Symantec 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Such excess represents the estimated fair value of the conversion feature and is recorded as Additional paid-in

capital. The debt discount is amortized using the Company’s effective interest rate over the term of the Convertible

Senior Notes as a non-cash charge to interest expense included in Interest expense. Debt issuance costs were

recorded in Other long-term assets and are being amortized to Interest expense using the effective interest method.

In conjunction with the issuance of the Convertible Senior Notes, we entered into note hedge transactions which

provide us with the option to purchase additional common shares at a fixed price after conversion. The cost incurred

in connection with the note hedge transactions, net of the related tax benefit, and the proceeds from the sale of

warrants, was included as a net reduction in Additional paid-in capital. Borrowings under our $1 billion senior

unsecured revolving credit facility are recognized at cost plus accrued interest based upon stated interest rates.

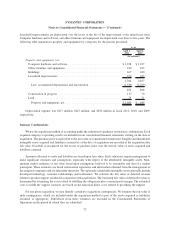

Trade Accounts Receivable

Trade accounts receivable are recorded at the invoiced amount and are not interest bearing. We maintain an

allowance for doubtful accounts to reserve for potentially uncollectible trade receivables. Additions to the

allowance for doubtful accounts are recorded as General and administrative expenses. We review our trade

receivables by aging category to identify specific customers with known disputes or collectability issues. In

addition, we maintain an allowance for all other receivables not included in the specific reserve by applying specific

percentages of projected uncollectible receivables to the various aging categories. In determining these percentages,

we analyze our historical collection experience and current economic trends. We exercise judgment when

determining the adequacy of these reserves as we evaluate historical bad debt trends, general economic conditions

in the U.S. and internationally, and changes in customer financial conditions. We also offset deferred revenue

against accounts receivable when channel inventories are in excess of specified levels and for transactions where

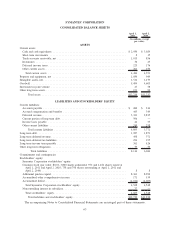

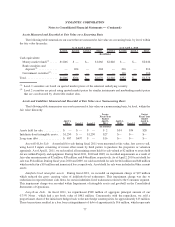

collection of a receivable is not considered probable. The following table summarizes trade accounts receivable, net

of allowances and reserves, for the periods presented:

April 1,

2011

April 2,

2010

As of

(In millions)

Trade accounts receivable, net:

Receivables................................................... $1,034 $873

Less: allowance for doubtful accounts ............................... (9) (8)

Less: reserve for product returns ................................... (12) (9)

Trade accounts receivable, net:................................... $1,013 $856

Inventories

Inventories are valued at the lower of cost or market. Cost is principally determined using the first-in, first-out

method. Adjustments to reduce the cost of inventory to its net realizable value are made, if required, for estimated

excess, obsolescence or impaired balances. Inventory predominantly consists of deferred costs of revenue and

finished goods. Deferred costs of revenue were $22 million as of April 1, 2011 and $23 million as of April 2, 2010,

of which $16 million and $17 million, respectively was related to consumer products that include content updates

and will be recognized ratably over the term of the subscription.

Property and Equipment

Property, equipment, and leasehold improvements are stated at cost, net of accumulated depreciation and

amortization. We capitalize costs incurred during the application development stage related to the development of

internal use software and enterprise cloud computing services. We expense costs incurred related to the planning

and post-implementation phases of development as incurred. Depreciation and amortization is provided on a

straight-line basis over the estimated useful lives of the related assets. Buildings are depreciated over 20 to 30 years.

71

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)