Symantec 2011 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

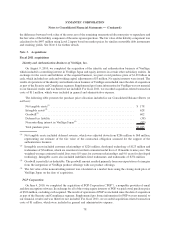

(2)

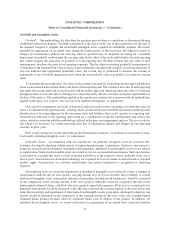

Intangible assets included customer relationships of $127 million, developed technology of $39 million, and

definite-lived tradenames of $4 million, which are amortized over their estimated useful lives of one to eight

years. The weighted-average estimated useful lives were 8.0 years for customer relationships, 4.0 years for

developed technology, and 1.0 years for definite-lived tradenames.

(3)

Goodwill was not tax deductible. The goodwill amount resulted primarily from our expectation of synergies

from the integration of MessageLabs product offerings with our product offerings.

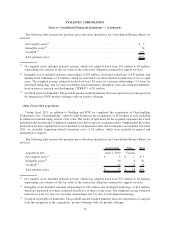

Other fiscal 2009 acquisitions

During fiscal 2009, in addition to MessageLabs, we completed acquisitions of five nonpublic companies for an

aggregate of $478 million in cash, including $6 million in acquisition-related expenses resulting from financial

advisory, legal and accounting services, duplicate sites, and severance. No equity interests were issued. We recorded

goodwill in connection with each of these acquisitions, which resulted primarily from our expectation of synergies

from the integration of the acquired company’s technology with our technology and the acquired company’s access

to our global distribution network. In addition, each acquired company provided a knowledgeable and experienced

workforce. Most of the goodwill from the PC Tools Pty Limited (“PC Tools”) acquisition was tax deductible, while

goodwill for the other acquisitions was not tax deductible or was not material. The results of operations for the

acquired companies have been included in our results of operations since their respective acquisition dates.

AppStream, Inc. (“AppStream”), and the Other acquisitions are included in our Security and Compliance segment

and SwapDrive, Inc. (“SwapDrive”) and PC Tools are included in our Consumer segment.

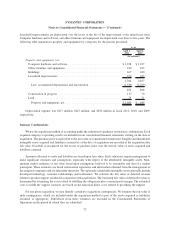

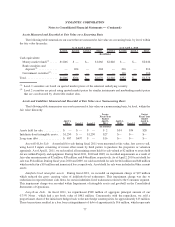

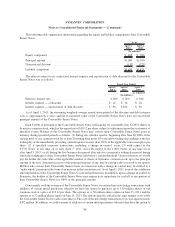

The following table presents the purchase price allocations related to these other fiscal 2009 acquisitions (in

millions):

AppStream SwapDrive PC Tools Others Total

(In millions)

Acquisition date............. April 18, 2008 June 6, 2008 October 6, 2008 Various

Net tangible assets (liabilities) . . $ 14 $ 2 $ (11) $ — $ 5

Intangible assets

(1)

........... 11 42 100 12 165

Goodwill .................. 27 81 173 27 308

Total purchase price .......... $ 52 $ 125 $ 262 $ 39 $478

(1)

Intangible assets included customer relationships of $43 million, developed technology of $90 million and

definite-lived tradenames of $1 million, which are amortized over their estimated useful lives of one to nine

years. The weighted-average estimated useful lives were 6.5 years for customer relationships, 5.5 years for

developed technology, and 1.4 years for definite-lived tradenames. Intangible assets also included indefinite-

lived trade-names of $31 million.

81

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)