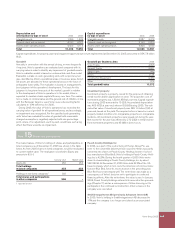

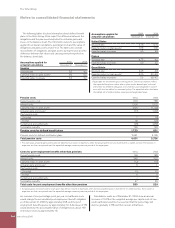

Goodwill

Annually, in connection with the annual closing, or more frequently

if required, Volvo’s operations are evaluated and compared with its

carrying value in order to identify any impairment of goodwill assets.

Volvo’s evaluation model is based on a discounted cash-fl ow model.

Evaluation is made on cash-generating units with reciprocal syner-

gies, identifi ed as Volvo’s operational areas or business areas. Good-

will assets are allocated to these operational areas on the basis of

anticipated future utility. The evaluation is based on management’s

best judgment of the operations’ development. The basis for this

judgment is long-term forecasts of the market’s growth in relation

to the development of Volvo’s operations. In the model, Volvo is

expected to maintain stable capital effi ciency over time. The evalua-

tion is made on nominal value and the general rate of infl ation, in line

with the European target, is used. Volvo uses a discounting factor

calculated to 12% before tax for 2005.

During 2005, the value of Volvo’s operations has exceeded the

carrying value of goodwill for all operational areas, and accordingly,

no impairment was recognized. For the specifi ed cash generating

units Volvo has evaluated the value of goodwill with reasonable

changed assumptions, negatively adjusted with one percentage

point, where of no adjustment, each by each, would have such a big

effect that there would be an impairment.

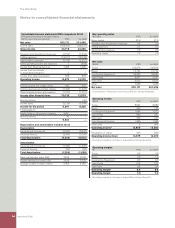

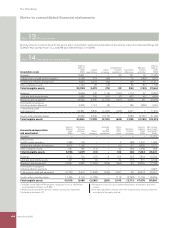

Goodwill per Business Area 2005

Volvo Trucks 4,096

Renault Trucks 2,007

Mack Trucks 982

Buses 1,134

Construction Equipment 2,480

Other 373

Total goodwill value 11,072

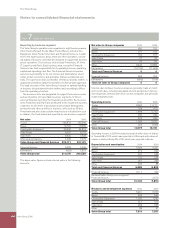

Investment property

Investment property is property owned for the purpose of obtaining

rental income and/or appreciation in value. The acquisition cost of

investment property was 1,534 (1.859) at year-end. Capital expendi-

tures during 2005 amounted to 15 (20). Accumulated depreciation

was 463 (472) at year-end, whereof 53 (68) during 2005. The esti-

mated fair value of investment property was SEK 1.9 billion (2,2) at

year-end, based on the yield. The required return is based on current

property market conditions for comparable properties in comparable

locations. All investment properties were leased out during the year.

Net income for the year was affected by 272 (332) in rental income

from investment properties and 45 (66) in direct costs.

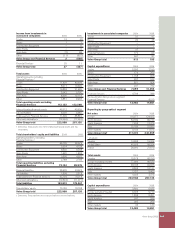

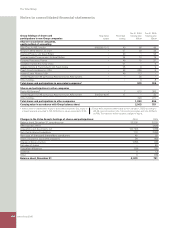

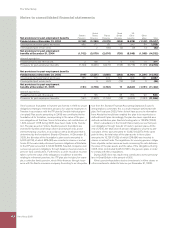

Note 15 Shares and participations

The market values of Volvo’s holdings of shares and participations in

listed companies as of December 31, 2005 are shown in the table

below. As from 2005 shares in listed companies would be revaluated

to current market value. The revaluation is booked to Equity and

amounts to 83 (–).

Carrying value Market value

Deutz AG 253 253

Total holdings

in listed companies 253 253

Holdings in non-listed companies

1 303 –

Total shares and participations

in other companies 556 –

1 reported at cost

Peach County Holdings Inc

In 2004, as a part of the restructuring of Henlys Group Plc, see

note 11, the convertible debenture loan issued to Henlys was partly

converted into shares in Peach County Holdings (owner of school

bus manufacturer Blue Bird). Volvo’s holding in Peach County Hold-

ings Inc is 42,5%. During the fourth quarter of 2005 Volvo wrote

down its shareholding in Peach County Holdings, Inc. by about

SEK 550 M. At December 31, 2005 Volvo held 42.5% of the US-

based company, which in turn owns the American school bus manu-

facturer Blue Bird. Since its reconstruction in the preceding year,

Blue Bird has not developed well. The write-down was made as a

consequence of Volvo’s decision not to participate in continued

fi nancing efforts. After the write-down, the value is zero. In January

2006, Peach County Holdings entered into reconstruction proceed-

ings (Chapter 11) and as a consequence of Volvo choosing not to

participate in the continued reconstruction, Volvo’s shares in the

company were cancelled.

Småföretagarinvest AB (previously Arbustum Invest AB)

In 2005, Volvo’s holding in Småföretagarinvest AB decreased to

17% and the company is no longer considered as an associated

company.