Volvo 2005 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 125

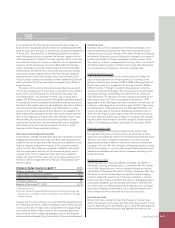

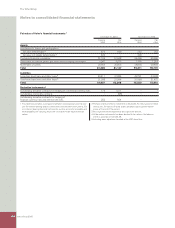

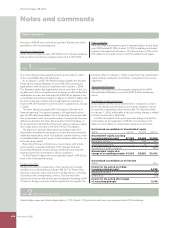

Signifi cant differences between IFRS and US GAAP for Volvo

A. Derivative instruments and hedging activities. Volvo uses forward

exchange contracts and currency options to hedge the value of

future commercial fl ows of payments in foreign currency and com-

modity purchases. As of 2005, Volvo applies IAS 39, Financial

Instruments: Recognition and Measurement. The 2004 numbers

have not been restated according to IAS 39. The accounting for

derivative instruments and hedging activities under IFRS corre-

sponds in substance with US GAAP.

Volvo applied hedge accounting under US GAAP for certain com-

mercial cash fl ow hedges for hedging of interest risk until 2003.

At January 1, 2004 this hedge accounting was ended. The basis

adjustment on previously hedged items booked in Other Compre-

hensive Income will be amortized over the remaining time to maturity

for the contracts.

At January 1, 2005, Volvo ceased to apply hedge accounting for

hedging of interest rate risks in fair value hedges. The basis adjust-

ment on previously hedged items will be amortized over the remain-

ing time to maturity for the contracts. The difference in net income

and equity for the terminated hedges is assignable to different

adjustment amounts for the hegdes items and different periods of

transition.

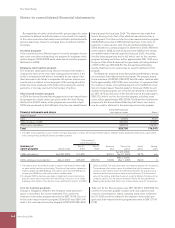

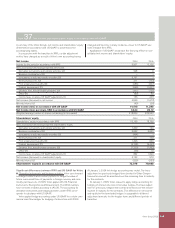

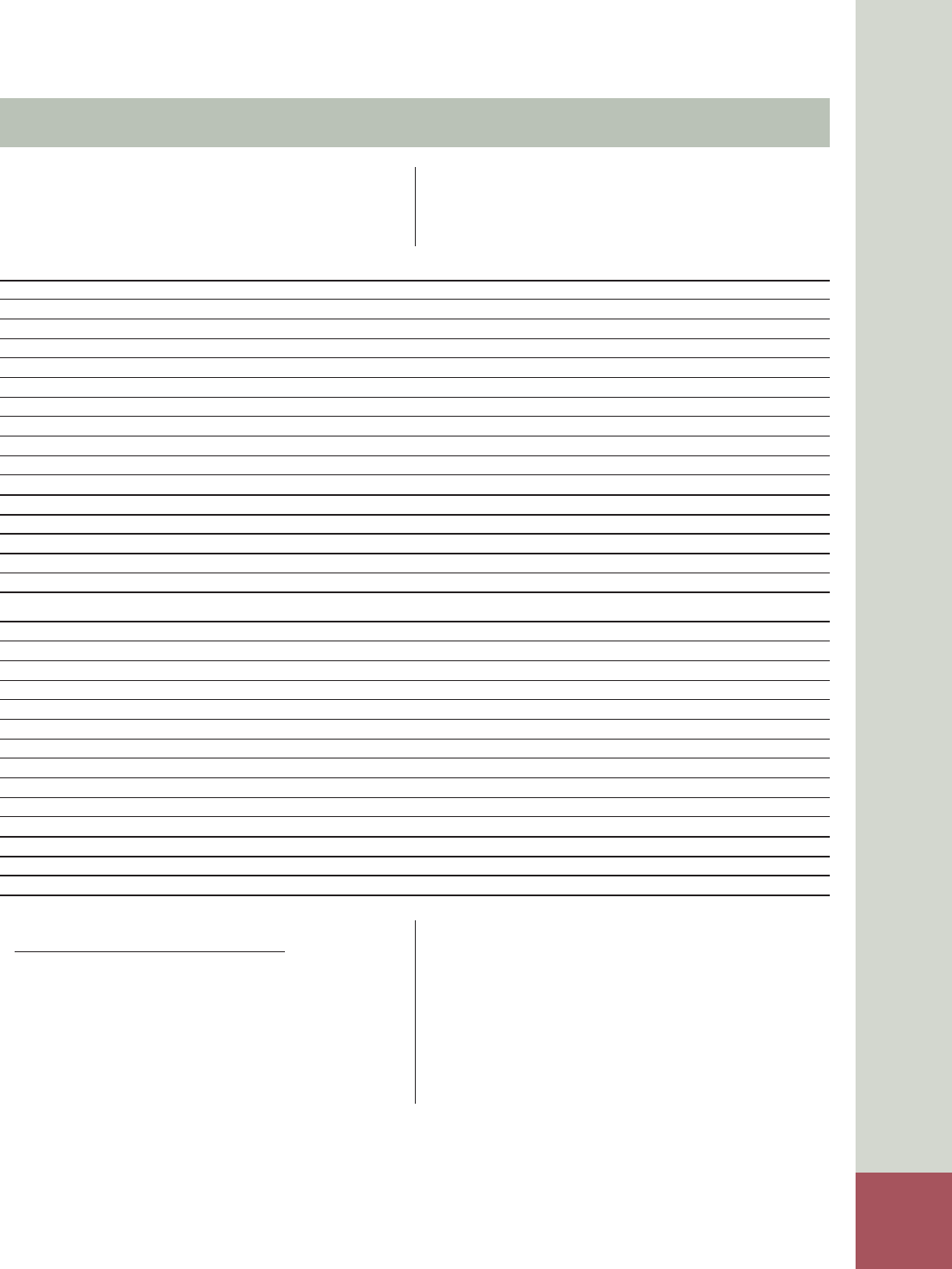

Note 37 Net income and shareholders’ equity in accordance with US GAAP

A summary of the Volvo Group’s net income and shareholders’ equity

determined in accordance with US GAAP, is presented in the

accompanying tables.

In conjunction with the transition to IFRS, certain adjustment

entries have changed as a result of Volvo’s own accounting having

changed and become, in many instances, closer to US GAAP, see

note 3 Impact from IFRS.

Application of US GAAP would have the following effect on con-

solidated net income and shareholders’ equity:

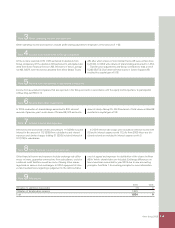

Net income 2004 2005

Income for the period in accordance with IFRS 9,907 13,106

Items increasing (decreasing) reported net income

Derivative instruments and hedging activities (A) 228 9

Business combinations (B) – –

Investments in debt and equity securities (C) 5,157 –

Restructuring costs (D) 311 (153)

Post-employment benefi ts (E) (286) (307)

Product development (F) (565) (1,601)

Entrance fees, aircraft engine programs (G) (392) (156)

Other (H) (60) 98

Income taxes on above US GAAP adjustments (I) 156 438

Net increase (decrease) in net income 4,549 (1,672)

Minority interest (J) (40) (38)

Net income (loss) in accordance with US GAAP 14,416 11,396

Net income (loss) per share, SEK in accordance with US GAAP 34.44 28.12

Weighted average number of shares outstanding (in thousands) 418,529 405,242

Shareholders’ equity 2004 2005

Shareholders’ equity in accordance with IFRS 70,155 78,768

Items increasing (decreasing) reported shareholders’ equity

Derivative instruments and hedging activities (A) 1,300 140

Business combinations (B) 5,932 5,932

Investments in debt and equity securities (C) (494) –

Restructuring costs (D) 311 158

Post-employment benefi ts (E) 1,326 990

Product development (F) (4,708) (6,450)

Entrance fees, aircraft engine programs (G) (1,320) (1,482)

Other (H) (56) 70

Income taxes on above US GAAP adjustments (I) 862 1,620

Net increase (decrease) in shareholders’ equity 3,153 978

Minority interest (J) (229) (260)

Shareholders’ equity in accordance with US GAAP 73,079 79,486