Symantec 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Each person holding one of the positions listed above is required to acquire and thereafter maintain the stock

ownership required within four years of becoming an executive of Symantec (or four years following the adoption

date of these guidelines).

Stock options and unvested restricted stock awards or restricted stock units do not count toward stock

ownership requirements. Until an executive meets the applicable stock ownership requirement, the executive is

encouraged to retain a percentage of any shares received as a result of the exercise of any stock option or other

equity award, net of the applicable exercise price and tax withholdings.

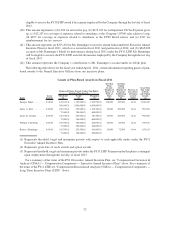

As of August 1, 2011, all named executive officers have reached the stated ownership requirements. See the

table below for individual ownership levels relative to the executive’s ownership requirement.

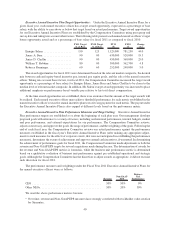

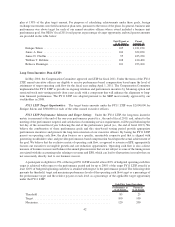

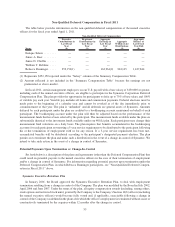

Named Executive Officer

Ownership

Requirement

(# of shares)

Holdings as of

August 1, 2011

Enrique Salem ........................................... 150,000 260,524

James A. Beer ........................................... 85,000 100,976

Janice D. Chaffin......................................... 35,000 44,642

William T. Robbins ....................................... 35,000 59,331

Rebecca Ranninger ....................................... 35,000 118,310

Recoupment Policies (Clawbacks)

Since fiscal 2009, we have included provisions within our executive annual incentive plans to the effect that we

will seek reimbursement of excess incentive cash compensation if our financial statements are the subject of a

restatement due to error or misconduct. Our long-term incentive plans have contained such provisions since their

inception during fiscal 2008.

Certain Other Securities Matters

Our Insider Trading Policy prohibits all directors and employees from short-selling Symantec stock or

engaging in transactions involving Symantec-based derivative securities, including, but not limited to, trading in

Symantec-based option contracts (for example, buying and/or writing puts and calls).

In addition, our Insider Trading Policy requires that our Chief Executive Officer, Chief Financial Officer, and

each of our directors conduct open market sales of our securities only through use of stock trading plans adopted

pursuant to Rule 10b5-1 of the Exchange Act. Rule 10b5-1 allows insiders to sell and diversify their holdings in our

stock over a designated period by adopting pre-arranged stock trading plans at a time when they are not aware of

material nonpublic information about us, and thereafter sell shares of our common stock in accordance with the

terms of their stock trading plans without regard to whether or not they are in possession of material nonpublic

information about the Company at the time of the sale. All other executives are strongly encouraged to trade using

10b5-1 plans.

Tax and Accounting Considerations on Compensation

The financial reporting and income tax consequences to the Company of individual compensation elements are

important considerations for the Compensation Committee when it reviews compensation practices and makes

compensation decisions. While structuring compensation programs that result in more favorable tax and financial

reporting treatment is a general principle, the Compensation Committee balances these goals with other business

needs that may be inconsistent with obtaining the most favorable tax and accounting treatment for each component

of its compensation.

Deductibility by Symantec. Under Section 162(m) of the Internal Revenue Code, we may not receive a

federal income tax deduction for compensation that is not performance-based (as defined in the Section 162(m)

rules) paid to the Chief Executive Officer and the next three most highly compensated executive officers (other than

our Chief Financial Officer) to the extent that any of these persons receives more than $1,000,000 in nonperfor-

mance-based compensation in any one year. While the Compensation Committee considers the Company’s ability

47