Volvo 2005 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

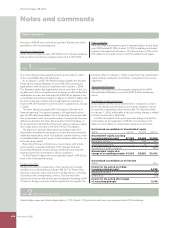

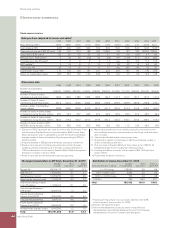

Proposed disposition of

unappropriated earnings

AB Volvo SEK M

Retained earnings 36,860

Net income 2005 4,360

Total 41,220

The Board is of the opinion that the dividend proposed below is justifiable on both the com-

pany and the Group level with regard to the demands on company and Group equity imposed

by the type, scope and risks of the business and with regard to the company’s and the

Group’s financial stregth, liquidity and overall position. The company’s equity would have been

86, or 0.2%, less if the assets and liabilities had not been valued at fair value in accordance

with chapter 4 section 14 a of the Annual Reports Act.

The Board of Directors and the President propose that the above sum be disposed of as

follows:

SEK M

To the shareholders, a dividend of SEK 16.75 per share 6,775

To be carried forward 34,445

Total 41,220

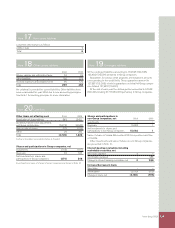

We hereby certify, to the best of our knowledge, that

– the annual accounts have been prepared in accordance with good accounting practices for

a stock market company;

– the information is, in all material respects, consistent with the actual conditions; and

– nothing of material importance has been omitted that could affect the financial position of

the company as presented in the annual report.1

1 This certifi cation, which has been provided in accordance with Section 3.6.2 of the Swedish Code of

Corporate Governance, does not mean that the board of directors and the President of the Company

assumes any further responsibility than what follows from the Swedish Companies Act (2005:551).

Göteborg, February 2, 2006

Finn Johnsson

Per-Olof Eriksson Patrick Faure

Haruko Fukuda Tom Hedelius Leif Johansson

Louis Schweitzer Ken Whipple

Martin Linder Olle Ludvigsson Johnny Rönnkvist

Our audit report was issued on February 2, 2006

PricewaterhouseCoopers AB

Olof Herolf Olov Karlsson

Authorized Public Accountant Authorized Public Accountant

Lead Partner Partner

Proposed disposition of unappropriated earnings

144 Volvo Group 2005