Volvo 2005 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

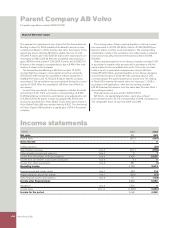

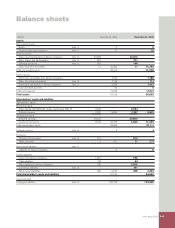

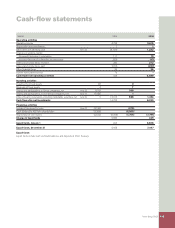

Volvo Group 2005 137

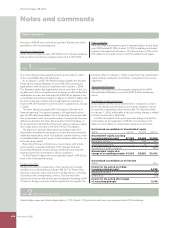

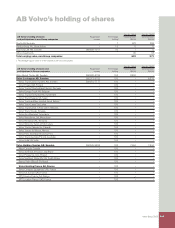

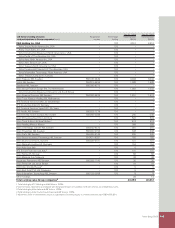

Shares and participations in Group companies

In 2005 all shares in Volvo Lastvagnar AB, 8,678, were received as

dividend from Volvo Global Trucks AB, after which shares in Volvo

Global Trucks AB were written down by 8,420 and sold inter-com-

pany for book value.

The holding in the service company Celero Support AB with a

book value of 25 was sold.

Shareholder contribution was made with 183 to Volvo Financial

Services AB.

2004: The remaining 2% of the shares in Kommersiella Fordon

Europa AB has been acquired for 28 by compulsory acquisition. The

acquisition costs of the stockholding increased with 4 and at year-

end the holding was written-down with 643.

25% of the shares in VFS Servizi Financiari Spa has been

acquired inter-company for 101.

The holdings in seven dormant Group companies with a total book

value of 82 have been transferred Group internal.

Shareholder contributions were made to Alviva AB, 2 and to

Celero Support AB, 10, whereupon the shareholdings were written

down by the corresponding amounts.

Shareholder contributions were also made to Volvo Bussar AB,

18, Volvo Global Trucks AB, 1 and Volvo Financial Services AB, 345.

Write-downs were carried out at year-end on holdings in Sotrof

AB, 600, Volvo China Investment Co Ltd, 99 and Volvo Penta UK,

10.

Shares and participations in non-Group companies

As of January 1, 2005, the Parent Company applies IAS 39 Finan-

cial Instruments: Recognition and Measurement, and accordingly all

investments in listed companies, except if these investments are

cl a ss ifi ed as a s so c ia te d com pa ni e s , shou ld be rep orte d in t he ba l-

an ce she et at fair val ue. AB Vol v o’s owne rs hi p in t he lis te d com pa ny

Deu tz AG h a s bee n valu at e d to m ar k et val ue dur in g 200 5 . The

eff ect of this tra ns it io n at J a nu a ry 1, 200 5 , amo unt ed to –501, aft e r

whi c h the valu e ha s incr e a se d by 83 d ur i ng the yea r. Also see Not e 1

Accounting principle s.

2004: Vol vo’s hold in g of S c a ni a B sh a re s was sol d to D eu t s ch e

Ba nk for an amou nt of 14,9 0 5 . As a c ons e qu en ce of the dive s t me nt,

the Sc a ni a hol din g was wr i t t en dow n in t he fou rt h quarte r of 2 0 0 3 .

Th e tra ns ac t i on wa s car r i ed ou t as p a rt o f Vol vo’s com mi tm en t to t he

Eur op e a n Comm is si o n to di v e s t the Sca ni a sha re s not late r tha n

Ap r il 23 , 200 4 . Af te r the sal e Vol vo own ed 27. 3 mill io n A sh a re s in

Sc a ni a AB . Th e hold in g was rev al ua te d to m a r ket va lu e on A p r il 15,

re sul ti ng in an i nc om e of 915 in 200 4 . At th e Annu al Ge ne r al Me et-

ing on Apr i l 16, 20 0 4, the Boa r d ’s prop os a l to t r an s fe r all A sh ar e s in

Sc a ni a to Ainax and ther e after to dist r ib u te the shar e s in A i nax to

Volvo’s sha re ho ld e r s was app ro ve d . The va lu e of t he dis tr i bu ti o n of

Ai nax was 6, 310. The shar e s in A i nax were dis tr i bu te d to Vol vo’s

sha re h ol de r s on June 8, 20 04 .

Dur i ng 20 0 4 Vol vo’s hold in g in H e nl ys Gr ou p Plc has bee n full y

wr i t t e n down and a w r i te - do w n of 95 wa s ther eb y cha rg e d to t he

income st atement.

Th e hold in g in B il ia AB wi th a b o ok va lu e of 25 was sol d .

Th e parti ci pa ti on s in B lu e Chip Jet HB were wr i t t en dow n by 1.

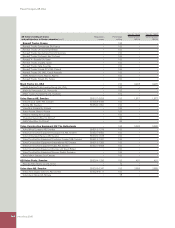

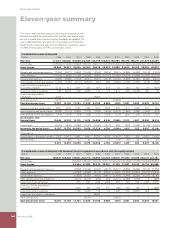

Group companies Non-Group companies

2004 2005 2004 2005

Balance December 31, previous year 41,329 40,393 813 691

Transition effect on shares in listed companies – – – (501)

Acquisitions/New issue of shares/Dividends 133 8,682 – –

Divestments (81) (26) (25) (2)

Shareholder contributions 376 183 – –

Write-downs (1,364) (8,420) (97) 0

Revaluation of shares in listed companies – – – 83

Balance, December 31 40,393 40,812 691 271

Note 12 Investments in shares and participations

Ho ld in gs of share s an d part i ci pa ti on s are spe ci fi ed i n AB Vol vo’s hol din g of s ha re s (p ag e s 141–143). C ha ng e s in h o ld in gs of s ha r es an d par-

tic i pa ti on s are show n belo w.