Volvo 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Volvo Group 2005

Financial

Report

2005

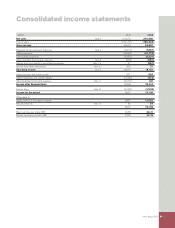

81 Consolidated income

statements

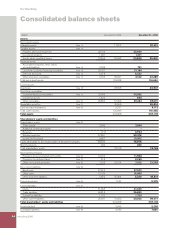

82 Consolidated balance

sheets

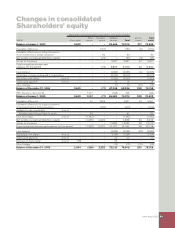

83 Changes in consolidated

Shareholders’ equity

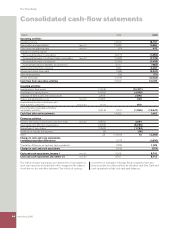

84 Consolidated cash-flow

statements

85 Notes to consolidated

financial statements

130 Parent Company AB Volvo

144 Proposed disposition of

unappropriated earnings

145 Audit report for AB Volvo

145 Examination of the

Corporate Governance

Report

146 Eleven-year summary

p. Note The Volvo Group

85 1 Accounting principles

89 2 Key sources of estimation uncertainty

91 3 Impact of IFRS

98 4 Acquisition and divestments of

shares in subsidiaries

99 5 Joint ventures

99 6 Associated companies

100 7 Segment reporting

102 8 Other operating income

and expenses

102 9 Income from investments

in associated companies

102 10 Income from other investments

103 11 Other fi nancial income and expenses

103 12 Income taxes

104 13 Minority interests

104 14 Intangible and tangible assets

105 15 Shares and participations

107 16 Long-term customer-fi nancing

receivables

107 17 Other long-term receivables

107 18 Inventories

108 19 Short-term customer-fi nancing

receivables

108 20 Other short-term receivables

109 21 Marketable securities

109 22 Cash and cash equivalents

109 23 Shareholders’ equity

109 24 Provisions for post-employment benefi ts

113 25 Other provisions

113 26 Non-current liabilities

114 27 Current liabilities

114 28 Assets pledged

115 29 Contingent liabilities

115 3 0 Cas h fl o w

116 31 L ea si ng

116 32 Transactions with related parties

117 33 G ov ernm ent g ra nt s

117 34 P erso nne l

120 35 Fees to the auditors

121 36 Financial risks and instruments

125 37 Net income and shareholders’ equity

in accordance with U.S. GAAP

p. Note Parent Company

134 1 Accounting principles

134 2 Administrative expenses

135 3 Other operating income

and expenses

135 4 Income from investments in

Group companies

135 5 Income from investments in

associated companies

135 6 Income from other investments

135 7 Interest income and expenses

135 8 Other fi nancial income and

expenses

135 9 Allocations

136 10 Income taxes

136 11 Intangible and tangible assets

137 12 Investments in shares and

participations

138 13 Other short-term receivables

138 14 Short-term investments in

Group companies

138 15 Untaxed reserves

138 16 Provisions for pensions

139 17 Non-current liabilities

139 18 Other current liabilities

139 19 Contingent liabilities

139 20 Cash fl ow

140 21 Financial risks and instruments

140 22 Personnel