Symantec 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Goodwill and Intangible Assets

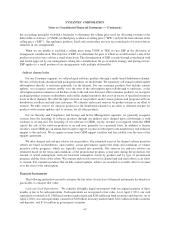

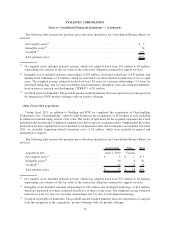

Goodwill. Our methodology for allocating the purchase price relating to acquisitions is determined through

established valuation techniques. Goodwill is measured as the excess of the cost of the acquisition over the sum of

the amounts assigned to tangible and identifiable intangible assets acquired less liabilities assumed. We review

goodwill for impairment on an annual basis during the fourth quarter of the fiscal year and whenever events or

changes in circumstances indicate the carrying value of goodwill may be impaired. In testing for a potential

impairment of goodwill, we determine the carrying value (book value) of the assets and liabilities for each reporting

unit, which requires the allocation of goodwill to each reporting unit. We then estimate the fair value of each

reporting unit, which are the same as our operating segments. The first step in evaluating goodwill for impairment is

to determine if the estimated fair value of equity is greater than the carrying value of equity of each reporting unit. If

step one indicates that impairment potentially exists, the second step is performed to measure the amount of

impairment, if any. Goodwill impairment exists when the estimated fair value of goodwill is less than its carrying

value.

To determine the reporting units’ fair values in the current year analysis, we used the income approach which is

based on the estimated discounted future cash flows of that reporting unit. The estimated fair value of each reporting

unit under the income approach is corroborated with the market approach which measures the value of a business

through an analysis of recent sales or offerings of a comparable entity. We also consider our market capitalization on

the date of the analysis. The methodology applied in the current year analysis was consistent with the methodology

applied in the prior year analysis, but was based on updated assumptions, as appropriate.

Our cash flow assumptions are based on historical and forecasted revenue, operating costs and other relevant

factors. To determine the reporting units’ carrying values, we allocated assets and liabilities based on either specific

identification or by using judgment for the remaining assets and liabilities that are not specific to a reporting unit.

Goodwill was allocated to the reporting units based on a combination of specific identification and relative fair

values, which is consistent with the methodology utilized in the prior year impairment analysis. The use of relative

fair values was necessary for certain reporting units due to impairment charges and changes in our operating

structure in prior years.

Prior to performing our second step in the goodwill impairment analysis, we perform an assessment of long-

lived assets, including intangible assets, for impairment.

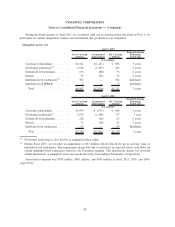

Intangible Assets. In connection with our acquisitions, we generally recognize assets for customer rela-

tionships, developed technology (which consists of acquired product rights, technologies, databases, and contracts),

in-process research and development, trademarks and tradenames. Indefinite-lived intangible assets are not subject

to amortization. Finite-lived intangible assets are carried at cost less accumulated amortization. Such amortization

is provided on a straight-line basis over the estimated useful lives of the respective assets, generally from one to

eleven years. Amortization for developed technology is recognized in Cost of revenue as Amortization of acquired

product rights. Amortization for customer relationships and certain tradenames is recognized in Operating

expenses.

On an interim basis, we assess the impairment of identifiable intangible assets whenever events or changes in

circumstances indicate that an asset group’s carrying amount may not be recoverable. Recoverability of certain

finite-lived intangible assets, particularly customer relationships and finite-lived tradenames, would be measured

by the comparison of the carrying amount of the asset group to which the assets are assigned to the sum of the

undiscounted estimated future cash flows the asset group is expected to generate. If the asset is considered to be

impaired, such amount would be measured as the difference between the carrying amount of the asset and its fair

value. Recoverability and impairment of other finite-lived intangible assets, particularly developed technology and

patents, would be measured by the comparison of the carrying amount of the asset to the sum of undiscounted

estimated future product revenues offset by estimated future costs to dispose of the product. In addition, for

indefinite-lived intangible assets, we review such assets for impairment on an annual basis consistent with the

73

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)