Symantec 2011 Annual Report Download - page 102

Download and view the complete annual report

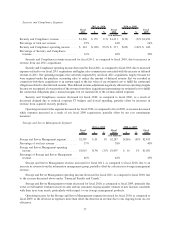

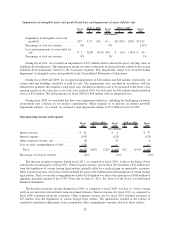

Please find page 102 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of April 1, 2011, our goodwill balance was $5 billion. Based on the impairment analysis performed on

January 4, 2011, we determined that the fair value of each of our reporting units exceeded the carrying value of the

unit by more than 10% of the carrying value. While discount rates are only one of several important estimates used

in the analysis, we determined that an increase of one percentage point in the discount rate used for each respective

reporting unit would not have resulted in an impairment indicator for any unit at the time of this analysis, except for

the Security and Compliance reporting unit which would have had a fair value 5% below carrying value. However,

we believe that the discount rate applied to the Security and Compliance reporting unit is appropriate and we applied

the same discount rate for this reporting unit in fiscal 2011 as we used in fiscal 2010. In addition to the discount rate,

the impairment test includes the consideration of a number of estimates, including growth rates, operating margins

and cost forecasts, foreign exchange rates and the allocation of certain tangible assets to the reporting units. Based

on the results of our impairment test, we do not believe that an impairment indicator exists as of our annual

impairment test date.

A number of factors, many of which we have no ability to control, could affect our financial condition,

operating results and business prospects and could cause actual results to differ from the estimates and assumptions

we employed. These factors include:

• a prolonged global economic crisis;

• a significant decrease in the demand for our products;

• the inability to develop new and enhanced products and services in a timely manner;

• a significant adverse change in legal factors or in the business climate;

• an adverse action or assessment by a regulator;

• successful efforts by our competitors to gain market share in our markets;

• a loss of key personnel;

• our determination to dispose of one or more of our reporting units;

• the testing for recoverability of a significant asset group within a reporting unit; and

• recognition of a goodwill impairment loss.

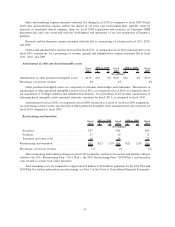

Intangible Asset Impairment. We assess the impairment of identifiable finite-lived intangible assets when-

ever events or changes in circumstances indicate that an asset group’s carrying amount may not be recoverable.

Recoverability of certain finite-lived intangible assets, particularly customer relationships and finite-lived trade-

names, would be measured by the comparison of the carrying amount of the asset group to which the assets are

assigned to the sum of the undiscounted estimated future cash flows the asset group is expected to generate. If the

asset is considered to be impaired, the amount of such impairment would be measured as the difference between the

carrying amount of the asset and its fair value. Recoverability and impairment of other finite-lived intangible assets,

particularly developed technology and patents, would be measured by the comparison of the carrying amount of the

asset to the sum of undiscounted estimated future product revenues offset by estimated future costs to dispose of the

product to which the asset relates. For indefinite-lived intangible assets, we review impairment on an annual basis

consistent with the timing of the annual evaluation for goodwill. These assets generally include tradenames,

trademarks and in-process research and development. Recoverability of indefinite-lived intangible assets would be

measured by the comparison of the carrying amount of the asset to the sum of the discounted estimated future cash

flows the asset is expected to generate plus expected royalties. If the asset is considered to be impaired, the amount

of such impairment would be measured as the difference between the carrying amount of the asset and its fair value.

Our cash flow assumptions are based on historical and forecasted future revenue, operating costs, and other relevant

factors. Assumptions and estimates about the remaining useful lives of our intangible assets are subjective and are

affected by changes to our business strategies. If management’s estimates of future operating results change, or if

there are changes to other assumptions, the estimate of the fair value of our identifiable intangible assets could

change significantly. Such change could result in impairment charges in future periods, which could have a

significant impact on our operating results and financial condition.

32