Volvo 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

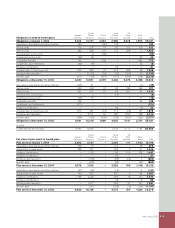

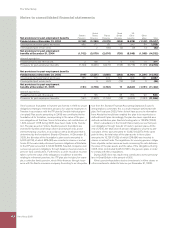

The Volvo Group

118 Volvo Group 2005

Re-negotiation of earlier defi ned-benefi ts pension plans for senior

executives to defi ned-contribution plans is now closed. The majority

of the senior executives that earlier were entitled to defi ned-benefi ts

pension plans have chosen to exchange those to defi ned-contribu-

tion plans.

Incentive programs

Volvo currently has two different types of incentive programs for cer-

tain senior executives outstanding, one program for employee stock

options (expires 2006/2008) and a share-based incentive program

(allotment in 2006).

Employee stock options program

The employee stock options may only be exercised if the holder is

employed by Volvo at the end of the vesting period. However, if the

holder’s employment with Volvo is terminated for any reason other

than dismissal or the holder’s resignation, the options may be exer-

cised in part, in relation to how large part of the vesting period the

holder has been employed. If the holder retires during the vesting

period, he or she may exercise the full number of options.

Share-based incentive program

In 2004 the Annual General Meeting approved a share-based incen-

tive program for certain senior executives within the Volvo Group.

Allotment of 63,667 shares in the program was executed in April

2005 and was based on the fulfi llment of certain non-market based

fi nancial goals for fi scal year 2004. The allotment was made from

Volvo’s treasury stock. Part of the allotment was carried out as a

cash payment. The total costs for the share-based incentive program

2004/2005 amounted to SEK 36 M and pertains to the costs for

payments in shares and in cash. The Annual General Meeting in

2005 decided on a similar program for allotment in 2006. Allotment

will be made in 2006 and will be based on the fulfi llment of certain

non-market based fi nancial goals for fi scal year 2005. Assuming

that the fi nancial goals are met in full, Volvo’s cost for the incentive

program including social fees will be approximately SEK 70 M, since

the price of the Volvo B shares at the grant date, excluding dividend

of SEK 12.50, was SEK 299.50. The Annual General Meeting

decided that Volvo’s own shares may be used for allotment in this

program.

The Board has proposed to the Annual General Meeting to decide

on a renewed share-based incentive program. The program means

that a maximum of 518,000 (185,000) Volvo B shares could be allot-

ted to approximately 240 (165) senior executives. It is proposed that

the number of shares to be allotted depend on the fulfi llment of cer-

tain non-market based fi nancial goals for fi scal year 2006. Assum-

ing that the fi nancial goals are met in full, the dividend is decided to

be SEK 16.75 and the price of the Volvo B share at the grant date is

SEK 370, Volvo’s cost for the incentive program, including social

costs, will be approximately SEK 230 M. The Board has furthermore

proposed to the Annual General Meeting that Volvo’s own shares

may be used for allotment in the share-based incentive program.

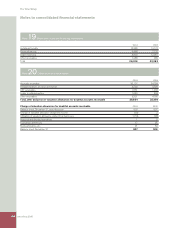

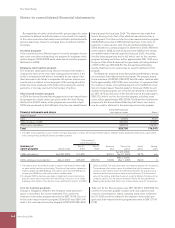

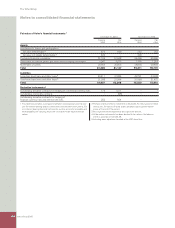

2003/2008 employee

Financial instruments and shares stock options number Shares

1

Board Chairman – –

CEO 50,000 4,000

Other members of GEC 340,000 31,000

Other senior executives 548,750 139,000

Total 938,750 174,000

1 The table shows payments in cash and the corresponding value in shares. Of the total 174,000 shares, 105,000 shares have been alloted and a cash-settle-

ment corresponding to 69,000 shares have been granted.

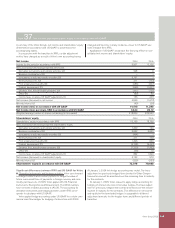

Total number of

outstanding options

Summary of Dec 31, Dec 31 Excercise Term of the Value/ Vesting,

option programs Alloment date 2004 2005 price options options years

Apr 28, 2000–

1998, call options

1 April 28, 2000 101,830 – 302.12 Apr 27, 2005 55.75 n/a

May 2, 2006–

2002, employee stock options

2 May 2, 2003 945,000 938,750 163.00 May 1, 2008 32.00 3

1 The options gives the holder the right to acquire one Series B Volvo share

for each option held from a third party. The price of the options is based on

market valuation by UBS Warburg. The options were fi nanced 50% by the

company and 50% from the option holder’s variable salary.

2 In January 2000, a decision was made to implement a new incentive pro-

gram for senior executives within the Volvo Group in the form of so-called

employee stock options. The decision covers allotment of options for 2000,

2001 and 2002. The executives have not made any payment for the options.

The employee stock options gives the holders the right to exercise their

options or alternatively receive the difference between the actual price at

that time and the exercise price determined at allotment. The theoretical

value of the options at allotment was set using the Black & Scholes pricing

model for options. For the options allotted in 2003, the Annual General

Meeting has decided that Volvo’s own shares may be used for the program.

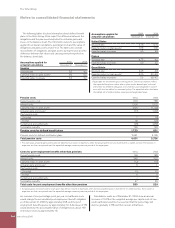

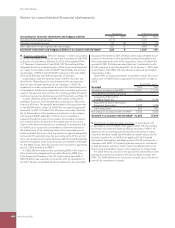

Cost for incentive programs

Change in obligations related to the employee stock option pro-

grams is recorded in the income statement. The cost for the

employee stock option program amounted to SEK 130 M. The cost

for the share-based incentive program 2004/2005 was SEK 13 M

and for the share-based incentive program 2005/2006 SEK 49 M.

Total cost for the three programs was SEK 192 M for 2005 (66). The

cost for the incentive program includes both cash payments and

costs for remuneration in shares, including social costs. At Decem-

ber 31, 2005, provision related to the employee stock option pro-

gram and share-based incentive program amounted to SEK 277 M

(128).

Notes to consolidated fi nancial statements