Volvo 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 Volvo Group 2005

Cash fl ow statement

Cash flow

Operating cash flow, excluding Financial

Services, amounted to SEK 6.8 billion. The

positi ve development during 2005 was related

to an increase in earnings. Working capital

increased by SEK 1.2 billion due to strong

sales growth. During the year transfers were

made to pension foundations, which is reported

in the item "Change in working capital", in the

amount of SEK 4.4 billion.

Cash flow after net investments within

Financial Services was negative SEK 4.4

billion in 2005 (neg. 5.5) as a result of con-

tinued growth in the credit portfolio.

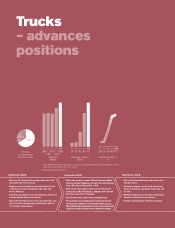

Investments

Investments in fixed assets in 2005, excluding

Financial Services, amounted to SEK 9.9 bil-

lion (7.2). Capital expenditures in Trucks, which

amounted to SEK 6.8 billion (4.7), were made

to improve efficiency in the European indus-

trial system, increase the number of service

workshops for the dealer network in Europe,

continued modification of the Hagerstown

plant in North America for manufacturing of

engines and transmissions and for a changeo-

ver for production of a new 13-litres engine in

Skövde, Sweden, and a new 11-liter engine in

Vénissieux. Capital expenditures increased in

Construction Equipment from SEK 0.7 billion

to SEK 0.9 billion, mainly for development of

production plants and in tools and equipment

for new products. In Volvo Aero the level of

capital expenditures increased from 0.5 billion

to SEK 0.8 billion. A major part of the invest-

ments relate to entrance fees to become a

partner in the new GEnx engine and in the

LM2500 industrial gas turbines, according to

agreements with General Electric. Investments

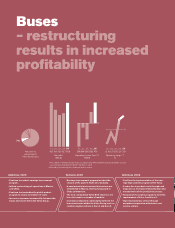

remained at the same level as last year in

Buses at SEK 0.2 billion and decreased in

Volvo Penta from SEK 0.3 billion to SEK 0.2

billion.

Approved future capital expenditures

amounting to SE K 7.8 billi on (8 .2) rel ate m ainly

to investments for the next generation of

trucks and engines.

Investments in leasing assets amounted to

SEK 0.3 billion (0.3).

Acquisitions and divestments

Net divestments in shares during 2005 had

a positive effect on cash flow amounting to

SEK 0.3 billion (15.1). The divestment in 2004

of the Scania B shares amounted to SEK 14.9

billion and had a significant effect on the

cash flow.

Acquired and divested companies had a

positive effect on cash flow SEK 0.7 billion

(neg 0.1). The amount includes among others

the sale of properties in Danafjord and the sale

of the service company Celero Support.

Financing and dividend

Net borrowings increased during 2005 by

SEK 3.6 billion. The new borrowing during the

year, mainly through the issue of bonds, con-

tributed SEK 42 billion. In 2004, net borrow-

ings decreased by SEK 8.8 billion.

An ordinary dividend amounting to SEK 5.1

billion, corresponding to SEK 12.50 per share,

was paid to AB Volvo’s shareholders during the

year. During 2005 AB Volvo repurchased own

shares to the amount of SEK 1.8 billion.

Change in liquid funds

The Group’s liquid funds decreased by SEK 0.7

billion during the year amounting to SEK 8.1

billion at December 31, 2005.

Capital expenditures1, excluding

Financial Services

Capital expenditures,

SEK bn

Capital expenditures,

% of net sales

1 Years 2004 and 2005 are reported in accordance with

IFRS and 2001, 2002 and 2003 in accordance with

prevailing Swedish GAAP. See Note 1 and 3.

Self-financing ratio1, excluding

Financial Services, %

Cash flow from operating

activities divided by net

investments in fixed and

leasing assets.

148 196 243 268 173

01 02 03 04 05

8.2 6.4 5.9

4.5 3.6 3.4

7.5

3.7

10.2

4.4

01 02 03 04 05