Symantec 2011 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.purchase up to 110 million shares of our common stock at a price of $27.3175 per share. The warrants expire on

various dates from July 2011 through August 2013 and must be settled in net shares. We received approximately

$326 million in cash proceeds from the sale of these warrants.

In the second quarter of fiscal 2011, we repurchased $500 million of aggregate principal amount of our

0.75% Notes. Concurrently with the repurchase, we sold a proportionate share of the initial note hedges back to the

note hedge counterparties for approximately $13 million. These transactions resulted in a loss from extinguishment

of debt of approximately $16 million, which represents the difference between book value of the notes net of the

remaining unamortized discount prior to repurchase and the fair value of the liability component of the notes upon

repurchase. The net cost of the repurchase of the 0.75% Notes and the concurrent sale of the note hedges was

$497 million in cash.

The remaining Convertible Senior Notes will have no impact on diluted earnings per share (“EPS”) until the

price of our common stock exceeds the conversion price of $19.12 per share because the principal amount of the

Convertible Senior Notes will be settled in cash upon conversion. Prior to conversion, we will include the effect of

the additional shares that may be issued if our common stock price exceeds $19.12 per share using the treasury stock

method. As a result, for the first $1.00 by which the average price of our common stock for a quarterly period

exceeds $19.12 per share there would be dilution of approximately 1.6 million shares on the 0.75% Notes and

2.6 million shares on the 1.00% Notes. As the share price continues to increase, additional dilution would occur at a

declining rate such that an average price of $27.3175 per share would yield cumulative dilution of approximately

25.1 million shares. If the average price of our common stock exceeds $27.3175 per share for a quarterly period we

will also include the effect of the additional potential shares that may be issued related to the warrants using the

treasury stock method. The Convertible Senior Notes along with the warrants have a combined dilutive effect such

that for the first $1.00 by which the average price exceeds $27.3175 per share there would be cumulative dilution of

approximately 30.1 million shares prior to conversion. As the share price continues to increase, additional dilution

would occur but at a declining rate.

Prior to conversion, the note hedge transactions are not considered for purposes of the EPS calculation, as their

effect would be anti-dilutive. Upon conversion, the note hedge will automatically serve to neutralize the dilutive

effect of the remaining Convertible Senior Notes when the stock price is above $19.12 per share. For example, if

upon conversion the price of our common stock was $28.3175 per share, the cumulative effect of approximately

30.1 million shares in the example above would be reduced to approximately 3 million shares.

The preceding calculations assume that the average price of our common stock exceeds the respective

conversion prices during the period for which EPS is calculated and excludes any potential adjustments to the

conversion ratio provided under the terms of the Convertible Senior Notes. See Note 13 for information regarding

the impact on EPS of the Convertible Senior Notes and warrants in the current period.

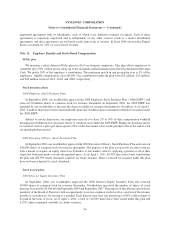

Revolving credit facility

In the second quarter of fiscal 2011, we entered into a four-year $1.0 billion senior unsecured revolving credit

facility that expires in September 2014 (the “credit facility”). The credit facility provides that we may borrow up to

$1.0 billion under revolving loans. Revolving loans under the credit facility bear interest, at our option, either at a

rate equal to a) LIBOR plus a margin based on our consolidated leverage ratio, as defined in the credit facility

agreement or b) the bank’s prime rate plus a margin based on our consolidated leverage ratio, as defined in the credit

facility agreement. Under the terms of this credit facility, we must comply with certain financial and non-financial

covenants, including a covenant to maintain a specified ratio of debt to EBITDA (earnings before interest, taxes,

depreciation and amortization). As of April 1, 2011, we were in compliance with all required covenants, and there

was no outstanding balance on the credit facility.

87

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)