Volvo 2005 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

124 Volvo Group 2005

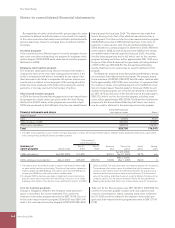

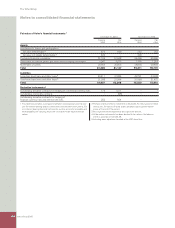

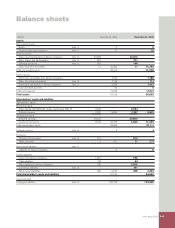

Fair value of Volvo’s fi nancial instruments 1

December 31, 2004 December 31, 2005

Carrying Fair Carrying Fair

value value value value

Assets

Investments in shares and participations

fair value determinable

2 670 169 253 253

fair value not reliably determinable 3 420 – 303 –

Customer-fi nancing receivables 51,193 51,948 64,466 65,365

Other loans to external parties and other interest-bearing receivables 3,047 3,075 1,355 1,318

Marketable securities 25,955 25,955 28,834 28,834

Total 81,285 81,147 95,211 95,770

Liabilities

Long-term bond loans and other loans

5 40,411 41,684 43,761 44,338

Short-term bank loans and other loans

5 21,396 21,584 31,589 31,472

Total 61,807 63,268 75,350 75,810

Derivative instruments

4

Outstanding derivative contracts for hedging of commercial currency risks 176 1,371 – –

Outstanding commodity contracts – (25) – –

Outstanding derivative contracts for hedging of

fi nancial currency risks and interest rate risks 252 924 – –

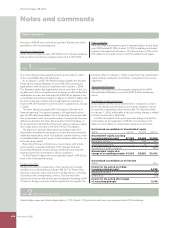

1 This table only includes a comparison between carrying values and fair val-

ues for interest bearing balance sheet items and derivative instruments. For

non interest bearing fi nancial instruments, such as accounts receivable and

trade payables, the carrying values are considered to be equal to the fair

values.

2 Pertains mainly to Volvo’s investment in Deutz AG. For the purpose of these

disclosures, fair values of listed shares are based upon quoted market

prices at the end of the period.

3 No single investment represents any signifi cant amount.

4 All derivative instruments has been booked to fair value in the balance

sheet in accordance with IAS 39.

5 Including basis adjustment booked at the IFRS transition.

Notes to consolidated fi nancial statements