Volvo 2005 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

122 Volvo Group 2005

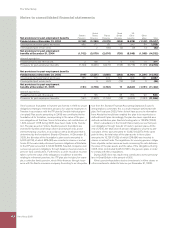

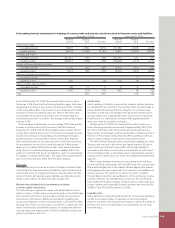

Outstanding forward contracts and option contracts for hedging of commercial currency risks

December 31, 2004 December 31, 2005

Notional Carrying Notional Carrying

amount 1 value Fair value amount 1 value Fair value

Foreign exchange forward contracts

– receivable position 26,203 264 1,775 37,754 536 536

– payable position 9,982 (88) (511) 36,980 (1,272) (1,272)

Options – purchased

– receivable position 2,831 – 112 4,769 51 51

– payable position – – – 3 (3) (3)

Options – written

– receivable position 233 – 0 – – –

– payable position 2,729 – (5) 4,142 (44) (44)

Subtotal 176 1,371 (732) (732)

Commodity forward contracts

– receivable position (10) – 7 394 54 54

– payable position 243 – (32) 71 (11) (11)

Total 176 1,346 (689) (689)

1 The notional amount of the derivative contracts represents the gross contract amount outstanding. To determine the estimated fair value, the major part of the

outstanding contracts have been marked to market. Discounted cash fl ows have been used in some cases.

Notes to consolidated fi nancial statements

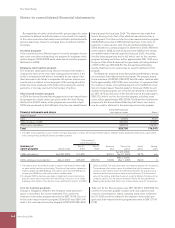

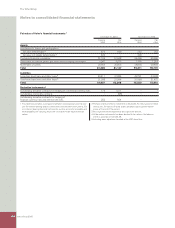

Outstanding forward contracts and option contracts as of December 31, 2005 for hedging of commercial currency risks

Other Fair

Currencies currencies value

2

Net fl ow Net fl ow Net fl ow

Million USD GBP EUR Net SEK

Due date 2006 amount 1,783 219 832 6,635

rate

1 7.46 13.44 9.32

Due date 2007 amount 906 – –

rate

1 7.46 – –

Due date 2008 amount 106 – –

and onwards rate

1 7.46 – –

Total 2,795 219 832 6,635

of which, option contracts 488 0 55 862

Fair value of forward and

option contracts, SEK M

2 (498) (28) (77) (129) (732)

1 Average forward contract rate.

2 Outstanding forward contracts valued at market rates.

Net fl ows per currency 2005 Other

Currencies currencies Total

Million USD GBP EUR Net SEK

Net fl ows 2005 amount 2,447 383 1,001

rate

3 7.4791 13.5849 9.2943

Net fl ows SEK M 3 18,300 5,200 9,300 14,400 47,200

Hedged portion, % 4 73 57 83

3 Average exchange rate during the fi nancial year.

4 Outstanding currency contracts, regarding commercial exposure due in 2006, percentage of net fl ows 2005.

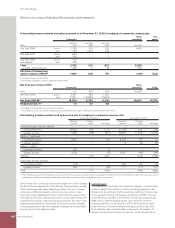

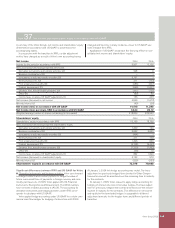

interest rate risks is reduced. Interest rate swaps are used to change

the fi xed interest rate periods of the Group’s fi nancial assets and lia-

bilities. Exchange rate swaps make it possible to borrow in foreign

currencies in different markets without incurring currency risks.

Volvo also holds standardized futures and forward rate agreements.

The majority of these contracts are used to secure interest levels for

short-term borrowing or deposits. Carrying amounts, fair values and

additional specifi cations of derivative instruments used to manage

currency and interest rate risks related to fi nancial assets and liabili-

ties are shown in the adjoining table.

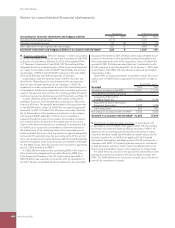

Cash-fl ow risks

The exposure for cash-fl ow risks related to changes in interest rates

pertains mainly to the Group’s customer fi nancing operations and

interest net. According to the Group policy, matching of interest rate

terms between lending and funding should exceed 80% in the cus-

tomer fi nancing operations. At the end of 2005, this matching was

99%. Volvo’s interest-bearing assets, apart from the customer

fi nancing portfolio, consisted at the end of 2005 mainly of liquid

funds that were invested in interest bearing securities with short-

term maturities. By use of derivative instruments, the target is to

achieve a fi xed interest period of six months for the Group’s liquid