Symantec 2011 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

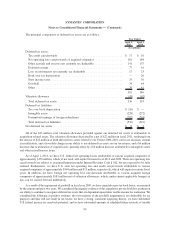

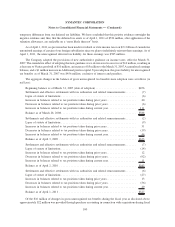

In July 2008, we reached an agreement with the IRS concerning our eligibility to claim a lower tax rate on a

distribution made from a Veritas foreign subsidiary prior to the July 2005 acquisition. The distribution was intended

to be made pursuant to the American Jobs Creation Act of 2004, and therefore eligible for a 5.25% effective

U.S. federal rate of tax, in lieu of the 35% statutory rate. The final impact of this agreement remains uncertain since

this relates to the taxability of earnings that are otherwise the subject of transfer pricing matters at issue in the IRS

examination of Veritas tax years 2002-2005. To the extent that we owe taxes as a result of these transfer pricing

matters in years prior to the distribution, we anticipate that the incremental tax due from this negotiated agreement

will decrease. We currently estimate that the most probable outcome from this negotiated agreement will be that we

will owe $13 million or less, for which an accrual has already been made.

We continue to monitor the progress of ongoing income tax controversies and the impact, if any, of the

expected tolling of the statute of limitations in various taxing jurisdictions.

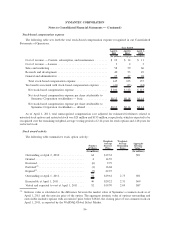

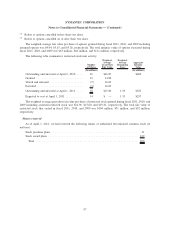

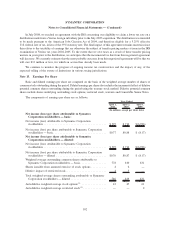

Note 13. Earnings Per Share

Basic and diluted earnings per share are computed on the basis of the weighted average number of shares of

common stock outstanding during the period. Diluted earnings per share also includes the incremental effect of dilutive

potential common shares outstanding during the period using the treasury stock method. Dilutive potential common

shares include shares underlying outstanding stock options, restricted stock, warrants and Convertible Senior Notes.

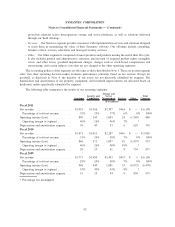

The components of earnings per share are as follows:

April 1,

2011

April 2,

2010

April 3,

2009

Year Ended

(In millions, except per share data)

Net income (loss) per share attributable to Symantec

Corporation stockholders — basic:

Net income (loss) attributable to Symantec Corporation

stockholders ........................................ $597 $714 $(6,786)

Net income (loss) per share attributable to Symantec Corporation

stockholders — basic .................................. $0.77 $0.88 $ (8.17)

Net income (loss) per share attributable to Symantec

Corporation stockholders — diluted:

Net income (loss) attributable to Symantec Corporation

stockholders ........................................ $597 $714 $(6,786)

Net income (loss) per share attributable to Symantec Corporation

stockholders — diluted ................................ $0.76 $0.87 $ (8.17)

Weighted average outstanding common shares attributable to

Symantec Corporation stockholders — basic................. 778 810 831

Shares issuable from assumed exercise of stock options .......... 4 6 —

Dilutive impact of restricted stock .......................... 4 3 —

Total weighted-average shares outstanding attributable to Symantec

Corporation stockholders — diluted . ...................... 786 819 831

Anti-dilutive weighted-average stock options

(1)

................ 43 47 61

Anti-dilutive weighted-average restricted stock

(1)

............... — — 2

102

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)