Symantec 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

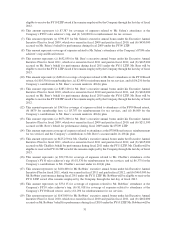

At the time award opportunities are established, there is no assurance that the amount of the target awards will

be realized. A participant must be an employee of the Company on the payment date to receive the payment,

creating a strong incentive for our executive officers to serve through the payment date for these awards. Subject to

certain limited exceptions, a participant who terminates his or her employment with the Company before the

payment date will not be eligible to receive the payment or any prorated portion thereof.

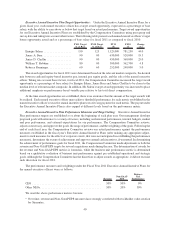

For fiscal 2011, our operating cash flow target was $1,611 million and we achieved 111% of our target,

resulting in a payout of 155% of target bonus amounts under our FY11 LTIP for our named executive officers who

remain our employees as of the end of fiscal 2013. This level of achievement against target compares to our reported

increase in cash flow from operations of approximately 6% from fiscal 2010 to fiscal 2011.

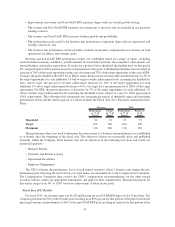

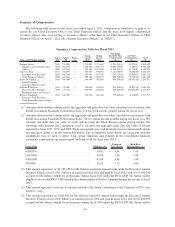

Our NEOs’ fiscal 2011 LTIP target awards, actual awards and total payout as percentage of target opportunity

are provided in the table below:

LTIP

Target ($)

LTIP Actual

Award ($)

Payout as

% of Target

Enrique Salem ................................... 2,000,000 3,100,000 155

James A. Beer ................................... 300,000 465,000 155

Janice D. Chaffin................................. 300,000 465,000 155

William T. Robbins ............................... 300,000 465,000 155

Rebecca Ranninger ............................... 300,000 465,000 155

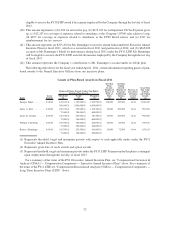

Equity Incentive Awards

The primary purpose of our equity incentive awards is to align the interests of our named executive officers

with those of our stockholders by rewarding the named executive officers for creating stockholder value over the

long-term. By compensating our executives with the Company’s equity, our executives hold a stake in the

Company’s financial future. The gains realized in the long term depend on our executives’ ability to drive the

financial performance of the Company. Equity incentive awards are also a useful vehicle for attracting and retaining

executive talent in our competitive talent market.

Our 2004 Equity Incentive Plan provides for the award of stock options, stock appreciation rights, restricted

stock, and restricted stock units (including performance-based restricted stock units). We granted named executive

officers stock options and restricted stock units in fiscal 2011 (as described in more detail below, including under the

Summary Compensation Table and Grants of Plan-Based Awards table on pages 50 and 52, respectively). We also

offer all employees the opportunity to participate in the 2008 Employee Stock Purchase Plan, which allows for the

purchase of our stock at a discount to the fair market value through payroll deductions. This plan is designed to

comply with Section 423 of the Code. During fiscal 2011, four named executive officers participated in the 2008

Employee Stock Purchase Plan.

We seek to provide equity incentive awards that are competitive with companies in our peer group and the other

information technology companies that the Compensation Committee includes in its market composite. As such,

we establish target equity incentive award grant guideline levels for the named executive officers based on market

pay assessments. When making annual equity awards to named executive officers, we consider corporate results

during the past year, the role, responsibility and performance of the individual named executive officer, the

competitive market assessment described above, prior equity awards, and the level of vested and unvested equity

awards then held by each named executive officer. In making equity awards, we also generally take into

consideration gains recognizable by the executive from equity awards made in prior years. Mercer provides

the Compensation Committee with market data on these matters, as well as providing to the Compensation

Committee summaries of the prior grants made to the individual named executive officers.

For fiscal 2011, on average 57% of the named executive officers’ (other than the CEO) equity incentive award

value was granted in the form of restricted stock units and approximately 43% in the form of stock options. The

CEO’s equity incentive award value for fiscal 2011 was approximately equally distributed between restricted stock

units and stock options.

43