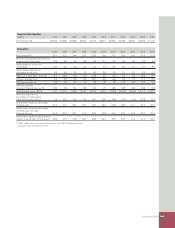

Volvo 2005 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

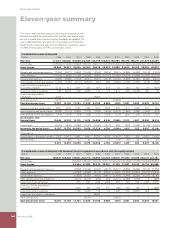

Volvo Group 2005 139

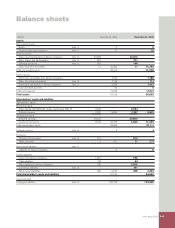

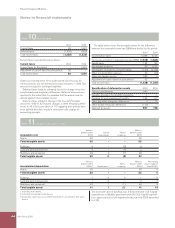

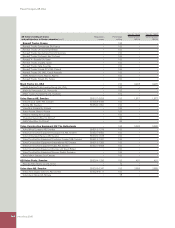

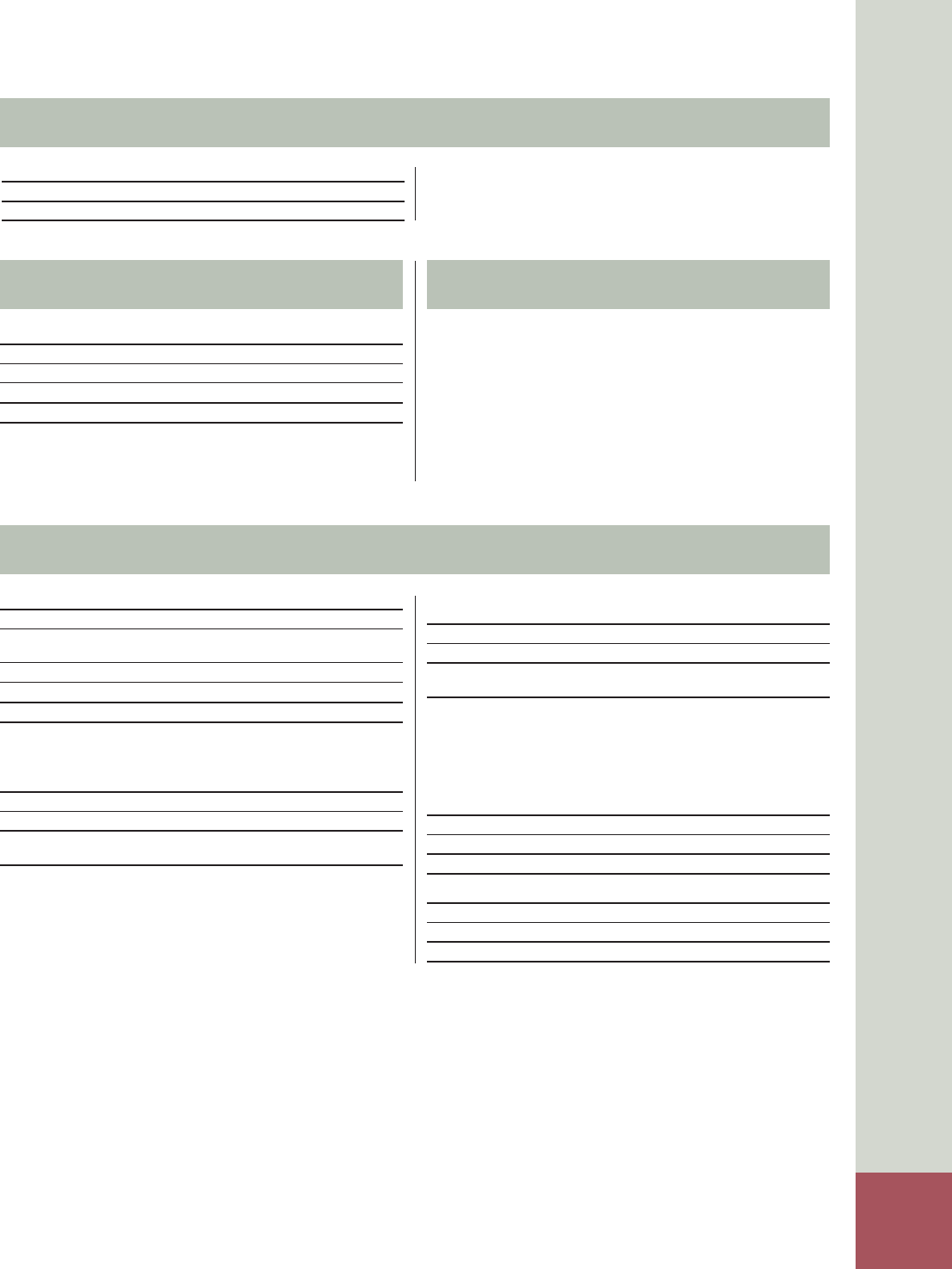

Note 18 Other current liabilities

2004 2005

Wages, salaries and withholding taxes 53 59

Other liabilities 156 279

Accrued expenses and prepaid income 90 120

Total 299 458

No collateral is provided for current liabilities. Other liabilities have

been recalculated for year 2004 due to new accounting principles.

See Note 1 Accounting principles for more information.

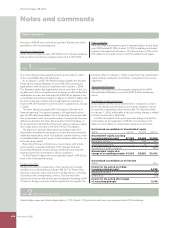

Note 19 Contingent liabilities

Of the contingent liabilities amounting to 133,595 (120,738),

133,462 (120,591) pertained to Group companies.

Guarantees for various credit programs are included in amounts

corresponding to the credit limits. These guarantees amount to

127,987 (115,266), of which guarantees on behalf of Group compa-

nies totaled 127,982 (115,261).

At the end of each year, the utilized portion amounted to 67,908

(53,142) including 67,776 (53,130) pertaining to Group companies.

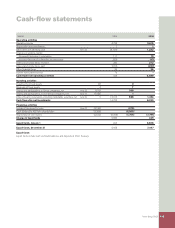

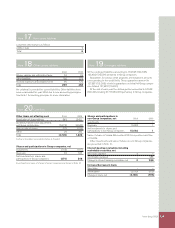

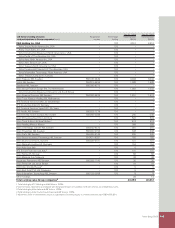

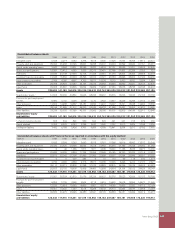

Note 20 Cash fl ow

Other items not affecting cash 2004 2005

Revaluation of shareholdings 545 8,421

Dividends, transfer price adjustments

and Group contributions (5,273) (6,940)

Gain on sale of shares (27) (519)

Other 29 260

Total (4,726) 1,222

Further information is provided in Notes 4, 5 and 6.

Shares and participations in Group companies, net

Investments (703) (197)

Disposals 33 545

Net investments in shares and

participations in Group companies (670) 348

Investments and sales of shares in Group companies are shown in Note 12.

Shares and participations in

non-Group companies, net 2004 2005

Investments – –

Disposals 15,082 1

Net investments in shares and

participations in non-Group companies 15,082 1

Sales of shares in Scania AB resulted 2004 in a positive cash fl ow

of 15,029.

Other investments and sales of shares in non-Group companies

are presented in Note 12.

Interest-bearing receivables including

marketable securities, net

New loans granted 0 –

Amortization received – 988

Change in interest-bearing receivables, net 0 988

Increase/decrease in loans

New loans – –

Amortization (3,180) (975)

Change in loans, net (3,180) (975)

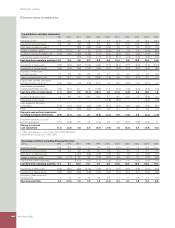

Note 17 Non-current liabilities

Long-term debt matures as follows:

2009 or later 6

Total 6