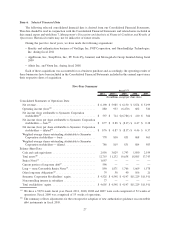

Symantec 2011 Annual Report Download - page 99

Download and view the complete annual report

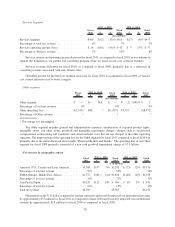

Please find page 99 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.incur expenses resulting from our eCommerce platform, components of which are recorded as a cost of revenue and

an operating expense.

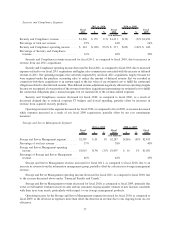

Fluctuations in the U.S. dollar compared to foreign currencies unfavorably impacted our international revenue

by approximately $53 million for fiscal 2011 as compared to fiscal 2010 and favorably impacted our international

revenue by approximately $14 million for fiscal 2010 as compared to fiscal 2009. We are unable to predict the extent

to which revenue in future periods will be impacted by changes in foreign currency exchange rates. If our level of

international sales and expenses increase in the future, changes in foreign exchange rates may have a potentially

greater impact on our revenue and operating results.

Our net income attributable to Symantec Corporation stockholders was $597 million for fiscal 2011 and

$714 million for 2010. Our net income for fiscal 2011 was negatively impacted by a loss of $21 million from the

liquidation of certain foreign entities and $27 million from the impairment of intangible assets, while net income for

fiscal 2010 was positively affected by a gain of $47 million from the liquidation of certain foreign entities. Our fiscal

2011 and fiscal 2010 net income were positively impacted relative to the preceding year by a decrease of

$119 million and $128 million, respectively, in cost of revenue primarily related to certain acquired product rights

becoming fully amortized. Net income for fiscal 2011 and fiscal 2010 was also positively impacted by tax benefits

resulting from the reversal of accrued liabilities and correlative benefits related to the Veritas Software tax

assessment for 2000 and 2001 of $49 million and $79 million, respectively.

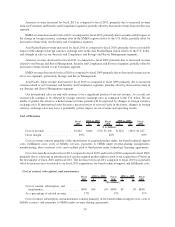

CRITICAL ACCOUNTING ESTIMATES

The preparation of the Consolidated Financial Statements and related notes included in this annual report in

accordance with generally accepted accounting principles in the United States, requires us to make estimates, which

include judgments and assumptions, that affect the reported amounts of assets, liabilities, revenue, and expenses,

and related disclosure of contingent assets and liabilities. We have based our estimates on historical experience and

on various assumptions that we believe to be reasonable under the circumstances. We evaluate our estimates on a

regular basis and make changes accordingly. Historically, our critical accounting estimates have not differed

materially from actual results; however, actual results may differ from these estimates under different conditions. If

actual results differ from these estimates and other considerations used in estimating amounts reflected in the

Consolidated Financial Statements included in this annual report, the resulting changes could have a material

adverse effect on our Consolidated Statements of Operations, and in certain situations, could have a material

adverse effect on liquidity and our financial condition.

A critical accounting estimate is based on judgments and assumptions about matters that are uncertain at the

time the estimate is made. Different estimates that reasonably could have been used or changes in accounting

estimates could materially impact the operating results or financial condition. We believe that the estimates

described below represent our critical accounting estimates, as they have the greatest potential impact on our

consolidated financial statements. See also Note 1 of the Notes to the Consolidated Financial Statements included in

this annual report.

Revenue Recognition

We recognize revenue primarily pursuant to the requirements under the authoritative guidance on software

revenue recognition, and any applicable amendments or modifications. Revenue recognition requirements in the

software industry are very complex and require us to make many estimates.

For software arrangements that include multiple elements, including perpetual software licenses and main-

tenance and/or services, packaged products with content updates, managed security services, and subscriptions, we

allocate and defer revenue for the undelivered items based on vendor specific objective evidence (“VSOE”) of the

fair value of the undelivered elements, and recognize the difference between the total arrangement fee and the

amount deferred for the undelivered items as revenue. VSOE of each element is based on the price for which the

undelivered element is sold separately. We determine fair value of the undelivered elements based on historical

evidence of our stand-alone sales of these elements to third parties or from the stated renewal rate for the

undelivered elements. When VSOE does not exist for undelivered items, the entire arrangement fee is recognized

29