Symantec 2011 Annual Report Download - page 60

Download and view the complete annual report

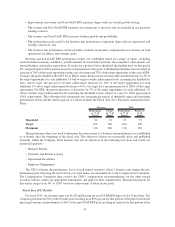

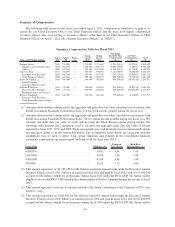

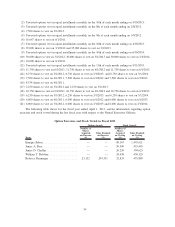

Please find page 60 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eligible to receive the FY10 LTIP award if he remains employed by the Company through the last day of fiscal

2012.

(6) This amount represents (a) $7,387 for coverage of expenses related to Mr. Salem’s attendance at the

Company’s FY09 sales achiever’s trip, and (b) $10,000 for reimbursement for tax services.

(7) This amount represents (a) $796,875 for Mr. Salem’s executive annual bonus under his Executive Annual

Incentive Plan for fiscal 2009, which was earned in fiscal 2009 and paid in fiscal 2010, and (b) $450,000

accrued on Mr. Salem’s behalf for performance during fiscal 2009 under the FY09 LTIP.

(8) This amount represents coverage of expenses related to Mr. Salem’s attendance at the Company’s FY08 sales

achiever’s trip and Board retreat.

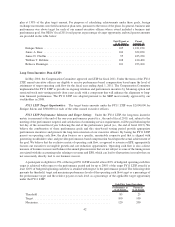

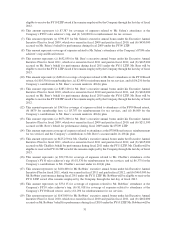

(9) This amount represents (a) $652,050 for Mr. Beer’s executive annual bonus under his Executive Annual

Incentive Plan for fiscal 2011, which was earned in fiscal 2011 and paid in fiscal 2012, and (b) $465,000

accrued on Mr. Beer’s behalf for performance during fiscal 2011 under the FY11 LTIP. Mr. Beer will be

eligible to receive the FY11 LTIP award if he remains employed by the Company through the last day of fiscal

2013.

(10) This amount represents (a) $426 for coverage of expenses related to Mr. Beer’s attendance at the FY10 Board

retreat, (b) $10,556 for membership fees, (c) $2,400 for reimbursement for tax services, and (d) $6,250 for the

Company’s contributions to Mr. Beer’s account under its 401(k) plan.

(11) This amount represents (a) $285,120 for Mr. Beer’s executive annual bonus under his Executive Annual

Incentive Plan for fiscal 2010, which was earned in fiscal 2010 and paid in fiscal 2011, and (b) $462,000

accrued on Mr. Beer’s behalf for performance during fiscal 2010 under the FY10 LTIP. Mr. Beer will be

eligible to receive the FY10 LTIP award if he remains employed by the Company through the last day of fiscal

2012.

(12) This amount represents (a) $363 for coverage of expenses related to attendance at the FY09 Board retreat,

(b) $879 for membership fees, (c) $5,707 for reimbursement for tax services, and (d) $6,000 for the

Company’s contributions to Mr. Beer’s account under its 401(k) plan.

(13) This amount represents (a) $673,200 for Mr. Beer’s executive annual bonus under his Executive Annual

Incentive Plan for fiscal 2009, which was earned in fiscal 2009 and paid in fiscal 2010, and (b) $211,500

accrued on Mr. Beer’s behalf for performance during fiscal 2009 under the FY09 LTIP.

(14) This amount represents coverage of expenses related to attendance at the FY08 Board retreat, reimbursement

for tax services and the Company’s contributions to Mr. Beer’s account under its 401(k) plan.

(15) This amount represents (a) $425,250 for Ms. Chaffin’s executive annual bonus under her Executive Annual

Incentive Plan for fiscal 2011, which was earned in fiscal 2011 and paid in fiscal 2012, and (b) $465,000

accrued on Ms. Chaffin’s behalf for performance during fiscal 2011 under the FY11 LTIP. Ms. Chaffin will be

eligible to receive the FY11 LTIP award if she remains employed by the Company through the last day of fiscal

2013.

(16) This amount represents (a) $52,726 for coverage of expenses related to Ms. Chaffin’s attendance at the

Company’s FY10 sales achiever’s trip, (b) $1,530 for reimbursement for tax services, and (c) $6,375 for the

Company’s contributions to Ms. Chaffin’s account under its 401(k) plan.

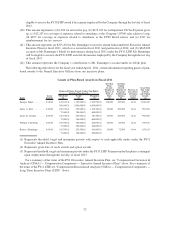

(17) This amount represents (a) $410,400 for Mr. Robbins’ executive annual bonus under his Executive Annual

Incentive Plan for fiscal 2011, which was earned in fiscal 2011 and paid in fiscal 2012, and (b) $465,000 for

Mr. Robbins’ performance during fiscal 2011 under the FY11 LTIP. Mr. Robbins will be eligible to receive the

FY11 LTIP award if he remains employed by the Company through the last day of fiscal 2013.

(18) This amount represents (a) $33,115 for coverage of expenses related to Mr. Robbins’ attendance at the

Company’s FY10 sales achiever’s trip, (b) $1,018 for coverage of expenses related to attendance at the

Company’s FY10 Board retreat, and (c) $1,294 for reimbursement for tax services.

(19) This amount represents (a) $163,800 for Mr. Robbins’ executive annual bonus under his Executive Annual

Incentive Plan for fiscal 2010, which was earned in fiscal 2010 and paid in fiscal 2011, and (b) $462,000

accrued on Mr. Robbins’ behalf for performance during fiscal 2010 under the FY10 LTIP. Mr. Robbins will be

51