Volvo 2005 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

128 Volvo Group 2005

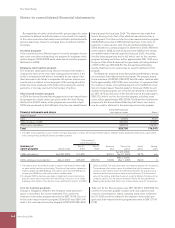

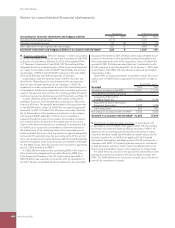

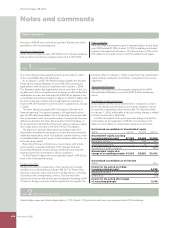

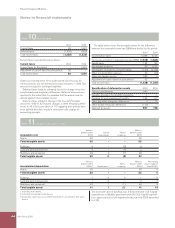

G. Entrance fees, aircraft engine programs. In connection with its

participation in aircraft engine programs, Volvo Aero in certain cases

pays an entrance fee. In Volvo’s accounting these entrance fees are

capitalized and amortized over 5 to 10 years. In accordance with US

GAAP, these entrance fees are expensed as incurred.

H. Other includes accounting differences regarding interest costs,

leasing, share-based payments, guarantees, revenue recognition,

consolidation of Variable Interest Entities and social costs on

employee benefi ts.

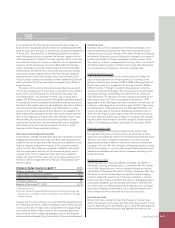

Interest expenses: In accordance with US GAAP, interest

expense incurred in connection with the fi nancing of the construc-

tion of property and other qualifying assets is capitalized and amor-

tized over the useful life of the related assets. In Volvo’s consolidated

accounts, interest expenses are reported in the year in which they

arise.

Leasing: The differences regarding leasing transactions pertain

to sale-leaseback transactions before 1997.

Share-based payments: Volvo applies IFRS 2 Share-based

payments: At grant date, the fair value of share payments is deter-

mined and the cost is recognized during the vesting period against

shareholders’ equity. Adjustment in 2005 pertains to settlement of

old options programs.

Guarantees: In accordance with FIN 45 “Guarantor’s Accounting

and Disclosure Requirement for Guarantees, Including indirect Guar-

antees of indebtedness for Others”, a liability should be recognized

at the time a company issues a guarantee for the fair value of the

obligations assumed under certain guarantee agreements. In

accordance with IFRS, a liability should be recognized to the extent a

company expects that a loss will be incurred as result of the guaran-

tee commitment. At December 31, 2005, the gross value of credit

guarantees issued for external parties amounted to 1,351 (2,869).

The fair value of these guarantees recognized under US GAAP

amounted to 62 (92). Counter guarantees received in respect of

these commitments amounted to 58 (56).

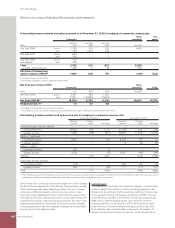

Revenue recognition: When determining timing for recognition

of revenue, US GAAP focuses more on the formal contract terms

while IFRS focuses more on actual risk that the residual value guar-

antee will be exercised. This means in certain cases that sales rec-

ognized under IFRS cannot be recognized under US GAAP.

Under IFRS all sales not qualifying for revenue recognition are

treated in the same way as deferred income. Under US GAAP sales

that are made to companies who in turn lease out the equipment

under operating leases are accounted for as fi nancing transactions

rather than as deferred income. The total impact of revenue recogni-

tion is an additional 322 (433) as assets under operating leases,

343 (270) reduced residual value liability and 886 (783) as interest-

bearing liabilities. The net income effect is positive 4 (negative 53).

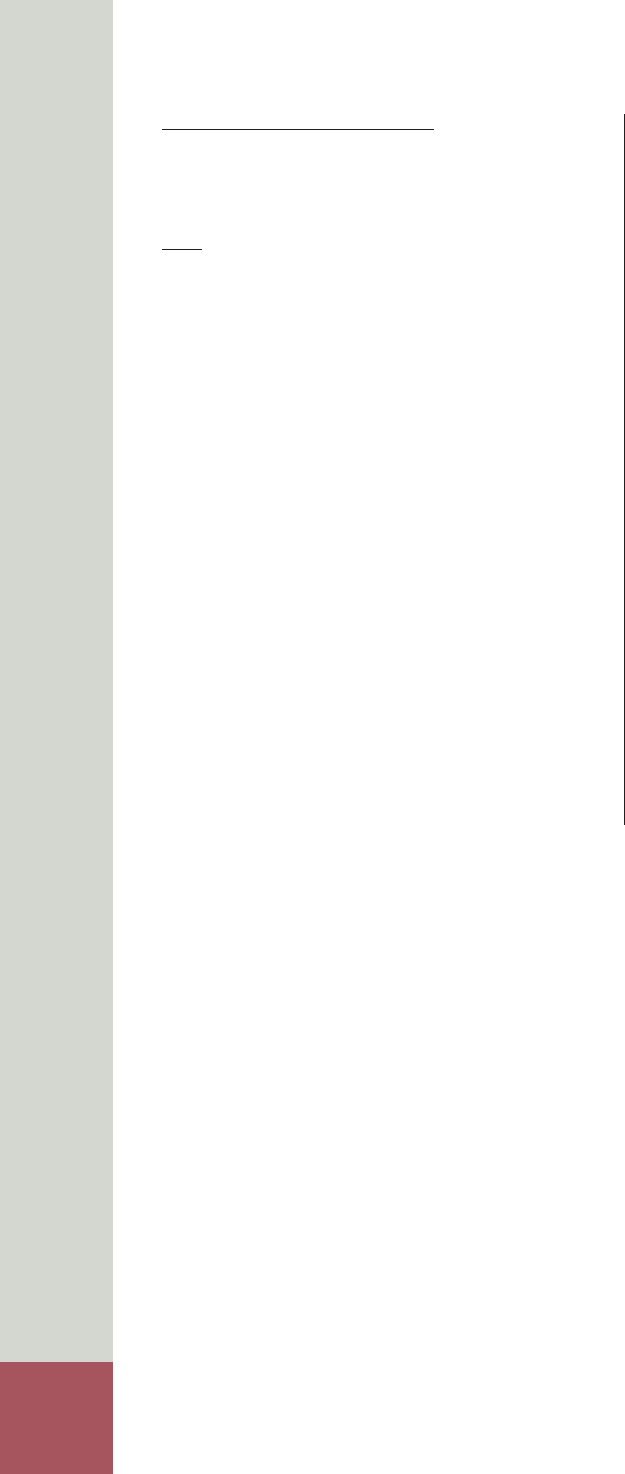

Variable Interest Entities: In accordance with US GAAP

FIN 46 certain entities should be consolidated where the Group is

the Primary Benefi ciary of the Variable Interest Entity. Volvo adopted

FIN 46 as per January 1, 2004. In Volvo this has had a limited

impact and a minor number of entities have been consolidated.

The majority of the consolidated entities are so called Franchisees

to Volvo Rents. The balance sheet impact is 25 (42) and the addition

in sales is 109 (112).

Contracts with character of a leasing agreement: Certain

contracts do not have the legal form of a leasing agreement, but

contain clauses based on which the contract can be considered a

leasing agreement. In Volvo’s reporting, under IFRS, this type of

asset is not recognized in the balance sheet. In accordance with US

GAAP, an assessment is made about whether the contract is consid-

ered a fi nancial or an operational lease and reporting shall be in

accordance with the accounting principles applied. The total effect

on Volvo in an adjustment of the 2005 fi gures is 67 in fi nancial leas-

ing assets, net, and 4 in increased depreciation. As of 2006, Volvo

will report in accordance with IFRIC 4, Determining whether an

agreement contains a lease or not, which in all signifi cant respects

coincides with US GAAP.

Notes to consolidated fi nancial statements