Symantec 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

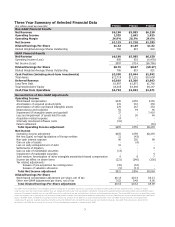

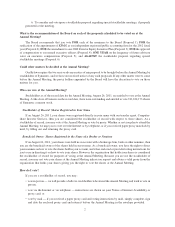

Three Year Summary of Selected Financial Data

($ in millions, except per share data)

FY2011 FY2010 FY2009

Non-GAAP Financial Results

Net Revenue $6,190 $5,985 $6,150

Operating Income 1,535 1,692 1,823

Operating Margin

24.8% 28.3% 29.6%

Net Income $1,119 $1,220 $1,283

Diluted Earnings Per Share $1.42 $1.49 $1.52

Diluted Weighted-Average Shares Outstanding 786 819 842

GAAP Financial Results

Net Revenue $6,190 $5,985 $6,150

Operating Income (Loss) 880 933 (6,470)

Net Income (Loss) $597 $714 ($6,786)

Diluted Earnings Per Share $0.76 $0.87 ($8.17)

Diluted Weighted-Average Shares Outstanding 786 819 831

Cash Position (including short-term investments) $2,958 $3,044 $1,992

Total Assets $12,719 $11,232 $10,638

Deferred Revenue $3,819 $3,206 $3,063

Long-Term Debt $1,987 $1,871 $1,766

Total Stockholders’ Equity $4,605 $4,548 $4,147

Cash Flow from Operations $1,794 $1,693 $1,671

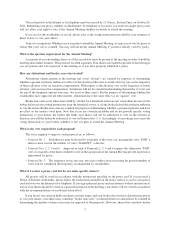

Reconciliation of Non-GAAP Adjustments

Operating Income

Stock-based compensation $145 $155 $156

Amortization of acquired product rights 115 233 353

Amortization of other purchased intangible assets 270 247 233

Restructuring and transition 92 94 96

Impairment of intangible assets and goodwill 27 - 7,419

Loss and impairment of assets held for sale 2 30 46

Acquisition-related expense 14 - -

Internally developed software costs (10) - -

Patent settlement - - (10)

Total Operating Income adjustment $655 $759 $8,293

Net Income

Operating Income adjustment $655 $759 $8,293

Net loss (gain) on legal liquidations of foreign entities 21 (43) -

Non-cash interest expense 96 105 98

Gain on sale of assets - (4) -

Loss on early extinguishment of debt 16 - -

Settlements of litigation - - 3

Gain on sale of marketable securities (13) - -

Impairment of marketable securities - - 4

Joint venture: Amortization of other intangible assets/stock-based compensation 9 8 7

Income tax effect on above items (221) (246) (336)

Tax related adjustments:

Release of pre-acquisition tax contingencies (32) (62) -

Release of valuation allowance (9) (11) -

Total Net Income adjustment $522 $506 $8,069

Diluted Earnings Per Share

Stock-based compensation adjustment per share, net of tax $0.14 $0.14 $0.13

Other non-GAAP adjustments per share, net of tax 0.52 0.48 9.56

Total Diluted Earnings Per Share adjustment $0.66 $0.62 $9.69

Our GAAP results of operations have undergone significant change due to a goodwill impairment, acquisitions, the impact of SFAS 123(R) and other corporate events. To help our readers

understand our past and future financial performance, we supplement the financials that we provide in accordance with generally accepted accounting principles (GAAP) with non-GAAP financial

measures. Management regularly uses our non-GAAP measures to understand, manage and evaluate our business and make operating decisions. These non-GAAP measures are among the primary

factors management uses in planning for and forecasting future periods. Investors are encouraged to review the reconciliation of our non-GAAP financial measures to the comparable GAAP results,

which is provided above, attached to our quarterly earnings release and available on our Web site at www.symantec.com/invest. These non-GAAP financial measures are not prepared in

accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be

considered a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

5