Symantec 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.compensation-related trends and developments in our industry and the broader talent market and regulatory

developments relating to compensation practices.

We paid Mercer approximately $200,000 for executive compensation services in fiscal 2011. In addition, with

the Compensation Committee’s approval, management engaged and Symantec paid Mercer and its affiliates for

other services, including approximately $1.975 million for other unrelated consulting and business services. We

also reimbursed Mercer and its affiliates for reasonable travel and business expenses.

The Compensation Committee establishes our compensation philosophy, approves our compensation pro-

grams and solicits input and advice from several of our executive officers and Mercer. As mentioned above, our

CEO provides the Board of Directors and the Compensation Committee with feedback on the performance of our

executive officers and makes compensation recommendations that go to the Compensation Committee for their

approval. Our CEO, CFO, Chief Human Resources Officer and General Counsel regularly attend the Compensation

Committee’s meetings to provide their perspectives on competition in the industry, the needs of the business,

information regarding Symantec’s performance, and other advice specific to their areas of expertise. In addition, at

the Compensation Committee’s direction, Mercer works with our Chief Human Resources Officer and other

members of management to obtain information necessary for Mercer to make their own recommendations as to

various matters as well as to evaluate management’s recommendations.

FACTORS WE CONSIDER IN DETERMINING OUR COMPENSATION PROGRAMS

We apply a number of compensation policies and analytic tools in implementing our compensation principles.

These policies and tools guide the Compensation Committee in determining the mix and value of the compensation

components for the named executive officers, consistent with our compensation philosophy. They include:

A Total Rewards Approach: Elements of the total rewards offered to our executive officers include base

salary, short- and long-term incentives including equity awards, health benefits, a deferred compensation program

and a consistent focus on individual professional growth and opportunities for new challenges.

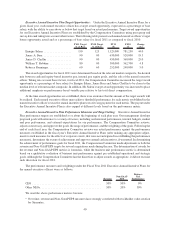

Focus on Pay-for-Performance: Our executive compensation program is designed to reward executives for

results. As described below, the pay mix for named executive officers emphasizes variable pay in the form of short-

and long-term cash and equity awards. Short-term results are measured by annual financial performance, specif-

ically revenue, non-GAAP earnings per share and, for all named executive officers other than our CEO, business

unit performance. Long-term results are measured by share price appreciation, and achievement of operating cash

flow targets. As explained below, beginning with fiscal 2012, our long-term results will also be measured by the

achievement of the total stockholder return ranking for our company as compared to the S&P 500.

Appropriate Market Positioning: Our general pay positioning strategy is to target the levels of base salary,

annual short-term cash incentive structure and long-term incentive opportunities and benefits for named executive

officers with reference to the relevant market composite for each position. The Compensation Committee may set

the actual components for an individual named executive officer above or below the positioning benchmark based

on factors such as experience, performance achieved, specific skills or competencies, the desired pay mix (e.g.,

emphasizing short- or long-term results), and our budget.

Through the end of fiscal 2011, our policy was to target the base salary and annual short-term cash incentive

structure for named executive officers at the 65th percentile of the relevant market composite with target long-term

incentive opportunities and benefits for named executive officers at the 50th percentile of the relevant market

composite. Base salary and short-term cash incentives were positioned at this level to attract and retain high caliber

talent in the highly competitive technology market. We believed that the target long-term incentive strategy allowed

us to be competitive in the market for top talent, while providing alignment with stockholders and keeping the burn

rate and dilution associated with our equity compensation programs within a range we deemed appropriate. For

fiscal 2011, the pay mix for executives emphasized long-term performance through a majority of pay opportunity

coming in the form of long-term award vehicles. By using these targets, we believed that upside opportunity in the

short- and long-term incentive plans was available in the event of outstanding financial performance in fiscal 2011.

Beginning in fiscal 2012, to further strengthen our pay for performance focus, we are shifting our general pay

positioning strategy to target 50th percentile of the relevant market composite for base salary and 65th percentile of

36