Volvo 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 115

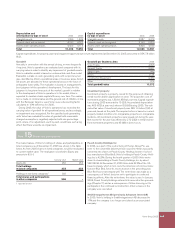

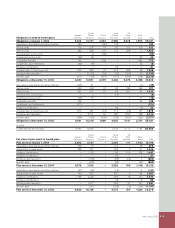

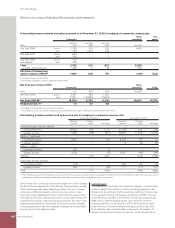

Note 29 Contingent liabilities

2004 2005

Credit guarantees

– issued for associated companies 110 13

– issued for customers and others 2,471 1,267

Tax claims 1,433 695

Other contingent liabilities 5,175 5,875

Total 9,189 7,850

The reported amounts for contingent liabilities refl ect the Volvo

Group’s risk exposure on a gross basis. The reported amounts have

thus not been reduced because of counter guarantees received or

other collaterals in cases where a legal offsetting right does not

exist. At December 31, 2005, the estimated value of counter guaran-

tees received and other collaterals, for example the estimated net

selling price of used products, amounted to 4,479 (5,135). Tax claims

pertain to charges against the Volvo Group for which provisions are

not considered necessary. Other contingent liabilities pertain mainly

to residual value guarantees.

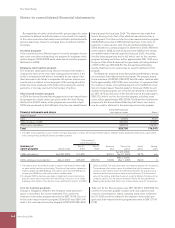

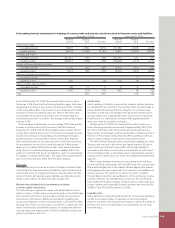

Legal proceedings

In March 1999, an FH 12 Volvo truck was involved in a fi re in the

Mont Blanc tunnel. The tunnel suffered considerable damage from

the fi re, which continued for 50 hours. 39 people lost their lives in

the fi re, and 34 vehicles were trapped in the tunnel. The Mont Blanc

tunnel was re-opened for traffi c in 2002. An expert group was

appointed by the Commercial Court in Nanterre, France, to investi-

gate the cause of the fi re and the losses it caused. At present, it is

not possible to anticipate the result of this on-going investigation or

the result of other French legal actions in progress regarding the

fi re. Following the closure in October 2003 of an investigation for

potential criminal liability for the fi re, the trial for unintentional man-

slaughter started in Bonneville (France) on 31st January, 2005 and

lasted until late April 2005. The judgment was given on 27th July,

2005. Volvo Truck Corporation was one of 16 parties tried for unin-

tentional manslaughter. Volvo Truck Corporation was acquitted and

not required to pay any civil damages to the plaintiffs. Volvo Truck

Corporation’s acquittal with regards to criminal charges is fi nal.

Some of the plaintiffs have appealed the award of civil damages and

those proceedings, hence, are ongoing. A claim was fi led with the

Commercial Court in Nanterre by the insurance company employed

by the French tunnel operating company against certain Volvo Group

companies and the trailer manufacturer in which compensation for

the losses claimed to have been incurred by the tunnel operating

company was demanded. The claimant requested that the Court

postpone its decision until the expert group has submitted its report.

The Court of Nanterre has since then declined jurisdiction in favor of

the civil Court of Bonneville before which several other claims had

been fi led in connection with this matter. As a result, the Court of

Bonneville is likely ultimately to rule on all civil liability claims fi led in

France against Volvo Group companies in connection with the Mont-

Blanc tunnel fi re. Volvo Group companies are also involved in pro-

ceedings regarding this matter before courts in Aosta and Turin

(Italy) and Brussels (Belgium). Although the aggregate amount

claimed is substantial, Volvo is unable presently to determine the

ultimate outcome of the legal proceedings mentioned above, the

only exception being the criminal charges mentioned above from

which Volvo Truck Corporation has now been acquitted.

Between 1985 and 1995, Volvo Aero Norway A/S (“VAN”) and

Snecma entered into several agreements relating to the supply by

VAN of components for the Snecma CFM56 engine. These aircraft

engine programs are long term agreements, with an expected term

of not less than thirty years. In 2005, Snecma fi led a request for

arbitration against VAN, requesting a declaratory award stating that

Snecma is entitled to calculate VAN’s compensation under the

agreements in other ways than the common and undisputed inter-

pretation of the agreements during nearly twenty years of perform-

ance. An award in Snecma’s favour would mean that the compensa-

tion would be signifi cantly reduced. It is diffi cult to assess the

magnitude of such a reduction of the concession levels since,

instead of fi xed levels of payment, the levels of payment to VAN

would be affected by the actual payments received by Snecma from

its customers. VAN has no access to the commercial information

needed to calculate the payment levels in such case. VAN has

rejected Snecma’s claims. Arbitral hearings are expected to be fi nal-

ized at the beginning of the autumn 2006.

Volvo is involved in a number of other legal proceedings incidental

to the normal conduct of its businesses. Volvo does not believe that

any liabilities related to such proceedings are likely to be, in the

aggregate, material to the fi nancial condition of the Volvo Group.

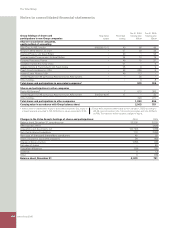

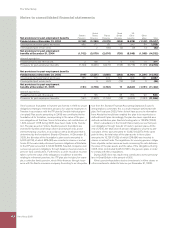

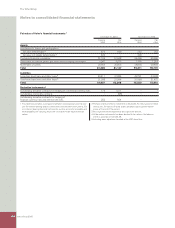

Note 30 Cash fl ow

Other items not affecting cash pertain to risk provisions and losses

related to doubtful receivables and customer-fi nancing receivables,

602 (551), capital gains on the sale of subsidiaries and other busi-

ness units 717 (95), write-down of shares in Peach County Holdings

Inc in 2005 and in 2004 revaluation of shares in Scania AB and

Henlys Group Plc amounting to 550 (negative 820), provision for

industrial relocation and contractual pension – (530), IFRS transition

effect – (negative 177) and other negative 20 (negative 19).

Net investments in customer-fi nancing receivables resulted in

2005 in a negative cash fl ow of SEK 7.8 billion (7.4). In this respect,

liquid funds were reduced by SEK 23.4 billion (19.4) pertaining to new

investments in fi nancial leasing contracts and installment contracts.

Divestments of shares and participations, net in 2005 amounted

to SEK 0.3 billion and in 2004 to SEK 15.1 billion, mainly related to

the divestment of the Scania B-shares.

Acquired and divested subsidiaries and other business units, net in

2005 amounted to SEK 0.6 billion and negative SEK 0.1 billion in 2004.

During 2005 and 2004 interest-bearing receivables including

marketable securities, net reduced liquid funds by SEK 1.3 billion

and SEK 6.4 billion, respectively.

The change during the year in bonds and other loans increased

liquid funds by SEK 3.6 billion (decrease 8.8). New borrowing during

the year, mainly the issue of bond loans, provided SEK 41.6 billion

(19.1). Amortization during the year amounted to SEK 33.4 billion

(28.9).