Symantec 2011 Annual Report Download - page 140

Download and view the complete annual report

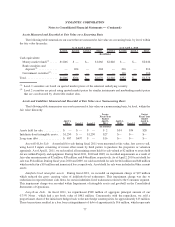

Please find page 140 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Short-Term Investments. Short-term investments consist of marketable debt or equity securities that are

classified as available-for-sale and recognized at fair value. The determination of fair value is further detailed in

Note 2. Our portfolios generally consist of (1) debt securities which include asset-backed securities, corporate

securities and government securities, and (2) marketable equity securities. As of April 1, 2011, our asset-backed

securities have contractual maturity dates in excess of 10 years. We regularly review our investment portfolio to

identify and evaluate investments that have indications of possible impairment. Factors considered in determining

whether a loss is other-than-temporary include: the length of time and extent to which the fair market value has been

lower than the cost basis, the financial condition and near-term prospects of the investee, credit quality, likelihood of

recovery, and our ability to hold the investment for a period of time sufficient to allow for any anticipated recovery

in fair market value.

Unrealized gains and losses, net of tax, and other-than-temporary impairments for all reasons other than credit

worthiness are included in Accumulated other comprehensive income. The amortization of premiums and discounts

on the investments, realized gains and losses, and declines in value due to credit worthiness judged to be

other-than-temporary on available-for-sale debt securities are included in Other income, net. We use the spe-

cific-identification method to determine cost in calculating realized gains and losses upon sale of short-term

investments.

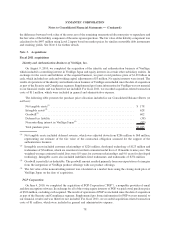

Equity Investments. We make equity investments in privately held companies whose businesses are com-

plementary to our business. These investments are accounted for under the cost method of accounting, as we hold

less than 20% of the voting stock outstanding and do not exert significant influence over these companies. The

investments are included in Other long-term assets. We assess the recoverability of these investments by reviewing

various indicators of impairment and determine the fair value of these investments by performing a discounted cash

flow analysis of estimated future cash flows if there are indicators of impairment. If a decline in value is determined

to be other-than-temporary, impairment would be recognized and included in Other income, net. As of April 1, 2011

and April 2, 2010, we held equity investments in privately-held companies of $30 million and $22 million,

respectively. Other-than-temporary impairments related to these investments were not material for the periods

presented.

Derivative Instruments. We transact business in various foreign currencies and have foreign currency risks

associated with monetary assets and liabilities denominated in foreign currencies. We utilize foreign currency

forward contracts to reduce the risks associated with changes in foreign currency exchange rates. Our forward

contracts generally have terms of six months or less and are transacted near month end periods. We do not use

forward contracts for trading purposes. The gains and losses on the contracts are intended to offset the gains and

losses on the underlying transactions. Both the changes in fair value of outstanding forward contracts and realized

foreign exchange gains and losses are included in Other income, net. Contract fair values are determined based on

quoted prices for similar assets or liabilities in active markets using inputs such as LIBOR, currency rates, forward

points, and commonly quoted credit risk data. For each fiscal period presented in this report, outstanding derivative

contracts and the related gains or losses were not material.

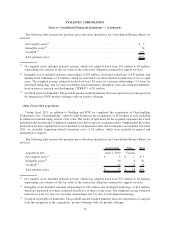

Senior Notes, Convertible Senior Notes, Note Hedges and Revolving Credit Facility. In the second quarter of

fiscal 2011, we issued $350 million in principal amount of 2.75% senior notes (“2.75% Notes”) due September 15,

2015 and $750 million in principal amount of 4.20% senior notes (“4.20% Notes”) due September 15, 2020,

collectively referred to as the Senior Notes, for an aggregate principal amount of $1.1 billion. In June 2006, we

issued $1.1 billion in principal amount of 0.75% convertible senior notes (“0.75% Notes”) and $1.0 billion in

principal amount of 1.00% convertible senior notes (“1.00% Notes”), collectively referred to as the Convertible

Senior Notes. Our Senior Notes are recorded at cost based upon par value at issuance. Our Convertible Senior Notes

are recorded at cost (in liability (debt) and equity (conversion option) components) based upon par value at issuance

less a discount. The liability component is recognized at fair value on the issuance date, based on the fair value of a

similar instrument that does not have a conversion feature at issuance. The excess of the principal amount of the

Convertible Senior Notes over the fair value of the liability component is the equity component or debt discount.

70

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)