Volvo 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

104 Volvo Group 2005

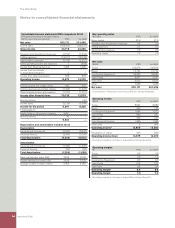

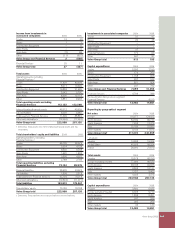

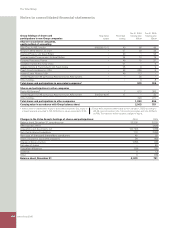

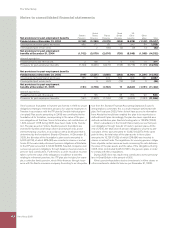

Note 13 Minority interests

Minority interests in income (loss) for the period and in shareholders’ equity consisted mainly of the minority interests in Volvo Aero Norge AS

(22%), in Wuxi da Hao Power Co, Ltd (30%) and in Berliet Maroc S.A (30%).

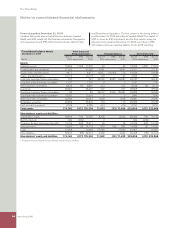

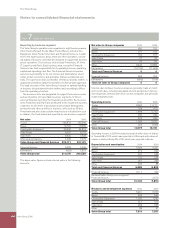

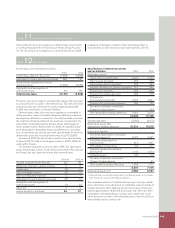

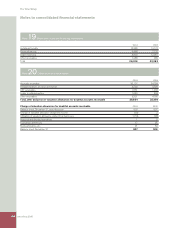

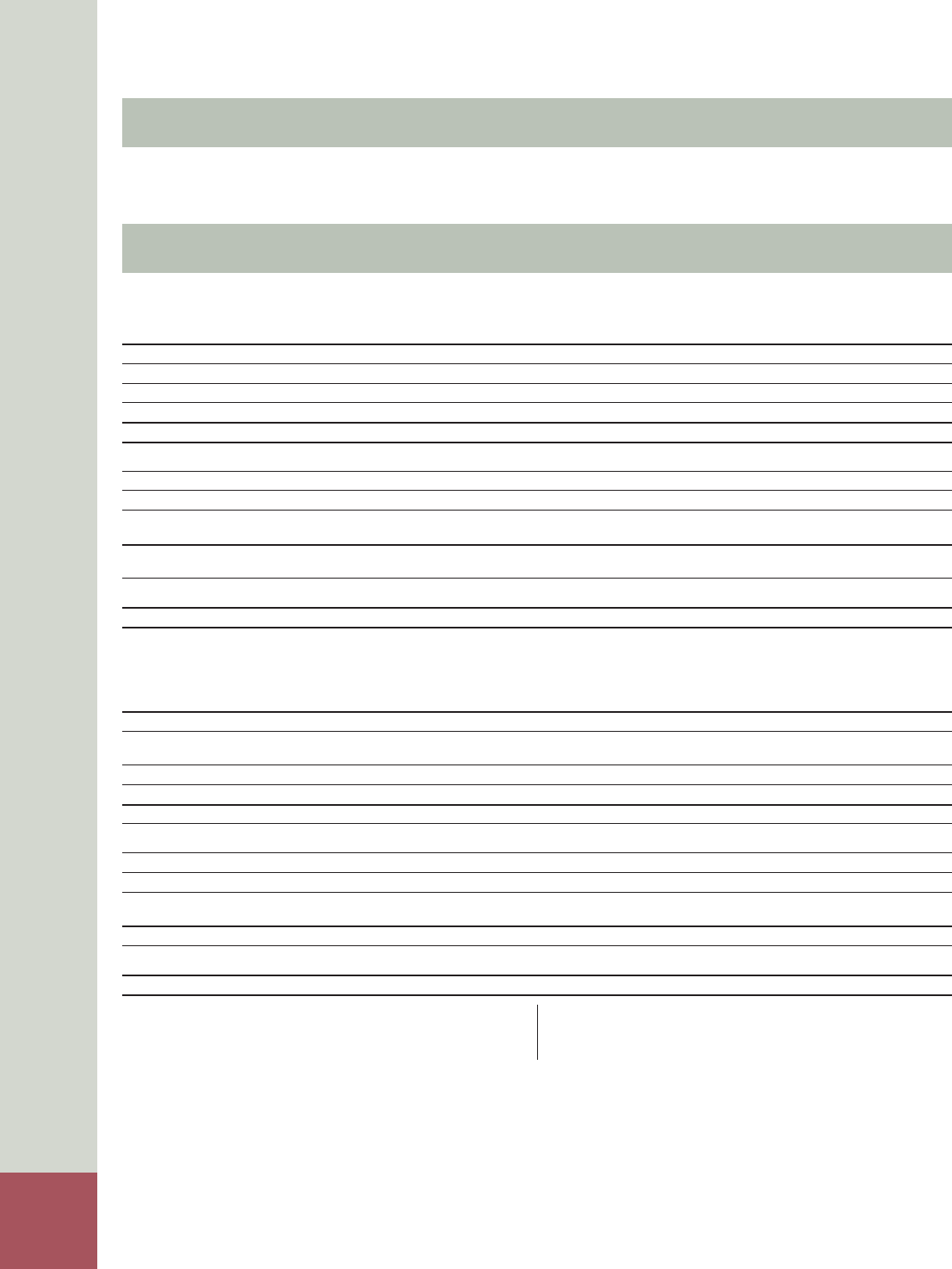

Note 14 Intangible and tangible assets

Value in Value in

balance Acquired and Reclassi- balance

sheet Capital Sales/ divested Translation fi cations sheet

Acquisition costs 2004 expenditures scrapping operations 5 differences and other 2005

Goodwill1 10,321 – – 20 721 10 11,072

Entrance fees, aircraft engine programs 2,758 374 (34) – 15 (142) 2,971

Product and software development 8,585 3,004 (28) – 189 67 11,817

Other intangible assets 1,734 95 (13) – 55 (87) 1,784

Total intangible assets 23,398 3,473 (75) 20 980 (152) 27,644

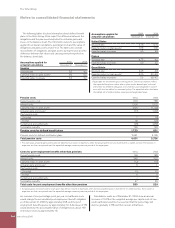

Buildings 16,928 742 (113) (181) 1,114 57 18,547

Land and land improvements 3,988 290 (91) (7) 402 42 4,624

Machinery and equipment2 39,530 4,685 (1,750) (457) 2,606 567 45,181

Construction in progress

including advance payments 2,435 1,112 (6) – 185 (659) 3,067

Total property, plant

and equipment 62,881 6,829 (1,960) (645) 4,307 7 71,419

Assets under operating leases 30,999 4,549 (3,770) – 2,988 (2,767) 31,999

Total tangible assets 93,880 11,378 (5,730) (645) 7,295 (2,760) 103,418

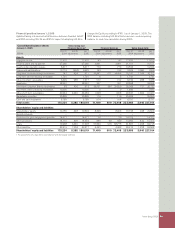

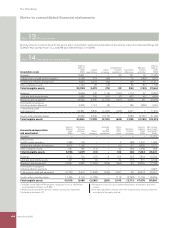

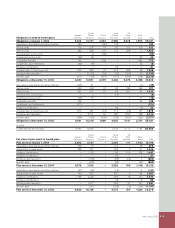

Value in Deprecia- Acquired Trans- Value in Net carrying

balance tion and and lation Reclassi- balance value in bal-

Accumulated depreciation sheet amortiza- Sales/ divested differ- fi cations sheet ance sheet 4

and amortization 2004 tion 3 scrapping operations 5 ences and other 2005 2005

Goodwill – – – – – – – 11,072

Entrance fees,

aircraft engine programs 1,386 104 – – 2 (55) 1,437 1,534

Product and software development 3,413 1,160 – – 60 57 4,690 7,127

Other intangible assets 987 145 (13) – 42 (65) 1,096 688

Total intangible assets 5,786 1,409 (13) – 104 (63) 7,223 20,421

Buildings 6,732 734 (37) 8 414 (37) 7,814 10,733

Land and land improvements 441 54 (2) 1 44 (17) 521 4,103

Machinery and equipment

2 24,557 3,582 (1,459) (259) 1,569 93 28,083 17,098

Construction in progress,

including advance payments – – – – – – – 3,067

Total property, plant and equipment 31,730 4,370 (1,498) (250) 2,027 39 36,418 35,001

Assets under operating leases 11,465 4,115 (1,788) – 1,118 (3,750) 11,160 20,839

Total tangible assets 43,195 8,485 (3,286) (250) 3,145 (3,711) 47,578 55,840

1 Includes on the date of IFRS adoption, acquisition costs of 14,184 and

accumulated amortization of 3,863.

2 Machinery and equipment pertains mainly to production equipment.

3 Includes write-downs, 72.

4 Acquisition costs less accumulated depreciation, amortization and write-

downs.

5 Includes subsidiaries and joint ventures that previously were accounted for

according to the equity method.

Notes to consolidated fi nancial statements