Symantec 2011 Annual Report Download - page 158

Download and view the complete annual report

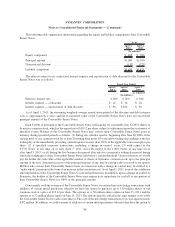

Please find page 158 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition, in the second quarter of fiscal 2011, we terminated our previous $1.0 billion senior unsecured

revolving credit facility that we entered into in July 2006. At the time of termination, there was no outstanding

balance on the credit facility. The original expiration date for this credit facility was July 2011.

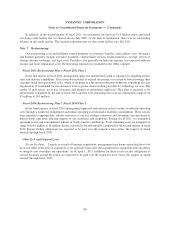

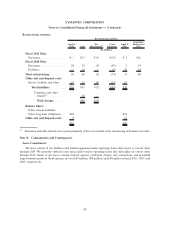

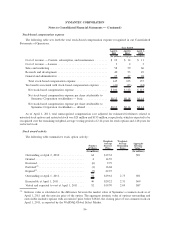

Note 7. Restructuring

Our restructuring costs and liabilities consist primarily of severance, benefits, and facilities costs. Severance

and benefits generally include severance payments, outplacement services, health insurance coverage, effects of

foreign currency exchange, and legal costs. Facilities costs generally include rent expense, less expected sublease

income and lease termination costs. Restructuring expenses are included in the Other segment.

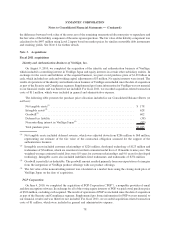

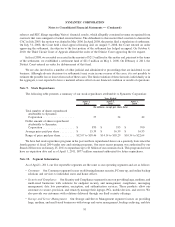

Fiscal 2011 Restructuring Plan (“Fiscal 2011 Plan”)

In the first quarter of fiscal 2011, management approved and initiated a plan to expand our consulting partner

sales and delivery capabilities. This action was initiated to expand our partner eco-system to better leverage their

customer reach and operational scale, which is resulting in a headcount reduction within our consulting services

organization. It is intended for our customers to have greater choice in their providers for technology services. The

results of such action are to pay severance and benefits to terminated employees. This plan is expected to be

substantially completed by the end of fiscal 2012, and the total remaining exit costs are estimated to range from

$5 million to $10 million.

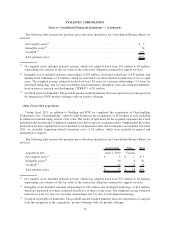

Fiscal 2010 Restructuring Plan (“Fiscal 2010 Plan”)

In the fourth quarter of fiscal 2010, management approved and initiated a plan to reduce worldwide operating

costs through a workforce realignment and reduce operating costs through a facilities consolidation. These actions

were initiated to appropriately allocate resources to our key strategic initiatives and streamline our operations to

deliver better and more efficient support to our customers and employees. During fiscal 2011, we terminated

operating leases and consolidated facilities in North America and Europe. Total remaining costs are estimated to

range from $5 million to $8 million and are expected to be substantially completed by the second quarter of fiscal

2012. Excess facility obligations are expected to be paid over the respective lease terms, the longest of which

extends through fiscal 2016.

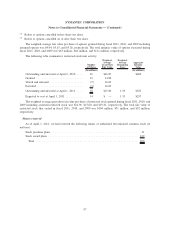

Other Exit and Disposal Costs

Excess Facilities. Largely as a result of business acquisitions, management may deem certain facilities to be

in excess either at the time of acquisition or for a period of time after the acquisition in conjunction with our efforts

to integrate and streamline our operations. As of April 1, 2011, liabilities for these excess facility obligations at

several locations around the world, are expected to be paid over the respective lease terms, the longest of which

extends through fiscal 2018.

88

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)