Volvo 2005 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

100 Volvo Group 2005

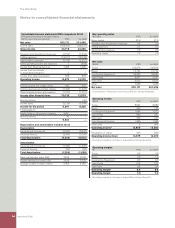

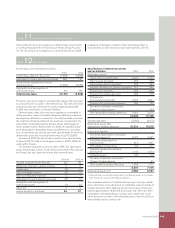

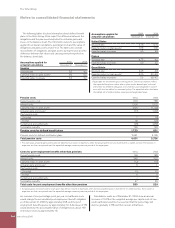

Reporting by business segment

The Volvo Group’s operations are organized in eight business areas:

Volvo Trucks, Renault Trucks, Mack Trucks, Buses, Construction

Equipment, Volvo Penta, Volvo Aero and Financial Services. In addi-

tion to the eight business areas, there are other operations consist-

ing mainly of business units that are designed to support the business

areas’ operations. The business units include Powertrain, 3P, Volvo

IT, Logistics and Parts. Each business area, except for Financial

Services, has total responsibility for its operating income, operating

capital and operating cash fl ow. The Financial Services business

area has responsibility for its net income and total balance sheet

within certain restrictions and principles that are established cen-

trally. The supervision and coordination of treasury and tax matters is

organized centrally to obtain the benefi ts of a Group-wide approach.

The legal structure of the Volvo Group is based on optimal handling

of treasury, tax and administrative matters and, accordingly, differs

from the operating structure.

The business units are designated to support the business areas

and are therefore not reportable business segments. In Volvo’s

external fi nancial reporting, the fi nancial results within the business

units Powertrain and Parts are distributed to the respective business

segments. As the three truck brands share product development,

production and other activities in business units such as 3P and

Powertrain and also share certain infrastructure in distribution such

as dealers, the truck brands are reported as one business segment.

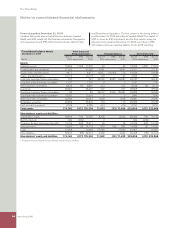

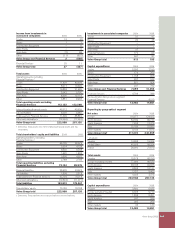

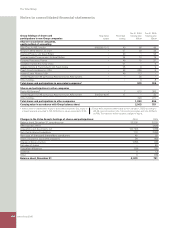

Net sales 2004 2005

Trucks 136,879 155,396

Buses 12,722 16,589

Construction Equipment 29,360 34,816

Volvo Penta 9,057 9,776

Volvo Aero 6,925 7,538

Other and eliminations 7,228 7,076

Volvo Group excl Financial Services 202,171 231,191

Financial Services 9,598 7,549

Eliminations (693) 1,819

Volvo Group total 211,076 240,559

The above sales fi gures include internal sales in the following

amounts:

Net sales to Group companies 2004 2005

Trucks 690 752

Buses 377 102

Construction Equipment 162 127

Volvo Penta 27 42

Volvo Aero 43 82

Other 9,440 10,589

Eliminations (10,739) (11,694)

Total excl Financial Services 0 0

Financial Services 693 755

Eliminations (693) (755)

Total net sales to Group companies 0 0

Internal sales between business areas are generally made at stand-

ard cost of sales, including calculated interest and product improve-

ment expenses. Internal sales from service companies are generally

made at market prices.

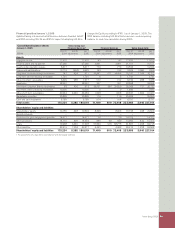

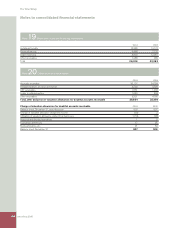

Operating income 2004 2005

Trucks 8,992 11,717

Buses 158 470

Construction Equipment 1,898 2,752

Volvo Penta 940 943

Volvo Aero 403 836

Financial Services 1,365 2,033

Other 923 (600)

Volvo Group total 14,679 18,151

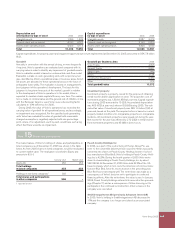

Operating income in 2004 included reversal of write-down of shares

in Scania AB of 915, which was reported in Other and write-down of

shares in Henlys Group Plc of 95, which was reported in Buses.

Depreciation and amortization 2004 2005

Trucks 5,306 5,307

Buses 219 249

Construction Equipment 627 658

Volvo Penta 122 224

Volvo Aero 391 366

Other 220 88

Total excl Financial Services 6,885 6,892

Financial Services 3,117 429

Reclassifi cation Group versus segment

Financial Services – 2,573

Volvo Group total 10,002 9,894

Research and development expenses 2004 2005

Trucks 5,491 5,200

Buses 484 569

Construction Equipment 1,033 1,083

Volvo Penta 311 413

Volvo Aero 209 225

Other 86 67

Volvo Group total 7,614 7,557

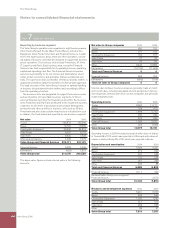

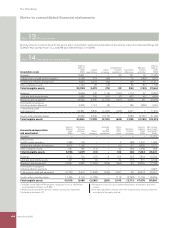

Notes to consolidated fi nancial statements

Note 7 Segment reporting