Volvo 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 29

The largest shareholders in AB

Volvo, December 31, 20051

Share capital, %2

Renault SA 20.7

AMF Pension 4.1

Alecta 3.0

Robur fonder (savings funds) 2.7

SEB Fonder / Trygg Försäkring 2.7

1 Following the repurchase of its own shares, AB

Volvo held 5.0% of the Company´s shares on Dec.

31, 2005.

2 Based on all registered shares.

Credit rating at December 31, 2005

Short term Long term

Moody’s P-2 stable A3 stable

Standard & Poor A2 stable Not rated

Share capital, December 31, 2005

Registered number of shares1 425,684,044

of which, Series A shares2 135,520,326

of which, series B shares3 290,163,718

Quota value, SEK 6

Share capital, SEK M 2,554

Number of shareholders 195,442

Private persons 185,637

Legal entities 9,805

1 Following the repurchase of the Group’s own

shares, the number of outstanding shares was

404,463,509.

2 Series A shares carry one vote each.

3 Series B shares carry one tenth of a vote each.

Dividend policy

The objective is that the effective return to the

shareholders, the dividend combined with the

change in the share price, should exceed the

average for the industry.

Dividend

For fiscal year 2005, the Board of Directors

proposes that the shareholders at the Annual

General Meeting approve a cash dividend of

SEK 16.75 per share, a total of approximately

SEK 6,775 M. This corresponds to a direct

return of 4.5% calculated at the year-end

2005/2006 rate of SEK 374.50 for the

Volvo B share.

Long-term credit rating

In October, AB Volvo signed an agreement

with Moody’s Investor Services for long-term

credit rating services, since Moody’s had, for

several years, evaluated the credit worthiness

of the Volvo Group without having a contract.

The long-term A3 credit rating provides access

to additional sources of financing and improved

access to the financial market.

A3 is among the highest credit ratings in

the transport and vehicle industry and one of

the highest among Nordic industrial compa-

nies.

More details on the Volvo share

can be found on page 150.

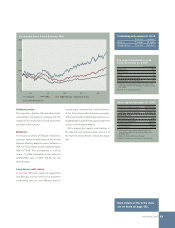

0

100

200

300

500

400

01 02 03 04 05

Volvo B AFSX MSCI-Europe – Machinery Index

Source: Stockholmsbörsen

Price trend, Volvo Series B shares, SEK