Symantec 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2010 acquisitions

During fiscal 2010, we completed two acquisitions of nonpublic companies for an aggregate of $42 million in

cash. No equity interests were issued. We recorded goodwill in connection with each of these acquisitions, which

resulted primarily from our expectation of synergies from the integration of the acquired company’s technology

with our technology. The goodwill for these acquisitions is only partially tax deductible, if at all. The results of

operations for the acquired companies have been included in our results of operations since their respective

acquisition dates. These acquisitions are included in our Security and Compliance segment.

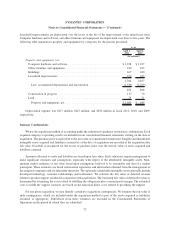

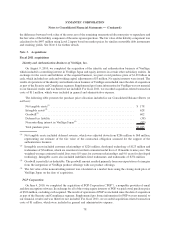

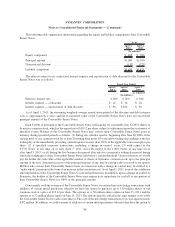

The following table presents the purchase price allocation included in our Consolidated Balance Sheets (in

millions):

Acquisition date ....................................................... Various

Net tangible assets (liabilities)............................................. $ —

Intangible assets

(1)

..................................................... 18

Goodwill ............................................................ 24

Total purchase price .................................................... $ 42

(1)

Intangible assets included customer relationships of $13 million and developed technology of $5 million, which

are amortized over their estimated useful lives of four to eleven years. The weighted-average estimated useful

lives were 10.0 years for customer relationships and 4.0 years for developed technology.

Fiscal 2009 acquisitions

MessageLabs

On November 14, 2008, we completed the acquisition of MessageLabs Group Limited (“MessageLabs”), a

nonpublic United Kingdom-based provider of on-line services to protect, control, encrypt, and archive electronic

communications. The acquisition complements our SaaS business. In exchange for all of the voting equity interests

of MessageLabs, we paid the following (in millions):

Cash paid for acquisition of common stock outstanding, excluding cash acquired .......... $632

Acquisition-related transaction costs ........................................... 8

Total purchase price ....................................................... $640

The results of operations for MessageLabs are included since the date of acquisition as part of the Security and

Compliance segment. Supplemental proforma information for MessageLabs was not material to our financial

results and was therefore not included. The purchase price was subject to an adjustment of up to an additional

$13 million in cash due to estimates in the initial purchase price that were not finalized. As a result, subsequent to

the acquisition date, the Company paid an additional $10 million to the seller which was allocated to Goodwill.

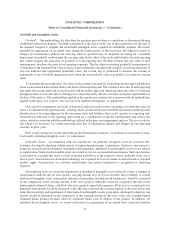

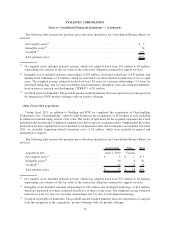

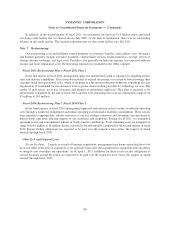

The following table presents the purchase price allocation (in millions):

Net tangible assets

(1)

....................................................... $ 20

Intangible assets

(2)

........................................................ 170

Goodwill

(3)

.............................................................. 480

Deferred tax liability....................................................... (30)

Total purchase price ....................................................... $640

(1)

Net tangible assets included deferred revenue, which was adjusted down from $34 million to $10 million,

representing our estimate of the fair value of the contractual obligation assumed for support services.

80

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)