Symantec 2011 Annual Report Download - page 55

Download and view the complete annual report

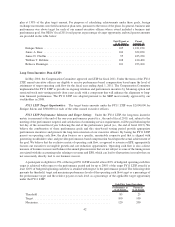

Please find page 55 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the same terms as are available to all employees generally. These rewards are designed to be competitive with

overall market practices, and are in place to attract and retain the talent needed in the business. In addition, named

executive officers are eligible to participate in the deferred compensation plan, and to receive other benefits

described below.

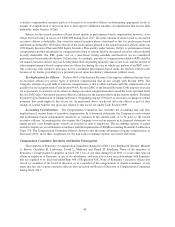

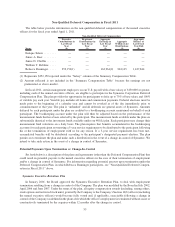

Deferred Compensation: Symantec’s named executive officers are eligible to participate in a nonqualified

deferred compensation plan that provides management employees on our U.S. payroll with a base salary of

$150,000 or greater (including our named executive officers) the opportunity to defer up to 75% of base salary and

100% of cash bonuses for payment at a future date. This plan is provided to be competitive in the executive talent

market, and to provide executives with a tax-efficient alternative for receiving earnings. One of our named executive

officers participated in this plan during fiscal 2011. The plan is described further under “Non-Qualified Deferred

Compensation in Fiscal 2011,” on page 55.

Additional Benefits: Symantec’s named executive officers typically do not receive perquisites, except in

limited circumstances when deemed appropriate by the Compensation Committee. For example, an additional

benefit available to named executive officers is reimbursement for up to $10,000 for financial planning services.

The Compensation Committee provides certain perquisites because it believes they are for business-related

purposes or are prevalent in the marketplace for executive talent. The value of the perquisites we provide are

taxable to the named executive officers and the incremental cost to us for providing these perquisites is reflected in

the Summary Compensation Table. (These benefits are disclosed in the All Other Compensation column of the

Summary Compensation Table on page 50).

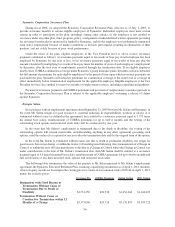

Change in Control and Severance Arrangements: Our Executive Retention Plan provides participants with

double trigger acceleration of equity awards, where equity vesting is only accelerated in the event the individual’s

employment is terminated without cause, or is constructively terminated, within 12 months after a change in control of the

Company (as defined in the plan). We believe that the double trigger acceleration provision appropriately achieves the

intent of the plan without providing an undue benefit to executives who continue to be employed following a change in

control transaction. The intent of the plan is to enable named executive officers to have a balanced perspective in making

overall business decisions in the context of a potential acquisition of the Company, as well as to be competitive with market

practices. The Compensation Committee believes that change in control benefits, if structured appropriately, serve to

minimize the distraction caused by a potential transaction and reduce the risk that key talent would leave the Company

before a transaction closes. We typically do not provide other change of control or severance arrangements to our

executive officers, although in connection with his promotion to CEO in 2009, we entered into an employment agreement

with Enrique Salem that provides him with certain benefits upon the involuntary termination of his employment under

certain circumstances, including acceleration of vesting and severance payments in connection with a change of control.

We do not provide for gross-ups of excise tax values under Section 4999 of the Internal Revenue Code. Rather, we allow

the named executive officer to reduce the benefit received or waive the accelerated vesting of options to avoid excess

payment penalties. Details of each individual named executive officer’s benefits, including estimates of amounts payable

in specified circumstances, are disclosed under “Potential Payments Upon Termination or Change in Control” below.

SUPPLEMENTARY POLICIES AND CONSIDERATIONS

We use several additional policies to ensure that the overall compensation structure is responsive to

stockholder interests and competitive with the market. Specific policies include:

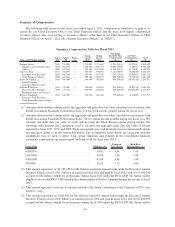

Stock Ownership Requirements

To ensure that our executive management team’s interests are aligned with our stockholders, we instituted

stock ownership requirements in October 2005. Minimum ownership levels are based on the executive’s level:

• CEO: 150,000 shares

• CFO: 85,000 shares

• Group Presidents and Executive Vice Presidents: 35,000 shares

• Chief Accounting Officer (if not otherwise included above): 20,000 shares

46