Symantec 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

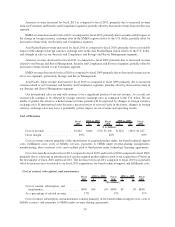

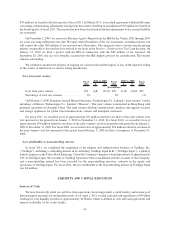

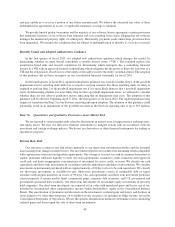

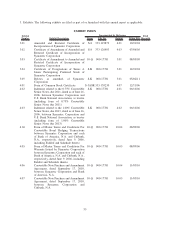

The following table presents the fair value and hypothetical changes in fair values on short-term investments

sensitive to changes in interest rates:

150 bps 100 bps 50 bps

Fair Value

As of (25 bps) (75 bps)

Value of Securities Given an

Interest Rate Increase of

X Basis Points (bps)

Value of Securities

Given an Interest

Rate Decrease of X

Basis Points (bps)

(In millions)

April 1, 2011 ........................... $ 5 $ 5 $ 5 $ 5 $ 5 *

April 2, 2010 ........................... $10 $10 $10 $10 $10 *

* Amount not applicable

The modeling technique used above measures the change in fair market value arising from selected potential

changes in interest rates. Market changes reflect immediate hypothetical parallel shifts in the yield curve of plus

150 bps, plus 100 bps, plus 50 bps, and minus 25 bps.

As of April 1, 2011, we had $1.1 billion in principal amount of fixed-rate Senior Notes outstanding, with a

carrying amount of $1.1 billion and a fair value of $1.05 billion, which fair value is based on market prices. As of

April 1, 2011, a hypothetical 50 BPS increase or decrease in market interest rates would change the fair value of the

fixed-rate debt by a decrease of approximately $34 million and an increase of approximately $35 million,

respectively. However, this hypothetical change in interest rates would not impact the interest expense on the

fixed-rate debt.

Foreign Currency Exchange Rate Risk

We conduct business in 43 currencies through our worldwide operations and, as such, we are exposed to

foreign currency risk. Foreign currency risks are associated with our cash and cash equivalents, investments,

receivables, and payables denominated in foreign currencies. Fluctuations in exchange rates will result in foreign

exchange gains and losses on these foreign currency assets and liabilities and are included in Other income, net. Our

objective in managing foreign exchange activity is to preserve stockholder value by minimizing the risk of foreign

currency exchange rate changes. Our strategy is to primarily utilize forward contracts to hedge foreign currency

exposures. Under our program, gains and losses in our foreign currency exposures are offset by losses and gains on

our forward contracts. Our forward contracts generally have terms of one to six months. At the end of the reporting

period, open contracts are marked-to-market with unrealized gains and losses included in Other income, net.

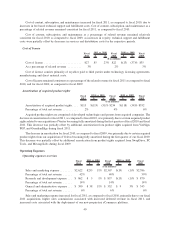

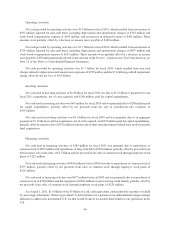

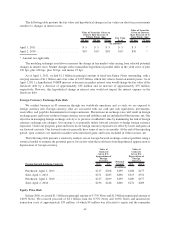

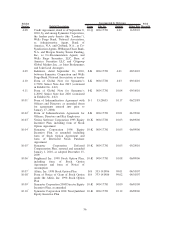

The following table presents a sensitivity analysis on our foreign forward exchange contract portfolio using a

statistical model to estimate the potential gain or loss in fair value that could arise from hypothetical appreciation or

depreciation of foreign currency:

Foreign Forward Exchange Contracts 10% 5%

Notional

Amount (5)% (10)%

Value of

Contracts

Given X%

Appreciation of

Foreign

Currency

Value of

Contracts

Given X%

Depreciation of

Foreign

Currency

(In millions)

Purchased, April 1, 2011 ........................ $217 $208 $199 $188 $177

Sold, April 1, 2011 ............................ $271 $283 $298 $313 $331

Purchased, April 2, 2010 ........................ $217 $209 $199 $189 $177

Sold, April 2, 2010 ............................ $236 $248 $260 $274 $289

Equity Price Risk

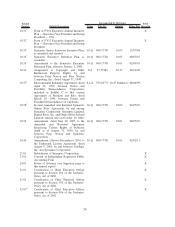

In June 2006, we issued $1.1 billion in principal amount of 0.75% Notes and $1.0 billion in principal amount of

1.00% Notes. We received proceeds of $2.1 billion from the 0.75% Notes and 1.00% Notes and incurred net

transaction costs of approximately $33 million, of which $9 million was allocated to equity and the remainder

49