Symantec 2011 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

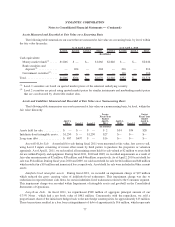

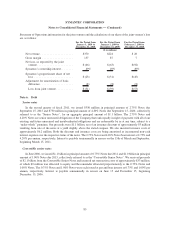

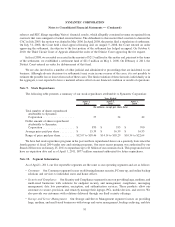

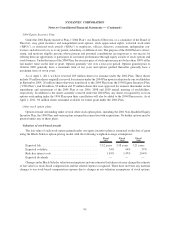

The following table summarizes information regarding the equity and liability components of the Convertible

Senior Notes:

April 1,

2011

April 2,

2010

As of

(In millions)

Equity component ............................................... $ 462 $ 586

Principal amount ................................................ $1,600 $2,100

Unamortized discount ............................................. (115) (229)

Liability component .............................................. $1,485 $1,871

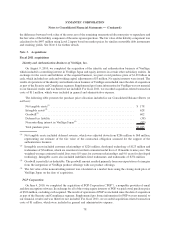

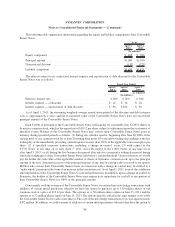

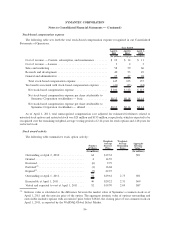

The effective interest rate, contractual interest expense and amortization of debt discount for the Convertible

Senior Notes was as follows:

April 1,

2011

April 2,

2010

April 3,

2009

Fiscal Year Ended

As Adjusted

(In millions)

Effective interest rate ................................... 6.78% 6.78% 6.78%

Interest expense — contractual ............................ $ 16 $ 18 $ 18

Interest expense — amortization of debt discount .............. $ 96 $104 $ 96

As of April 1, 2011, the remaining weighted-average amortization period of the discount and debt issuance

costs is approximately 2 years and the if-converted value of the Convertible Senior Notes does not exceed the

principal amount of the Convertible Senior Notes.

Each $1,000 of principal of the Convertible Senior Notes will initially be convertible into 52.2951 shares of

Symantec common stock, which is the equivalent of $19.12 per share, subject to adjustment upon the occurrence of

specified events. Holders of the Convertible Senior Notes may convert their Convertible Senior Notes prior to

maturity during specified periods as follows: (1) during any calendar quarter, beginning after June 30, 2006, if the

closing price of our common stock for at least 20 trading days in the 30 consecutive trading days ending on the last

trading day of the immediately preceding calendar quarter is more than 130% of the applicable conversion price per

share; (2) if specified corporate transactions, including a change in control, occur; (3) with respect to the

0.75% Notes, at any time on or after April 5, 2011, and with respect to the 1.00% Notes, at any time on or

after April 5, 2013; or (4) during the five business-day period after any five consecutive trading-day period during

which the trading price of the Convertible Senior Notes falls below a certain threshold. Upon conversion, we would

pay the holder the cash value of the applicable number of shares of Symantec common stock, up to the principal

amount of the note. Amounts in excess of the principal amount, if any, may be paid in cash or in stock at our option.

Holders who convert their Convertible Senior Notes in connection with a change in control may be entitled to a

“make whole” premium in the form of an increase in the conversion rate. As of April 1, 2011, none of the conditions

allowing holders of the Convertible Senior Notes to convert had been met. In addition, upon a change in control of

Symantec, the holders of the Convertible Senior Notes may require us to repurchase for cash all or any portion of

their Convertible Senior Notes for 100% of the principal amount.

Concurrently with the issuance of the Convertible Senior Notes, we entered into note hedge transactions with

affiliates of certain initial purchasers whereby we have the option to purchase up to 110 million shares of our

common stock at a price of $19.12 per share. The options as to 58 million shares expire on June 15, 2011 and the

options as to 52 million shares expire on June 15, 2013. The options must be settled in the same manner as we settle

the Convertible Senior Notes (cash or net shares). The cost of the note hedge transactions to us was approximately

$592 million. In addition, we sold warrants to affiliates of certain initial purchasers whereby they have the option to

86

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)