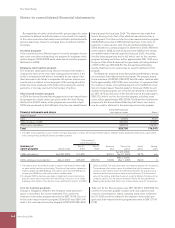

Volvo 2005 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

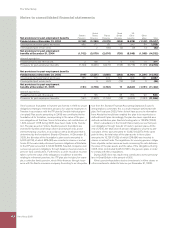

The Volvo Group

114 Volvo Group 2005

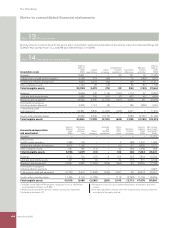

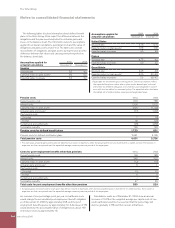

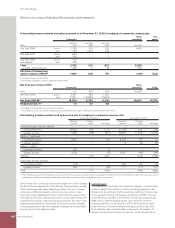

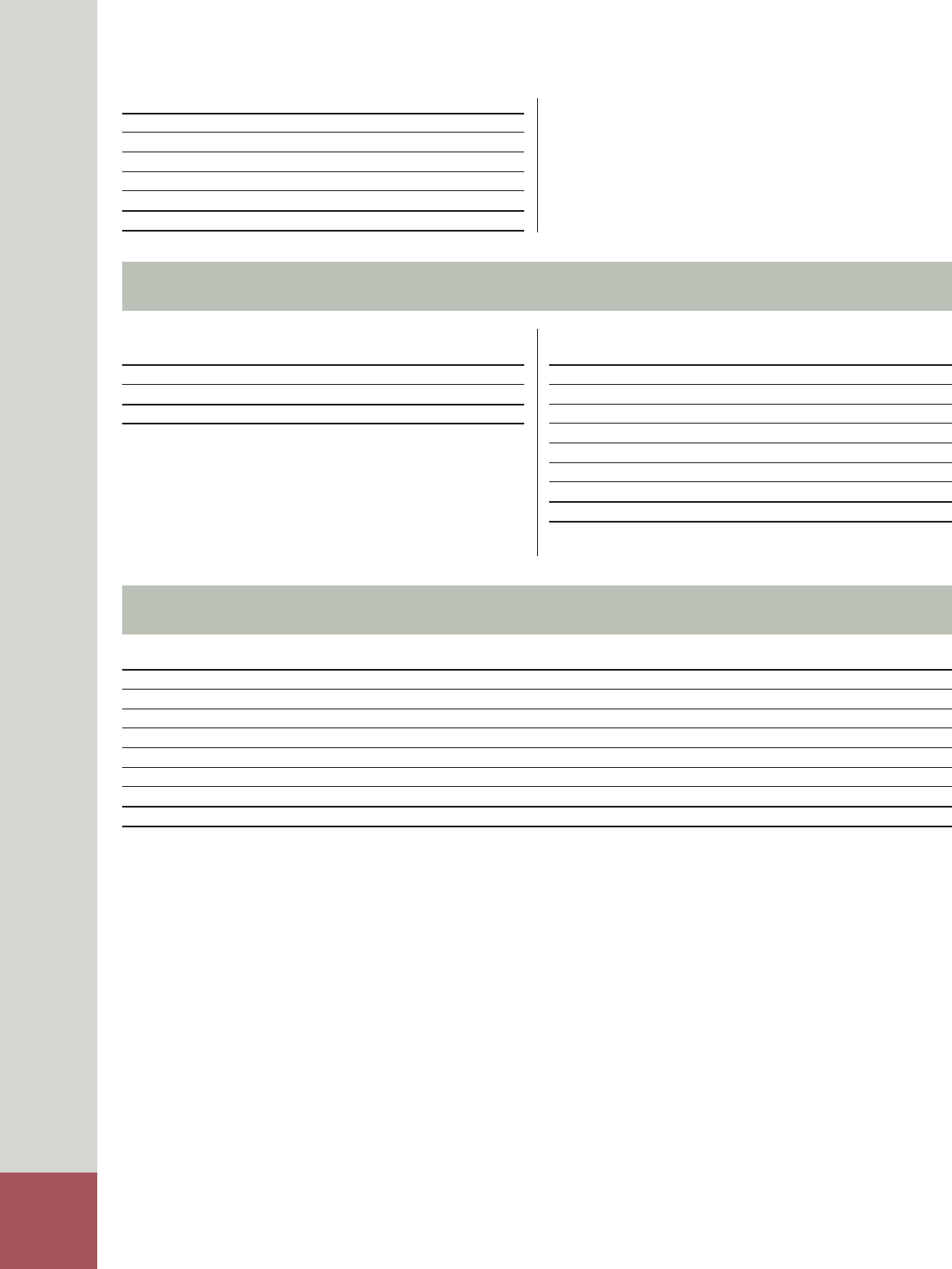

Long-term loans mature as follows:

2007 17,892

2008 13,395

2009 3,647

2010 5,192

2011 or later 3,429

Total 43,555

Of other long-term liabilities the majority will mature within fi ve years.

At year-end 2005, credit facilities granted but not utilized and

which can be used without restrictions amounted to approximately

SEK 21 billion (19). Approximately SEK 20 billion of these facilities

consisted of stand-by facilities for loans with varying maturities

through the year 2010. A fee normally not exceeding 0.25% of the

unused portion is charged for credit facilities.

Note 27 Current liabilities

Balance sheet amounts for loans were as follows:

2004 2005

Bank loans 4,267 5,204

Other loans 17,129 26,126

Total 21,396 31,330

Bank loans include current maturities, 2,243 (2,259), of long-term

loans. Other loans include current maturities of long-term loans,

18,983 (13,324), and commercial paper, 5,413 (2,667).

Non-interest-bearing liabilities accounted for 67,681 (57,657), or

68% (73) of the Group’s total current liabilities.

Balance sheet amounts for Other current liabilities were as follows:

2004 2005

Advances from customers 2,298 2,460

Wages, salaries and withholding taxes 4,987 5,680

VAT liabilities 1,193 1,351

Accrued expenses and prepaid income 9,736 11,850

Deferred leasing income 1,141 1,406

Residual value liability 1,873 1,840

Other liabilities 3,863 5,675

Total 25,091 30,262

Secured bank loans at year-end 2005 amounted to 186 (194). The

corresponding amount for other current liabilities was 1,685 (1,578).

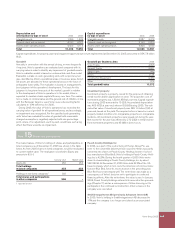

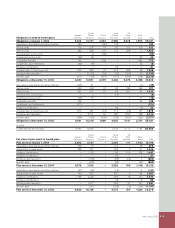

Note 28 Assets pledged

2004 2005

Property, plant and equipment – mortgages 205 593

Assets under operating leases 1,665 1,700

Chattel mortgages 374 350

Receivables 319 360

Inventories 13 16

Cash, marketable securities 470 230

Other assets pledged – 6

Total 3,046 3,255

The liabilities for which the above assets were pledged amounted at year-end to 3,372 (3,194).

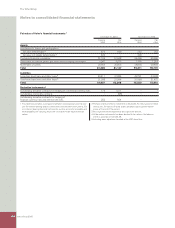

Notes to consolidated fi nancial statements