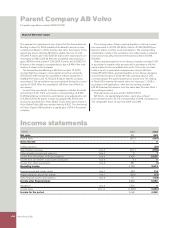

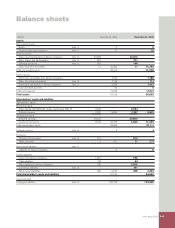

Volvo 2005 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

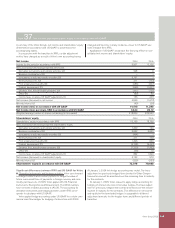

Volvo Group 2005 121

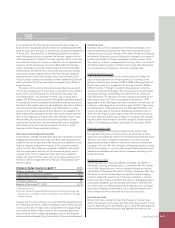

Note 36 Financial risks and instruments

In its operations, the Volvo Group is exposed to various types of

fi nancial risks. Groupwide policies, which are updated and decided

upon annually, form the basis of each Group company’s management

of these risks. The objectives of the Group’s policies for manage-

ment of fi nancial risks are to optimize the Group’s capital costs by

utilizing economies of scale, to minimize negative effects on income

as a result of changes in currency or interest rates, to optimize risk

exposure and to clarify areas of responsibility within the Group’s

fi nance and treasury activities. Monitoring and control that estab-

lished policies are adhered to is conducted continuously centrally

and at each Group company. Most of the Volvo Group’s fi nancial

transactions are carried out through Volvo’s inhouse bank, Volvo

Treasury, which conducts its operations within established risk man-

dates and limits. Credit risks are mainly managed by the different

business areas.

The nature of the various fi nancial risks and objectives and poli-

cies for the management of these risks is described in the sections

below. Volvo’s accounting policies for fi nancial instruments are

described in Note 1. As presented in Note 1, as of 2005, Volvo

applies IAS 39, Financial Instruments: Recognition and Measurement.

In accordance with this standard all derivatives shall be reported at

fair value in the balance sheet. In calculating the fair values of fi nan-

cial instruments, Volvo has primarily used offi cial rates or prices

quoted on the capital markets. In their absence, the valuation has

been made by discounting future cash fl ows at the market interest

rate for each maturity for instruments with maturities shorter than

three months, the carrying value has been assumed to closely

approximate the fair value. All reported fair values are calculated

values that will not necessarily be realized. The effects of the

transition to IAS 39 are presented in Note 3.

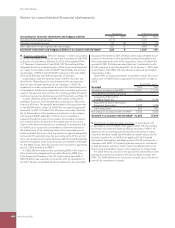

Fair value of derivative instruments

In accordance with IAS 39, derivative fi nancial instruments used for

hedging of forecasted commercial cash-fl ows and electricity con-

sumption have been reported at fair value, which is debited or cred-

ited to a separate component of equity to the extent the require-

ments for cash-fl ow hedge accounting are fulfi lled. To the extent

that the requirements are not met, the unrealized gain or loss is

charged to the income statement. Gains and losses related to

hedges are reported at the same time as the gains and losses on

the items that are hedged effect the Group’s consolidated share-

holders’ equity.

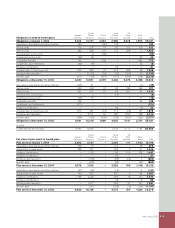

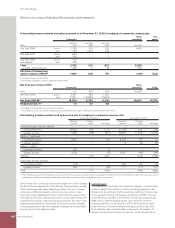

Change in hedge reserve in equity1, 2 2005

Balance at January 1, 2005 1,007

Change due to commercial derivatives (1,495)

Change due to commodity forward contracts 53

Translation difference 24

Balance at December 31, 2005 (411)

1 After tax amounts.

2 Income has beed charged by 405 before tax concerning exchange rate

gains/losses on forward contracts and options, reversed from the hedge

reserve in equity.

Considering the more complex rules under IAS 39 regarding deriva-

tive fi nancial instruments used for hedging of interest-rate risks and

currency-rate risks on loans, Volvo has decided not to apply hedge

accounting for interest-rate contracts. The unrealized gains and

losses through to the settlement/expiration date of the fi nancial

instrument were charged to the fi nancial net in the income statement.

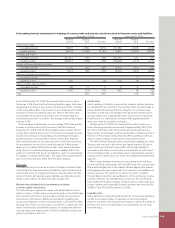

Currency risks

Currency risks in Volvo’s operations are related to changes in the

value of contracted and projected future fl ows of payments (com-

mercial currency risks), to changes in the value of loans and fi nancial

investments (fi nancial currency risks) and to changes in the value of

assets and liabilities in foreign subsidiaries (equity currency risks).

The objective of Volvo’s management of currency risks is to minimize

short-term negative impact on Volvo’s income and fi nancial position

as a consequence of changes in currency exchange rates.

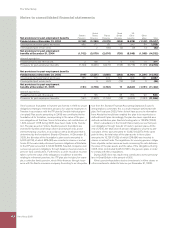

Commercial currency risks

Volvo uses forward contracts and currency options to hedge the

value of future payments in foreign currencies. According to the

Group’s currency policy, between 50% to 80% of the projected net

fl ow in each currency is hedged for the coming 6 months, 30% to

60% for months 7 through 12 and fi rm fl ows beyond 12 months

should normally be fully hedged. The nominal amount of all forward

and option contracts outstanding as of December 31, 2005 was

SEK 39.5 billion. The fair value of these contracts amounted on the

same date to a loss of 732. If assuming an instantaneous 10%

appreciation of the SEK against all other currencies, the fair value of

contracts outstanding would amount to a gain of 2,621. If assuming

an instantaneous 10% weakening of the SEK against all other cur-

rencies the fair value of contracts outstanding would be a loss of

4,101. Actual foreign currency rates rarely move instantaneously in

the same direction and the actual impact of exchange rate changes

may thus differ from the above sensitivity analyses. Further specifi -

cations of outstanding contracts are included in the tables below.

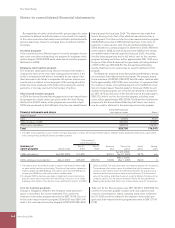

Financial currency risks

Loans and deposits in the Group companies are mainly made

through Volvo Treasury in local currencies and fi nancial currency

exposure in the individual entities are thereby being minimized. Volvo

Treasury uses various derivative instruments in order to provide

deposits and lending in different currencies without increasing the

company’s own risk. The Volvo Group’s net fi nancial position is being

affected by changes in currency rates because fi nancial assets and

liabilities are allocated between Group companies operating in dif-

ferent currencies.

Equity currency risks

The Group value of assets and liabilities in foreign subsidiaries is

affected by currency exchange rates in connection with the transla-

tion to SEK. Equity currency risks are being minimized by ongoing

optimization of the amount of equity in foreign subsidiaries with con-

sideration of commercial and legal prerequisites. Equity hedging

could be made if the equity level of a foreign subsidiary is consid-

ered as too high. At year-end 2005, net assets in subsidiaries and in

associated companies outside Sweden amounted to SEK 33.7 bil-

lion. Of this amount, SEK 0.8 billion was hedged by loans in foreign

currencies. Hedging of investments in associated companies and

other companies will be executed on a case-by-case basis.

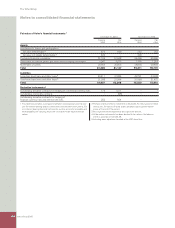

Interest rate risks

Interest rate risks include the risks that changes in interest rates

affects the Group’s income and cash-fl ow (cash-fl ow risks) or the fair

value of fi nancial assets and liabilities (price risks). By matching fi xed

interest periods of fi nancial assets and liabilities the exposure for