Symantec 2011 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

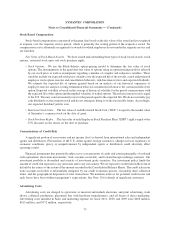

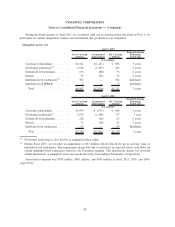

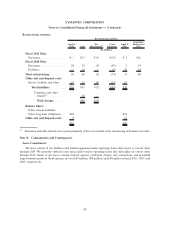

Total future amortization expense for intangible assets that have definite lives, based upon our existing

intangible assets and their current estimated useful lives as of April 1, 2011, is estimated as follows (in millions):

2012 ................................................................. $ 362

2013 ................................................................. 326

2014 ................................................................. 181

2015 ................................................................. 127

2016 ................................................................. 76

Thereafter ............................................................. 134

Total ................................................................. $1,206

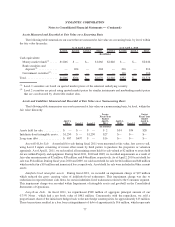

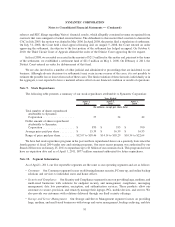

Note 5. Investment in Joint Venture

On February 5, 2008, Symantec formed Huawei-Symantec Technologies Co., Ltd. (“joint venture”) with a

subsidiary of Huawei Technologies Co., Limited (“Huawei”). The joint venture is domiciled in Hong Kong with

principal operations in Chengdu, China. We contributed cash of $150 million, licenses related to certain intellectual

property and intangible assets in exchange for 49% of the outstanding common shares of the joint venture. The joint

venture develops, manufactures, supports and markets security and storage appliances and solutions to global

telecommunications carriers and enterprise customers. Huawei contributed its telecommunications storage and

security business assets, engineering, sales and marketing resources, personnel, and licenses related to intellectual

property in exchange for a 51% ownership interest in the joint venture.

The contribution of assets to the joint venture was accounted for at its carrying value. The historical carrying

value of the assets contributed by Symantec comprised a significant portion of the net assets of the joint venture. As

a result, our carrying value of the investment in the joint venture exceeded our proportionate share in the book value

of the joint venture by approximately $75 million upon formation of the joint venture. As the contributions for both

Symantec and Huawei were recorded at historical carrying value by the joint venture, this basis difference is

attributable to the contributed identified intangible assets. The basis difference is being amortized over a weighted-

average period of 9 years, the estimated useful lives of the underlying identified intangible assets to which the basis

difference is attributed.

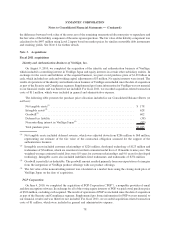

We have a one-time option to purchase an additional two percent ownership interest from Huawei for

$28 million. The period to exercise this option began on February 5, 2011. We determined the value of the option

using the Black-Scholes option-pricing model. The value of the option is not considered material to the financial

statements. We have concluded that the option does not meet the definition of a derivative under the authoritative

guidance. As of the date of this filing, we continue to evaluate the exercise of this option.

If Symantec declines its option to purchase the additional two percent ownership interest, Symantec and

Huawei would each then have the right to purchase all of the other partner’s ownership interest through a bid

process. As of the date of this filing, this bid process has not been triggered.

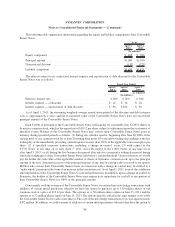

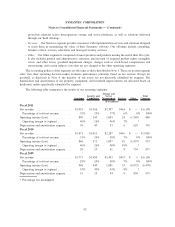

We account for our investment in the joint venture under the equity method of accounting. Under this method,

we record our proportionate share of the joint venture’s net income or loss based on the quarterly financial

statements of the joint venture. We record our proportionate share of net income or loss one quarter in arrears. In

determining our share of the joint venture’s net income or loss, we adjust the joint venture’s reported results to

recognize the amortization expense associated with the basis difference described above. Summarized audited

84

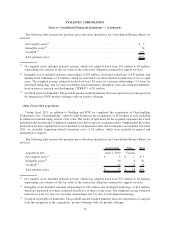

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)