Symantec 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the relevant market composite for short- and long-term incentive compensation and total direct compensation.

These adjustments will allow for enhanced emphasis on higher variable compensation rewards commensurate with

performance that drives stockholder value creation and for less emphasis on fixed compensation.

Competitive Market Assessments: Market competitiveness is one factor that the Compensation Com-

mittee considers each year in determining a named executive officer’s overall compensation package, including pay

mix. The Compensation Committee relies on various data sources to evaluate the market competitiveness of each

pay element, including publicly-disclosed data from a peer group of companies (see discussion below) and

published survey data from a broader set of information technology companies that are similar in size to Symantec

and that the Compensation Committee and its advisors, including Mercer, believe represent Symantec’s compe-

tition in the broader talent market. The peer group’s proxy statements provide detailed pay data for the top five

positions. Survey data provides compensation information from a broader group of information technology

companies, with positions matched based on specific job scope and responsibilities. The Compensation Committee

considers data from these sources in developing a market composite that it uses as a framework for making

compensation decisions for each named executive officer’s position.

Symantec is a prominent participant in the information technology industry. This industry is characterized by

rapid rates of change, intense competition from small and large companies, and significant cross-over in leadership

talent needs. As such, we compete for executive talent with leading software and services companies as well as in

the broad information technology industry. Further, because we believe that stockholders measure our performance

against a wide array of technology peers, the Compensation Committee uses a peer group that consists of a broader

group of high technology companies in different market segments that are of a comparable size to us. The

Compensation Committee uses the peer group, as well as other relevant market data, to evaluate named executive

officer pay levels (as described above). In addition, the peer group performance is used as input for setting

performance targets for our annual incentive plan.

The peer group is generally reviewed on an annual basis, and may be adjusted from time to time based on a

comparison of market capitalization, industry and peer group performance. We did not make any changes to our

peer group for fiscal 2011. The following companies were included in our peer group analysis:

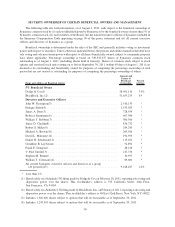

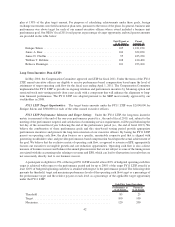

Symantec Peer Group

Adobe Systems Analog Devices Apple

CA Cisco Systems Electronic Arts

EMC Harris Corp Juniper Networks

Lexmark International NetApp Oracle

Qualcomm Seagate Technology Yahoo!

Appropriate Pay Mix: Consistent with our pay-for-performance philosophy, our executive officers’

compensation is structured with a large portion of their total direct compensation paid based on the performance

of the Company and the applicable business unit. In determining the mix of the various reward elements and the

value of each component, the Compensation Committee takes into account the executive’s role, the competitiveness

of the market for executive talent, company performance, business unit performance, internal pay equity and

historical compensation. In making its determinations with regard to compensation, the Compensation Committee

reviews the various compensation elements for the CEO and the other named executive officers (including base

salary, target annual bonus, target and accrued award payments under the Long Term Incentive Plans, and the value

of vested and unvested equity awards actually or potentially issued).

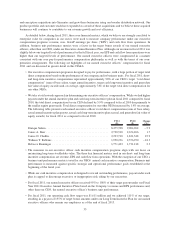

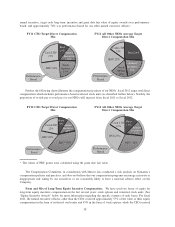

The percentage of an executive officer’s compensation opportunity that is at-risk or variable instead of fixed is

based primarily on the officer’s level of influence at Symantec. Executive officers generally have a greater portion

of their pay at risk through short- and long-term incentive programs than the rest of our employee population

because of their relatively greater responsibility and ability to influence the Company’s performance. A materially

higher proportion of the CEO’s compensation opportunity is at-risk relative to the other named executive officers

because the nature of his role and ability to influence the Company’s performance. As illustrated by the following

charts, for fiscal 2011, approximately 90% of our CEO’s target total direct compensation (sum of base salary, target

37